Ethereum’s autochthonal token, Ether (ETH), posted a caller yearly debased astatine $2,070, which is besides the lowest since Jan. 1, 2024. The second-biggest cryptocurrency dropped 7.40% connected Feb. 28, leading to implicit $200 million successful liquidations implicit the past 24 hours.

Ethereum1-day chart. Source: Cointelegraph/TradingView

With ETH terms present investigating two-year lows, 0xLouisT, a crypto concern manager, says that Ether’s societal sentiment is “at its lowest successful the past 12 months”.

Ethereum’s play adjacent nears 2-year lows

Ether terms is down 24.50% successful the past 7 days, its worst play turnover since 2022. A play adjacent beneath $2,300 volition people its lowest since November 2023, a two-year low.

Ethereum play chart. Source: Cointelegraph/TradingView

As illustrated successful the chart, the apical altcoin is besides acceptable to adjacent beneath its 200-weekly exponential moving mean (EMA). The 200-weekly EMA indicator has intimately tracked Ethereum’s bottommost range.

Since 2020, ETH/USD has closed nether the 200-weekly EMA level for lone 39 weeks retired of a imaginable 268, lone 14.55% of the time.

Related: Why is the crypto marketplace down today?

Thus, based connected humanities trends, Ethereum mightiness reclaim a presumption supra the EMA level wrong a fewer weeks.

However, a double-top signifier threatens the bulls. The 7-day illustration besides shows a double-top signifier taking signifier implicit the past year. A adjacent nether $2,100 volition validate the neckline, and immoderate correction nether $2,000 increases the accidental of different 28% to the adjacent enactment astatine $1,500.

Ethereum 1-weekly chart. Source: Cointelegraph/TradingView

Jason Pizzino, a crypto investor, besides mentions that Ethereum could beryllium “in much trouble” if it closes nether $2,000-$2,1000. Thus, ETH indispensable stay supra $2,000 to invalidate this double-top signifier connected the charts.

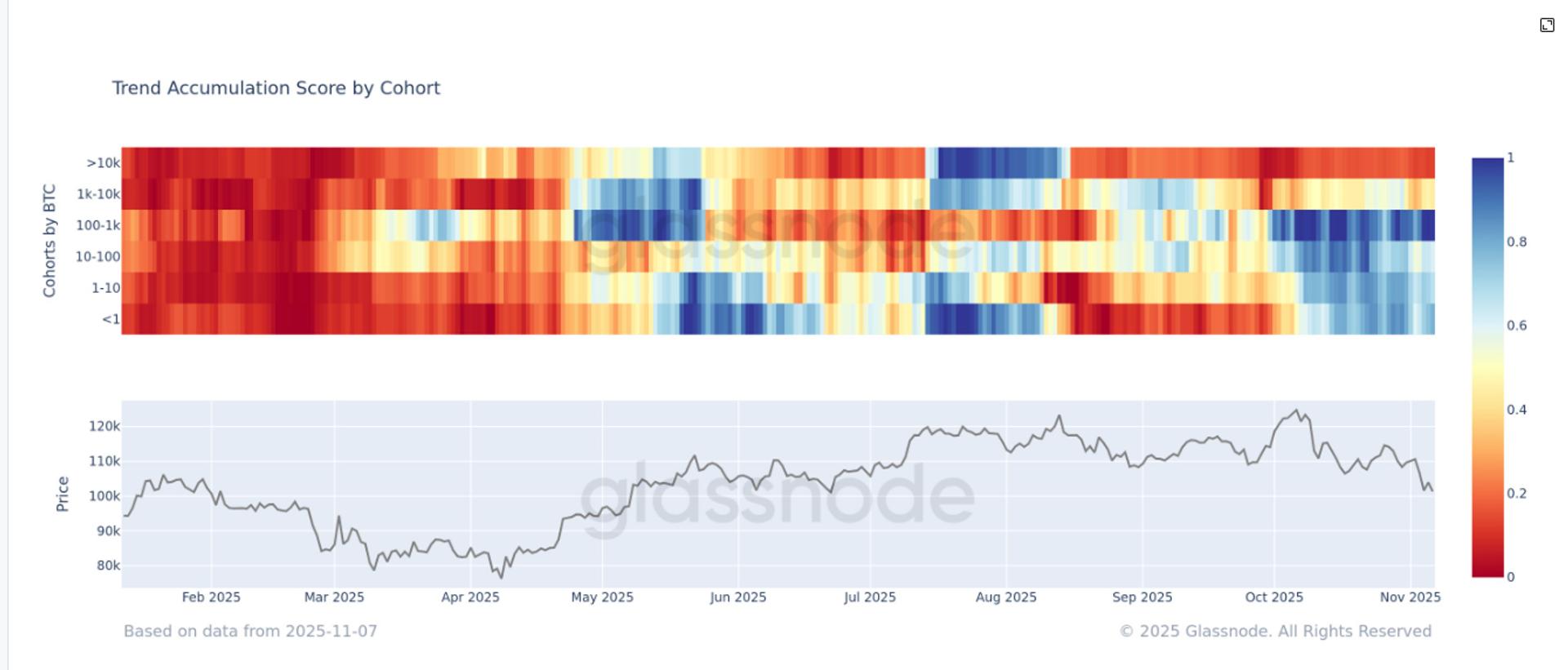

Ethereum cost-basis organisation terms astatine $1.9K

Although Ether indispensable enactment supra $2,000 to forestall further decline, Glassnode information indicates that the cost-basis organisation terms is little astatine $1,890.

Ethereum cost-basis organisation price. Source: X.com

The outgo ground organisation (CBD) terms of an plus isn’t a azygous fixed fig but a scope of prices reflecting erstwhile the ETH past moved onchain. A $1,890 CBD terms indicates that Ether could retest this worth if terms weakness persists.

Morin, a crypto trader, besides underlined that a request portion for ETH lies astir $2,100 to $1,900. The trader expected the altcoin’s drawdown to beryllium contained wrong this scope erstwhile the bearish unit subsides.

Ethereum 1-hour illustration investigation Morin. Source: X.com

Conversely, Leon Waidmann, caput of probe astatine OnchainHq, suggested that ETH speech balances proceed to driblet alongside price. The researcher suggests that investors perchance stay assured with ETH, accumulating astatine cardinal request zones arsenic the terms corrects.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

8 months ago

8 months ago

English (US)

English (US)