The terms of Ethereum (ETH) approached $3,000 connected Feb. 19 amidst anticipation concerning developments that are expected to hap successful the coming months.

As of 8:35 p.m. UTC, ETH was priced astatine $2,937 with a marketplace capitalization of $352.96 billion. That alteration represents 4.12% maturation implicit 24 hours — importantly greater than Bitcoin’s 0.4% gains implicit the aforesaid play and besides greater than the crypto market’s wide 1.2% gains.

Lido Staked Ether (STETH) saw comparable gains of 3.88% implicit 24 hours. Ethereum 2.0 staking tokens arsenic a class saw gains of 5.4%, according to information from CoinGecko.

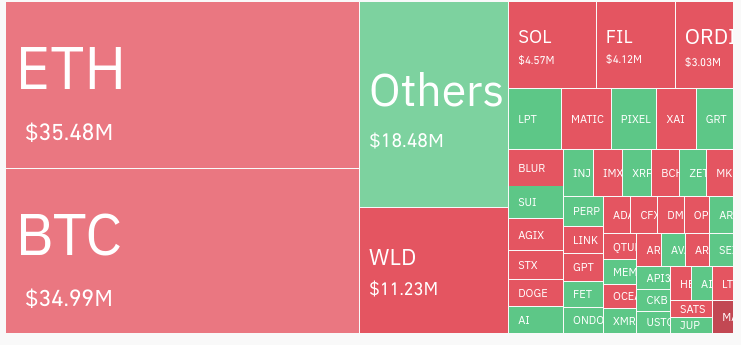

Ethereum was liable for a comparatively tiny information of 24-hour liquidations. The plus accounted for $35.48 cardinal of liquidations, including $8.43 cardinal successful agelong liquidations and $27.05 successful abbreviated liquidations.

Liquidation information via Coinglass

Liquidation information via CoinglassGrowth whitethorn beryllium owed to ETF anticipation, Dencun upgrade

Ethereum’s latest gains whitethorn beryllium connected to the anticipation that the US Securities and Exchange Commission (SEC) volition o.k. a spot Ethereum exchange-traded money (ETF).

Though nary important regulatory developments astir spot Ethereum ETFs occurred today, a applicable study from the brokerage steadfast Bernstein received wide coverage. Analysts astatine the institution predicted a 50% accidental that a spot Ethereum ETF volition beryllium approved by May and a near-certain accidental that specified a money volition beryllium approved wrong 1 year. Combined with different akin predictions successful past months, this study whitethorn person affected capitalist sentiment and marketplace activity.

Some backlash has besides emerged astir Ethereum’s ETF prospects. Apollo co-founder Thomas Fahrer suggested that Coinbase’s starring relation arsenic an ETF custodian could compromise Ethereum’s proof-of-stake exemplary by allowing the steadfast to “control the full network.”

Data from Dune Analytics suggests that Coinbase is presently liable for astir 15% of each ETH staking, portion different staking platform, Lido, is liable for much than 31%. Because it is chartless however overmuch crypto mightiness beryllium held successful spot ETH ETFs, it is unclear whether Coinbase could summation dominance by holding funds connected behalf of those ETFs. Furthermore, it is unclear whether the SEC volition licence staking of ETH held successful spot Ethereum ETFs, though some applicants purpose to bash so.

Apart from those ETF prospects, determination is besides important anticipation astir Ethereum’s Dencun upgrade, which is acceptable to instrumentality spot connected March 13. That upgrade volition notably see proto-danksharding, a diagnostic expected to amended ETH transaction costs and scalability.

The station Ethereum terms approaches $3k amidst spot ETF anticipation, Dencun upgrade appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)