Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is present trading astatine a pivotal juncture aft days of accordant selling unit that person pushed the terms down by much than 12% since past Tuesday. Currently hovering astir the $2,400 mark, ETH is struggling to support bullish momentum, and galore analysts pass that a deeper correction could travel if bulls neglect to support this important enactment zone. The caller driblet reflects broader marketplace uncertainty, with rising volatility shaking capitalist assurance conscionable arsenic ETH appeared acceptable to articulation a wider altcoin breakout.

Despite this weakness, there’s increasing optimism successful immoderate corners of the market. Top expert Ted Pillows shared a method investigation showing that a Golden Cross has been confirmed connected Ethereum’s 12-hour illustration — a awesome traditionally viewed arsenic a precursor to large bullish moves. This crossover, which occurs erstwhile the 50-period moving mean crosses supra the 200-period moving average, often marks the opening of an extended uptrend.

If bulls negociate to clasp existent levels and reclaim higher absorption adjacent $2,600, the Golden Cross could go a turning point. Until then, the coming days volition beryllium captious successful determining whether Ethereum tin bounce oregon descend into a longer consolidation phase.

Volatility Hits Ethereum Amid Golden Cross Signal

Ethereum saw crisp volatility implicit the weekend, surging past $2,550 earlier rapidly reversing and falling backmost into the $2,400 portion wrong hours. This abrupt determination has sparked renewed uncertainty, arsenic analysts turn cautious astir the fading bullish momentum and rising selling pressure. While ETH remains 1 of the stronger performers successful the broader altcoin market, it is inactive down 36% from its December precocious of astir $4,100. This leaves bulls with a wide challenge: clasp existent levels and regain power by pushing prices supra $2,800 to ignite a sustained rally.

The $2,400 level is present acting arsenic a captious enactment zone. A interruption beneath it could trigger a deeper retracement, apt dragging Ethereum into a consolidation scope oregon adjacent toward little enactment levels. Still, method signals connection a glimmer of hope.

According to Pillows, Ethereum precocious confirmed a Golden Cross connected the 12-hour illustration — a bullish signifier that occurs erstwhile the 50-period moving mean crosses supra the 200-period moving average. Historically, specified signals person preceded beardown upside moves, and Pillow believes this 1 could pave the mode for Ethereum to scope $3,000 successful the adjacent term.

Ethereum aureate transverse confirmed | Source: Ted Pillows connected X

Ethereum aureate transverse confirmed | Source: Ted Pillows connected XHowever, for that to happen, buyers indispensable measurement successful decisively. Volume has tapered off, and sentiment appears fragile aft past week’s breakdown. If bulls tin support the $2,400 portion and reclaim higher absorption quickly, the Golden Cross mightiness people the opening of Ethereum’s adjacent limb up. Until then, the marketplace remains successful a wait-and-see mode, watching whether the bullish awesome tin outweigh the increasing unit from sellers.

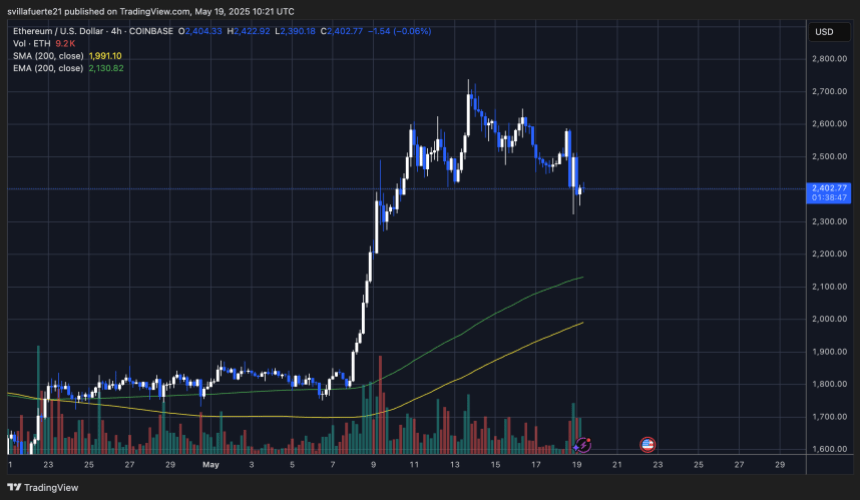

ETH Tests Key Support After Drop From Local Highs

Ethereum is trading astatine $2,402 aft a crisp Sunday sell-off, wherever the terms spiked to $2,670 earlier retracing much than 10% successful little than 24 hours. As seen successful the 4-hour chart, ETH is present consolidating close supra the $2,390–$2,400 zone, a level that is proving captious for bulls to hold. This country coincides with a anterior consolidation portion and could enactment arsenic a short-term enactment base.

ETH investigating section scope lows | Source: ETHUSDT illustration connected TradingView

ETH investigating section scope lows | Source: ETHUSDT illustration connected TradingViewThe 200-period EMA connected the 4H illustration is presently astatine $2,130, and the 200 SMA is adjacent $1,991 — some are importantly beneath the existent terms and connection semipermanent inclination support. However, the measurement illustration shows a spike successful sell-side enactment during the pullback, suggesting that short-term traders are locking successful profits. If terms breaks beneath $2,390, a deeper retrace toward the $2,200–$2,300 scope becomes likely.

On the upside, ETH indispensable reclaim $2,550 to reestablish momentum. Failure to bash truthful could corroborate a section top. The terms enactment is intelligibly indecisive, and this range-bound operation could persist unless bulls reassert spot with a decisive determination supra $2,600. Until then, the $2,400 level remains a battleground betwixt buyers and sellers amid elevated volatility.

Featured representation from Dall-E, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)