The communicative surrounding Ethereum’s aboriginal has fundamentally shifted, and is rapidly solidifying its relation arsenic the global, compliant colony furniture for accepted concern (TradFi). This strategical translation is inextricably linked to the dominance of Stablecoins and the explosive maturation of Tokenized Real-World Assets (RWAs).

Network Effects Of Stablecoins And RWA On Ethereum

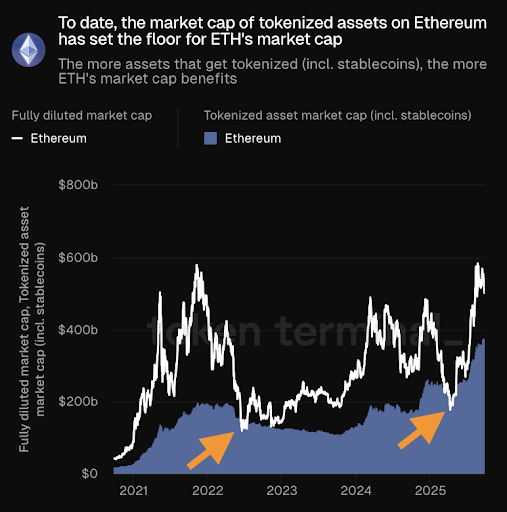

In a caller post connected X, the Token Terminal highlighted a cardinal penetration focusing connected wherefore Stablecoins and RWAs substance for the Ethereum marketplace cap. To date, Stablecoins and RWAs are important for ETH, arsenic the marketplace capitalization of tokenized assets connected ETH acts arsenic the level for ETH’s marketplace cap.

The reasoning is that arsenic much assets are tokenized connected the ETH blockchain, including the monolithic market of stablecoins and the increasing assemblage of RWAs, the full worth locked and secured by the web increases, and the much Ethereum’s marketplace headdress benefits.

Source: Chart from Token Terminal connected X

Source: Chart from Token Terminal connected XA Host and Producer of The Edge_Pod, known arsenic DeFi_Dad, has reflected connected however rewarding it feels to yet spot stablecoins cementing credibility for Ethereum and the decentralized concern (DeFi).

For years, explaining crypto successful existent beingness carried antagonistic associations, which were often tied to terms speculation oregon hype. Meanwhile, the communicative has shifted, and stablecoins person provided a clear, relatable introduction point, with investors focused connected investing successful integer wealth applications utilizing Stablecoins.

However, the adept pointed retired that the stablecoins are present truthful mainstream successful the media that adjacent authorities officials and accepted media are taking them seriously. Unlike Bitcoin, which galore radical lone subordinate with volatile terms action, stablecoins supply applicable inferior and a mode to gain 5–10% yields on-chain.

According to DeFi_Dad, astir of it is built connected ETH and stablecoins, which are similar Fundstrat and the ChatGPT infinitesimal for crypto, a breakthrough merchandise that clicks instantly for the masses. From there, stablecoins would go the stepping chromatic into DeFi output and broader integer plus exposure.

A Stronger Foundation For Future Development

Amid the Ethereum advancements, the caller Go-Pulse v3.3.0 has officially been released, a large rebase that is going to marque the ETH network adjacent faster and much robust. Richard Heart mentioned that the update from the aged Go-Ethereum (GETH) v1.13.13 has gone each the mode up to the caller v1.16.3, which would present important show and ratio improvements.

Heart credited ETH’s relation successful the process, noting that the Ethereum mainnet serves arsenic the eventual investigating ground. By proving stableness connected the ETH, PulseChain is the archetypal to integrate and is the astir reliable and optimized bundle enhancements into its ain ecosystem.

Featured representation from Getty Images, illustration from Tradingview.com

1 month ago

1 month ago

English (US)

English (US)