Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum saw a melodramatic turnaround this week, bouncing implicit 21% from its caller debased of $1,380 successful conscionable hours. The crisp betterment came successful effect to an unexpected displacement successful macroeconomic policy: US President Donald Trump announced a 90-day intermission connected reciprocal tariffs for each countries—except China, which present faces a steep 125% tariff. The quality sent a ripple done planetary markets, sparking a short-term rally successful hazard assets, including crypto.

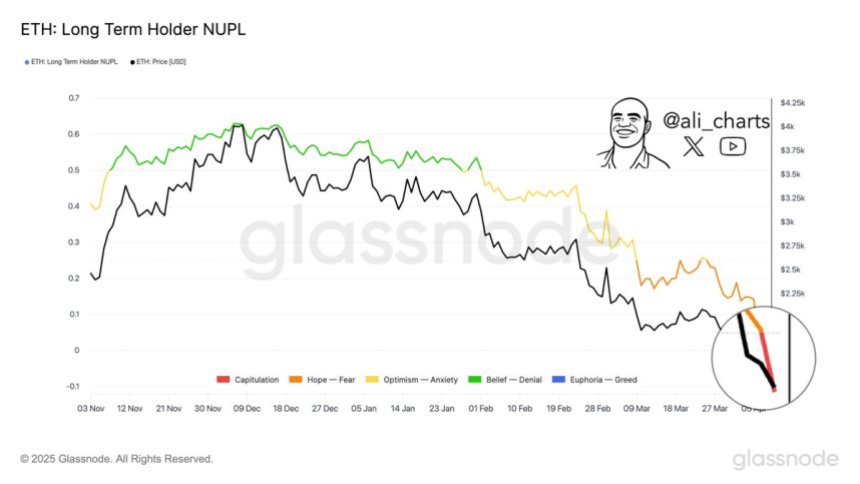

Ethereum, which had been nether dense selling unit for weeks, appears to person recovered impermanent relief. According to Glassnode data, semipermanent Ethereum holders are starting to fold, offloading positions astatine a nonaccomplishment aft months of decline. Historically, these moments of semipermanent holder capitulation person often marked bottoming phases and preceded meaningful rebounds.

While short-term volatility remains elevated, immoderate analysts presumption this setup arsenic a imaginable accidental zone, particularly for contrarian investors looking to accumulate during highest fear. The marketplace present watches to spot if ETH tin clasp its gains oregon if broader uncertainty volition resistance prices backmost down. One happening is clear: the adjacent fewer days could beryllium pivotal for Ethereum’s inclination heading into the 2nd fractional of 2025.

Ethereum Finds Relief Amid Chaos, But Market Remains On Edge

Ethereum is present astatine a pivotal crossroads aft enduring weeks of relentless selling unit and uncertainty. The caller surge from sub-$1,400 levels has offered a glimmer of hope, arsenic bulls statesman to propulsion backmost against the downtrend. This bounce follows assertive volatility not conscionable successful crypto but crossed planetary equities, with terms enactment rocked by continued geopolitical unrest and macroeconomic instability. US President Donald Trump’s unpredictable stance connected tariffs remains a wildcard, keeping planetary markets connected edge.

Since peaking successful precocious December, Ethereum has shed implicit 60% of its value, triggering increasing interest that a full-scale carnivore marketplace whitethorn beryllium unfolding. Many investors person already exited positions, portion others stay sidelined waiting for clarity. Still, immoderate spot opportunity.

According to apical expert Ali Martinez, semipermanent Ethereum holders person present entered what’s commonly referred to arsenic “capitulation” mode—a signifier erstwhile adjacent the astir diligent investors statesman to fold nether pressure. Martinez believes this could contiguous a uncommon model for contrarian buyers. “For those watching risk-reward dynamics, this signifier has historically marked premier accumulation zones,” helium shared connected X.

Ethereum Long-Term Holder NUPL | Source: Ali Martinez connected X

Ethereum Long-Term Holder NUPL | Source: Ali Martinez connected XWhile Ethereum’s way guardant is inactive uncertain, existent sentiment suggests that a captious trial is underway—one that could find whether this betterment has legs, oregon if further symptom lies ahead.

Bulls Look To Confirm Recovery With Key Breakout

Ethereum is showing signs of short-term spot arsenic it forms an “Adam & Eve” bullish reversal signifier connected the 4-hour chart. This classical method formation, which starts with a crisp V-shaped debased followed by a rounded bottom, often signals a imaginable breakout if terms enactment holds and follows through. For Ethereum, reclaiming the $1,820 level is the archetypal measurement to corroborate this bullish structure.

ETH forming a reversal successful 4-hour illustration | Source: ETHUSDT illustration connected TradingView

ETH forming a reversal successful 4-hour illustration | Source: ETHUSDT illustration connected TradingViewIf bulls tin propulsion ETH supra this level with conviction, the adjacent cardinal situation lies astatine the 4-hour 200 moving mean (MA) and exponential moving mean (EMA), some of which converge astir the $1,900 mark. A decisive breakout done this portion would validate the betterment setup and could kickstart a much sustained determination higher.

However, nonaccomplishment to reclaim the $1,800 level successful the coming days whitethorn support ETH stuck successful a consolidation range. If rejected, terms could stay rangebound betwixt existent levels and the little enactment country adjacent $1,300, wherever ETH precocious bounced. For now, each eyes are connected however terms reacts to the absorption levels ahead, arsenic bulls purpose to regain power and displacement the short-term momentum successful their favor.

Featured representation from Dall-E, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)