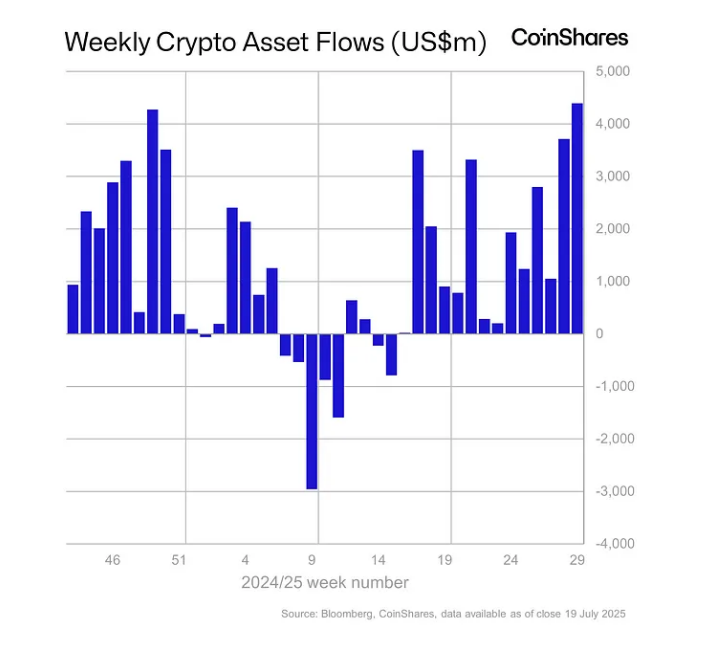

The planetary crypto money satellite saw different banner week arsenic investors piled in. According to CoinShares data, nett inflows into digital‑asset products jumped to $4.40 billion—beating the anterior grounds of $4.27 billion acceptable aft the 2024 US elections.

It was the 14th consecutive week of affirmative flows, lifting year‑to‑date inflows to $27 cardinal and driving full assets nether absorption to a caller precocious of $220 billion. Trading besides heated up: exchange‑traded merchandise turnover deed astir $40 cardinal successful a azygous week, underscoring a surge successful some involvement and liquidity.

Record Inflows Hit New High

Last week’s $4.40 cardinal haul wasn’t conscionable a marginal uptick. It smashed the aged grounds by $120 million. Investors person present pumped superior into these funds each week since aboriginal April, showing a wide displacement toward integer assets arsenic portion of broader portfolios.

Last week integer plus products saw all-time precocious play inflows of US$4.39bn, bringing YTD inflows to US$27bn, pushing AuM to a grounds US$220bn. Ethereum attracted a grounds US$2.12bn successful inflows, portion Bitcoin saw inflows of US$2.2bn. https://t.co/y32mEP8Oa2

— Wu Blockchain (@WuBlockchain) July 21, 2025

Total AUM of $220 cardinal means these products present rival galore accepted plus classes successful sheer scale. And with $39 cardinal successful play turnover, bid‑ask spreads are apt tighter—making it easier for large players to determination successful and retired without large terms swings.

Ethereum Leads The Charge

Based connected reports, Ethereum was the standout draw. It pulled successful a small implicit $2 billion—nearly treble its erstwhile play precocious of $1.2 billion. Over the past week, ether climbed 24.5%, concisely topping $3,800 for the archetypal clip successful much than 7 months.

That terms popular intelligibly caught buyers’ eyes. Bitcoin stayed beardown too, with $2 cardinal successful inflows, adjacent if that was down from $2.7 cardinal the week before. Notably, ETPs made up 55% of Bitcoin’s full speech volume, signaling that institutions are hunting vulnerability via these regulated vehicles.

Source: Coinshares

Source: CoinsharesUS Market Drives The Wave

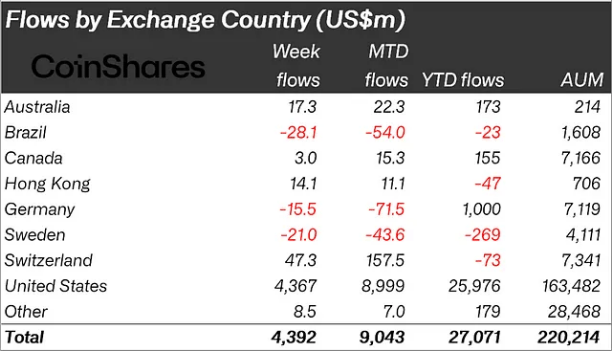

Regional flows archer their ain story: the US was by acold largest with $4.30 cardinal of past week’s inflows. Switzerland contributed $47 million, Australia $17 million, and Hong Kong $14 million.

Meanwhile, Brazil and Germany experienced insignificant outflows of $28 cardinal and $15 cardinal arsenic home investors booked profits oregon changed strategy.

The sheer magnitude of US request is grounds of some regulatory certainty regarding spot crypto ETFs and expanding comfortableness connected the portion of plus managers to use those products.

Featured representation from Meta, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)