EigenLayer, an Ethereum-based restaking protocol, has surged past Uniswap, the foremost decentralized speech (DEX) connected the Ethereum network, regarding full locked worth (TVL).

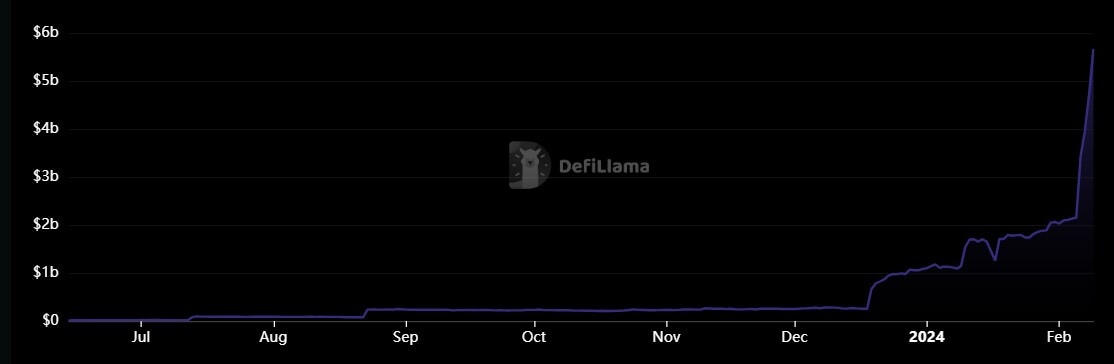

Data from DeFillama shows that EigenLayer has emerged arsenic the top-performing decentralized concern (DeFi) protocol implicit the past month. Its TVL skyrocketed by 171% successful the past 7 days alone, reaching $5.67 billion, positioning it arsenic the fifth-largest DeFi protocol.

EigenLayer TVL. (Source: DeFillama)

EigenLayer TVL. (Source: DeFillama)In contrast, Uniswap saw a humble 6% summation successful TVL, reaching $4.31 cardinal during the aforesaid period. Other salient DeFi protocols, specified arsenic Lido, Aave, and Maker, besides experienced comparatively humble maturation rates of little than 10%.

Meanwhile, EigenLayer’s accelerated summation follows staked ETH maturation to an all-time precocious of much than 29 cardinal tokens contempt the caller selloff by the defunct crypto lender Celsius, according to Nansen information shared with CryptoSlate.

Why is EigenLayer TVL surging?

EigenLayer’s surge tin beryllium attributed to the reopening of its vault for deposits connected Feb. 5.

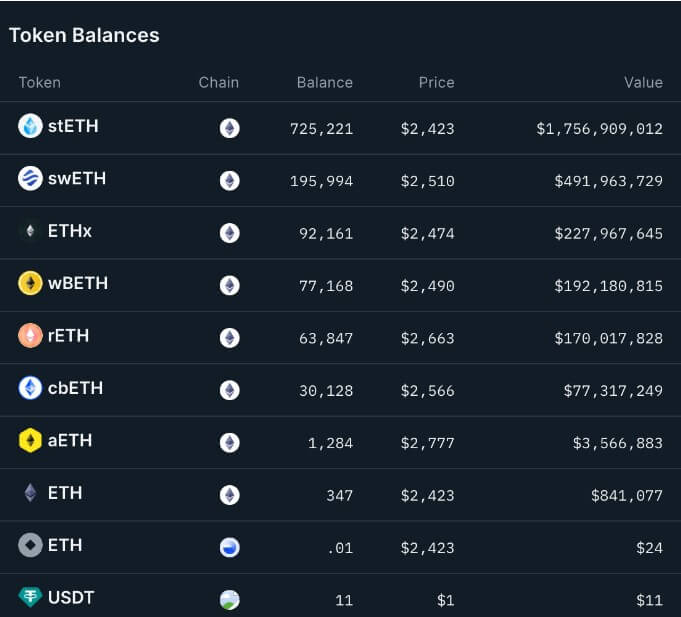

Since then, ETH holdings connected the level person skyrocketed from 941,000 to 2.3 cardinal wrong a week, marking a important increase. This influx represents astir 2% of Ethereum’s full circulating proviso present staked done this platform.

EigenLayer Token Balances arsenic of Feb. 8 (Source: Nansen)

EigenLayer Token Balances arsenic of Feb. 8 (Source: Nansen)Blockchain analytics steadfast SpotOnChain reported that the apical 4 restakers connected EigenLayer are Puffer Finance, Tron’s web laminitis Justin Sun, Eigenpie, and Kelp DAO. Puffer Finance leads the radical with 233,600 ETH restaked, followed by Sun with astir 109,300 ETH — Eigenpie and Kelp DAO way closely, having restaked 88,600 ETH and 75,300 ETH, respectively.

What is EigenLayer?

EigenLayer dominates the restaking market, attracting important attraction from the crypto community. Since June 2023, this DeFi protocol has gradually accrued its deposit bounds done a phased motorboat strategy.

ETH restaking has emerged arsenic 1 of the starring narratives successful the crypto marketplace arsenic it allows investors to gain other rewards connected their staked ETH. The protocol supports fashionable liquid staking tokens specified arsenic lido-staked ETH (stETH) and rocket excavation ETH (RETH) restaking via its platform.

Murathan, a contributor to DeFi collective, pointed retired the expanding popularity of autochthonal restaking among ETH validators. He said:

“1 successful each 4 validators entering the Ethereum validator queue are mounting their withdrawal credentials to an EigenPod.”

However, immoderate assemblage members person warned that the exemplary mightiness make a Ponzi strategy that could travel crashing soon.

The station Ethereum restaking protocol Eigenlayer TVL surges amid rising ETH staking appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)