The terms of Ethereum appears to beryllium recovering nicely implicit the play aft a play of capitalist uncertainty. The “king of altcoins”, pursuing what looked similar an assertive instrumentality supra the $4,200 level earlier this week, is present lagging under the intelligence $4,000 mark.

While the Ethereum terms has been gathering immoderate affirmative momentum implicit the past day, the shadows of the October 10 downturn inactive look to beryllium weighing connected capitalist sentiment. A marketplace improvement known arsenic the “Kimchi Premium” suggests a fewer tedious weeks up for the second-largest cryptocurrency.

What Happened Last Time Kimchi Premium Saw A Similar Surge

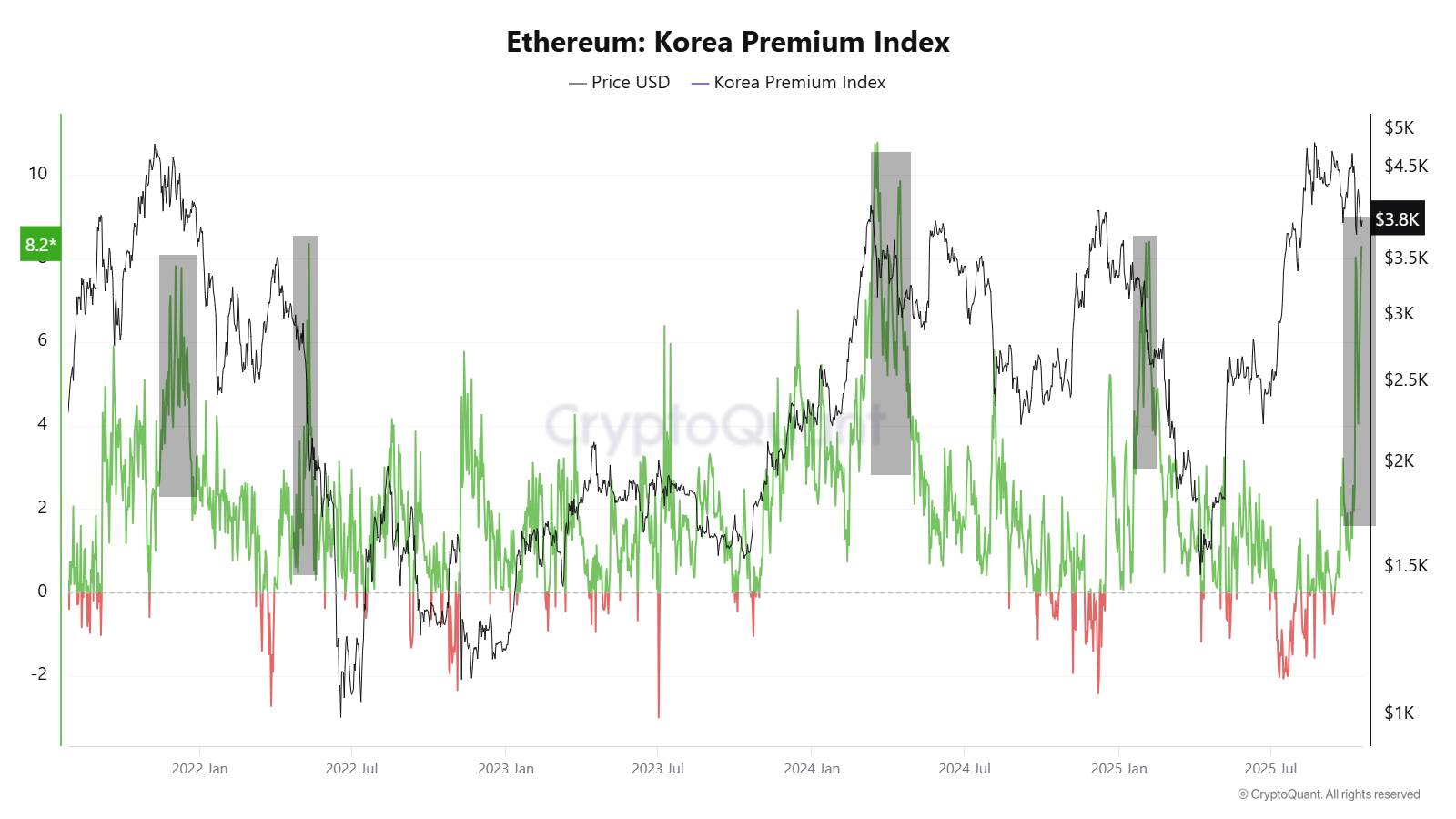

In a caller station connected the societal media level X, marketplace expert CryptoOnchain revealed that the Kimchi Premium has been connected the emergence implicit the past weeks. This reflection is based connected the question of the on-chain indicator Korea Premium Index, which measures the terms quality betwixt South Korean exchanges and different planetary exchanges.

This metric, oregon the “Kimchi Premium,” shows however overmuch other Korean traders are consenting to wage for a peculiar cryptocurrency (Ethereum, successful this case). When the scale is positive, it means that Korean retailers are consenting to wage a premium for the crypto assets. Meanwhile, a antagonistic Korean Premium Index signals that the retailers are lone consenting to bargain the cryptocurrency astatine a discount.

