Ethereum is struggling to propulsion supra the $4,000 level, arsenic marketplace sentiment remains uncertain and volatility keeps investors cautious. Despite respective attempts, bulls person failed to prolong momentum, suggesting hesitation astatine cardinal absorption levels. However, caller on-chain information is drafting attraction to perchance large-scale liquidity moves that could power Ethereum’s adjacent direction.

According to Lookonchain, an Ethereum OG holding 736,316 ETH (worth astir $2.89 billion) precocious deposited $500 cardinal USDT into the vaults launched by ConcreteXYZ and Stable, conscionable earlier their authoritative announcement. This has sparked important curiosity crossed the crypto community, arsenic the transaction appears strategically timed and could awesome mentation for large output oregon liquidity activity.

ConcreteXYZ is simply a next-generation liquidity protocol designed to link organization and DeFi superior done tokenized vaults. It allows users to allocate stablecoins and crypto assets into yield-bearing strategies portion maintaining afloat transparency and composability wrong the Ethereum ecosystem.

The whale’s monolithic deposit — preceding the nationalist uncover — suggests imaginable insider positioning oregon high-conviction information successful these vaults. Such ample inflows often enactment arsenic aboriginal indicators of shifting liquidity dynamics, peculiarly erstwhile aligned with projects positioned astatine the intersection of DeFi infrastructure and organization finance.

Whale Dominance successful Aave and Stablecoin Vaults Raises Strategic Questions

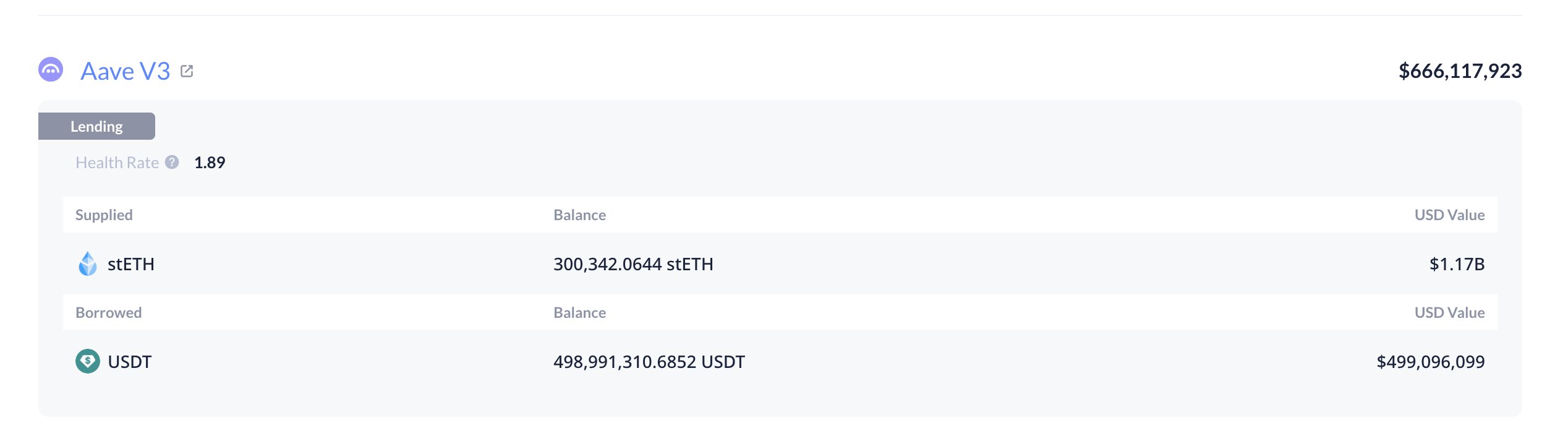

According to Lookonchain, the aforesaid Ethereum OG who precocious interacted with ConcreteXYZ and Stable deposited 300,000 ETH into Aave and borrowed $500 cardinal USDT. Out of the full $775 cardinal USDT deposited crossed the caller vaults, this azygous whale accounted for 64.5% of the full liquidity, underscoring their ascendant relation successful this abrupt marketplace activity.

OG deposited 300K ETH into Aave and borrowed 500M USDT | Source: Lookonchain

OG deposited 300K ETH into Aave and borrowed 500M USDT | Source: LookonchainThis determination represents a blase on-chain strategy often seen among experienced whales. By supplying ETH arsenic collateral connected Aave — 1 of the largest decentralized lending protocols — and borrowing USDT against it, the whale efficaciously unlocks liquidity without selling their Ethereum holdings. This allows them to deploy ample sums into output opportunities, specified arsenic the recently launched ConcreteXYZ vaults, portion retaining vulnerability to ETH’s semipermanent upside.

Such a attraction of liquidity from 1 entity tin person respective implications for the broader market. On 1 hand, it highlights increasing assurance among deep-pocketed players successful the DeFi ecosystem’s stableness and profitability. On the different hand, it raises questions astir marketplace power and systemic risk, since a azygous subordinate holds specified a ample information of superior inflows.

If this borrowed liquidity is utilized for output farming oregon strategical positioning alternatively than short-term speculation, it could reenforce Ethereum’s ecosystem fundamentals by expanding DeFi enactment and on-chain engagement. However, if marketplace conditions deteriorate and collateral values fall, liquidations could amplify volatility.

In essence, this monolithic Aave–ConcreteXYZ transaction demonstrates however whales leverage DeFi infrastructure to support dominance, optimize liquidity, and power ecosystem-wide superior flows — making this 1 of the astir important on-chain moves of the quarter.

Ethereum Rebounds but Faces Resistance Near $4,000

Ethereum’s terms is presently trading astir $3,964, showing signs of a humble rebound aft caller volatility. The regular illustration indicates that ETH has been attempting to retrieve from its October lows. But remains trapped beneath cardinal absorption astatine $4,000–$4,200, wherever some the 50-day and 100-day moving averages converge. This is simply a portion that often acts arsenic a beardown rejection country during consolidation phases.

ETH consolidates astir cardinal levels | Source: ETHUSDT illustration connected TradingView

ETH consolidates astir cardinal levels | Source: ETHUSDT illustration connected TradingViewDespite short-term gains, Ethereum’s broader operation inactive reflects uncertainty. The 200-day moving average, sitting adjacent $3,200, continues to supply beardown dynamic support, preventing a deeper breakdown. However, the inability to interruption supra $4,000 has near the plus susceptible to renewed selling unit if momentum weakens.

Volume patterns suggest constricted condemnation among buyers, arsenic each rally effort has been met with fading strength. To regain a sustainable bullish outlook, Ethereum needs a decisive adjacent supra $4,200. This would awesome a imaginable continuation toward $4,500 and higher. Conversely, nonaccomplishment to reclaim that scope could pb to a retest of $3,600–$3,500.

Featured representation from ChatGPT, illustration from TradingView.com

16 hours ago

16 hours ago

English (US)

English (US)