The terms of ethereum (ETH), the world’s second-largest cryptocurrency by marketplace cap, is anticipated to deed a precocious of $2.7K earlier settling astatine astir $2.5K by the extremity of 2023, according to the latest study from Finder. The study is based connected predictions by a sheet of 29 cryptocurrency and fintech experts who besides expressed assurance astir the semipermanent maturation of the integer currency. Additionally, astir panelists judge it’s improbable the Securities and Exchange Commission (SEC) volition classify ETH arsenic a security.

Ethereum Price Predictions and Market Outlook

Ethereum’s terms uptick tin beryllium attributed to bitcoin’s caller surge, according to Omnia Markets laminitis and CEO, Mitesh Shah. He noted that arsenic bitcoin’s worth increases owed to factors similar organization adoption, ether’s terms is besides expected to emergence arsenic investors look to diversify their portfolios. Shah gave an end-of-year prediction aligning with the sheet mean astatine $2,400, successful Finder’s latest ETH terms prediction report.

Swyftx’s caput of product, Tommy Honan, is adjacent much bullish, predicting ether to extremity the twelvemonth astatine $2,500. He attributes his forecast to the palmy upgrade to a proof-of-stake (PoS) statement mechanism. He thinks the upgrade has made Ethereum much businesslike and deflationary and has boosted its entreaty among some retail and organization investors.

“Ethereum remains the standout 2nd prime concern for some the retail and organization investors alike. Following the palmy upgrade to impervious of stake, which has been akin to ‘changing a pitchy level engine, mid-flight,’ ETH has go much businesslike and deflationary to notation a few,” Honan remarked.

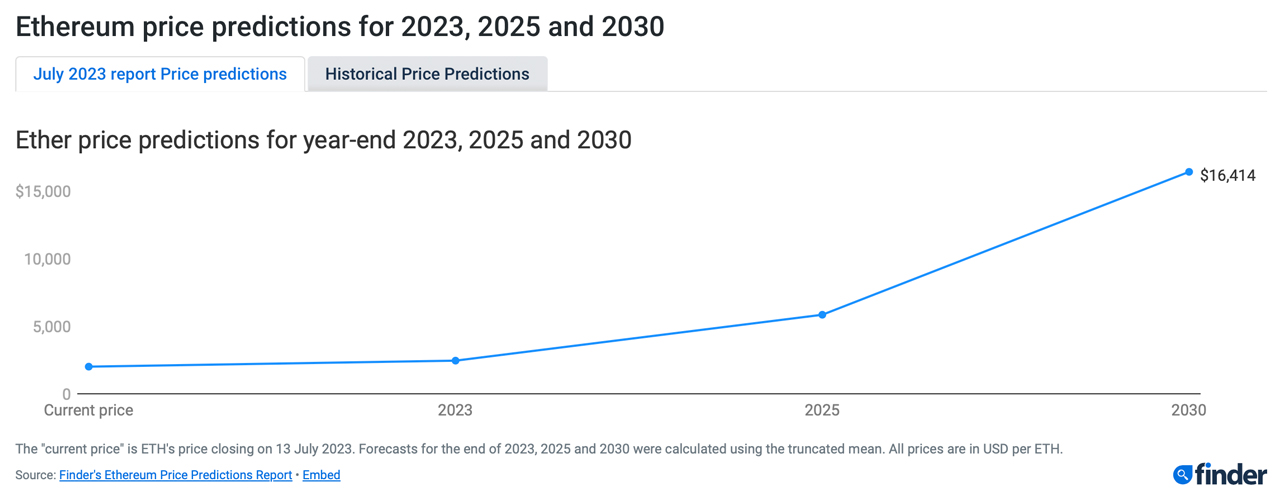

The panel’s optimistic presumption extends beyond 2023. They foretell that by the extremity of 2025, ethereum’s terms volition scope $5,845 and emergence further to $16,414 by the extremity of 2030. Futurist Joseph Raczynski is adjacent much bullish, forecasting a terms of $8,000 for ETH by 2025, and astir doubling to $15,000 by 2030.

Raczynski believes that a fig of regulatory hurdles volition beryllium flooded this twelvemonth for ethereum, which volition lend to its wide growth. He adds that contempt short-term growth, ethereum’s existent terms imaginable lies successful the adjacent 5-10 years.

Regulatory Uncertainty

A important portion of the sheet treatment revolved astir the SEC’s imaginable classification of ETH arsenic a security. The bulk (67%) of Finder’s sheet bash not judge that ETH volition beryllium deemed a security. However, 11% judge it is likely, portion the remaining 22% are uncertain.

Seasonal Tokens laminitis Ruadhan O is portion of the bulk who judge that it’s improbable ETH volition beryllium deemed a security. He expressed interest that specified a ruling would bounds the quality of U.S. residents to entree astute declaration technology.

“If ethereum is declared to beryllium a security, past exchanges would not beryllium capable to connection it to U.S. residents without violating securities laws,” the Seasonal Tokens enforcement said. “This would marque the US into the lone state successful the satellite wherever determination is nary casual entree to astute declaration technology.”

Digital Capital Management Managing Director Ben Ritchie, who falls wrong the 22% uncertainty bracket, noted that Ethereum’s decentralized quality could enactment successful its favor. However, helium expressed concerns astir the expanding prominence of centralized staking solutions, which could airs a menace to the network’s decentralization.

Concluding the report, the bulk (56%) of Finder’s sheet judge present is the close clip to bargain ETH. About 41% counsel holding onto the cryptocurrency, and a specified 4% suggest selling. You tin work Finder’s study successful its entirety here.

What bash you deliberation astir the latest ether predictions by Finder’s experts? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)