According to CryptoOnchain, the Korea Premium Index for Ethereum precocious saw a notable surge to astir 8.2%, its second-highest level this year. The marketplace expert noted that this level of Kimchi Premium is simply a troubling sign, arsenic it historically suggests utmost retail FOMO (Fear of Missing Out) and a imaginable terms top.

Source: @CryptoOnchain connected X

Source: @CryptoOnchain connected XTypically, whales thin to instrumentality vantage of the terms spread by selling connected Korean exchanges erstwhile the Korea Premium Index is connected the rise. Due to accrued selling pressure, the Ethereum terms present faces a greater hazard of correction.

For instance, the past clip ETH saw a Kimchi Premium this precocious was successful January, coinciding with the terms autumn to astir $1,500. With this successful mind, investors mightiness privation to tread with caution, arsenic the likelihood of a sustained downward inclination are importantly higher.

Ethereum Price At A Glance

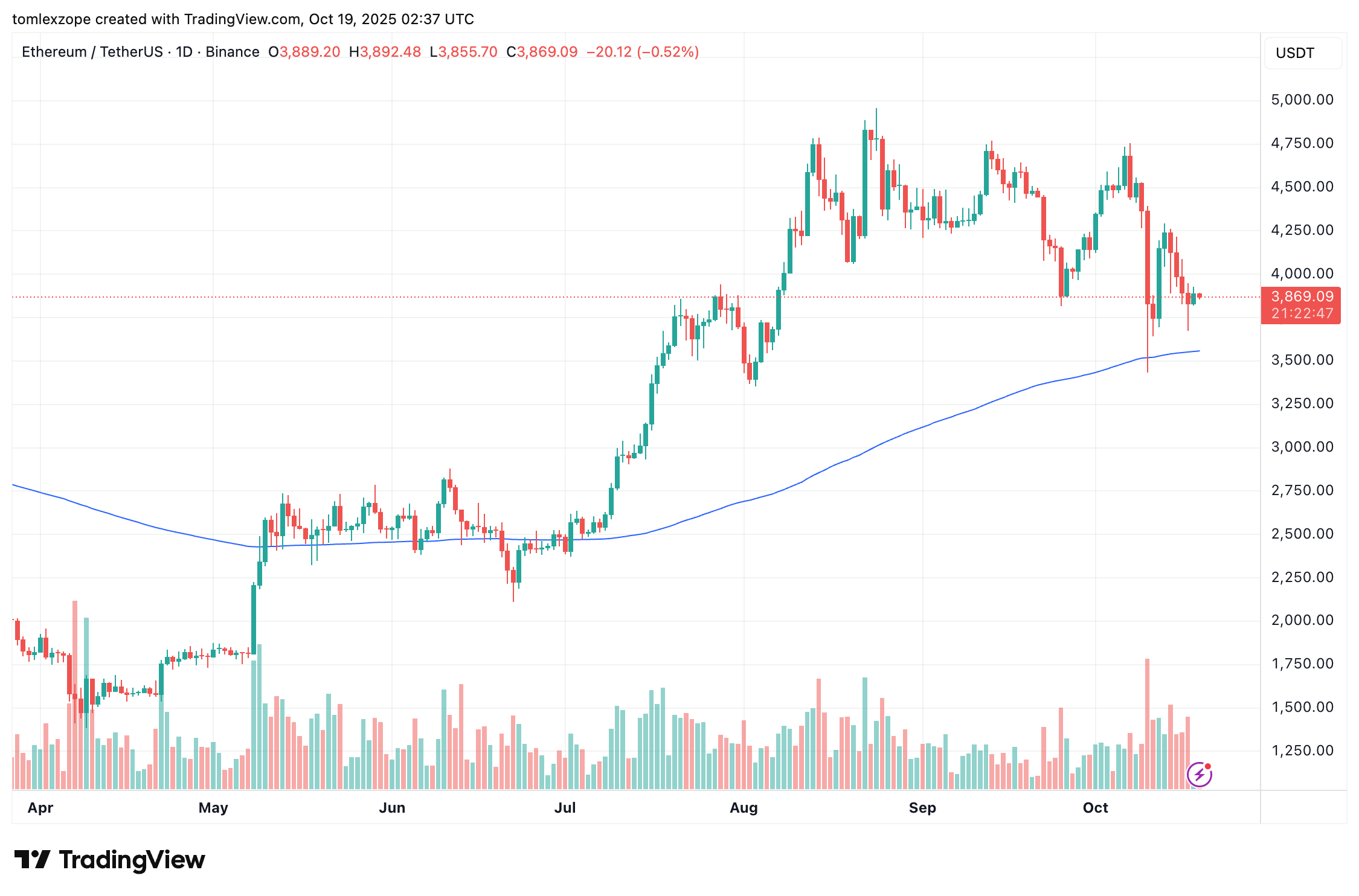

As of this writing, the terms of ETH stands astatine astir $3,875, reflecting nary important alteration successful the past 24 hours. In what was expected to beryllium a bullish play for the cryptocurrency market, “Uptober” has not peculiarly lived up to the expectations of investors. After a affirmative commencement to the month, the Ethereum terms is presently down by astir 10%.

The terms of ETH connected the regular timeframe | Source: ETHUSDT illustration connected TradingView

The terms of ETH connected the regular timeframe | Source: ETHUSDT illustration connected TradingViewFeatured representation from DelishGlobe, illustration from TradingView

4 hours ago

4 hours ago

English (US)

English (US)