Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

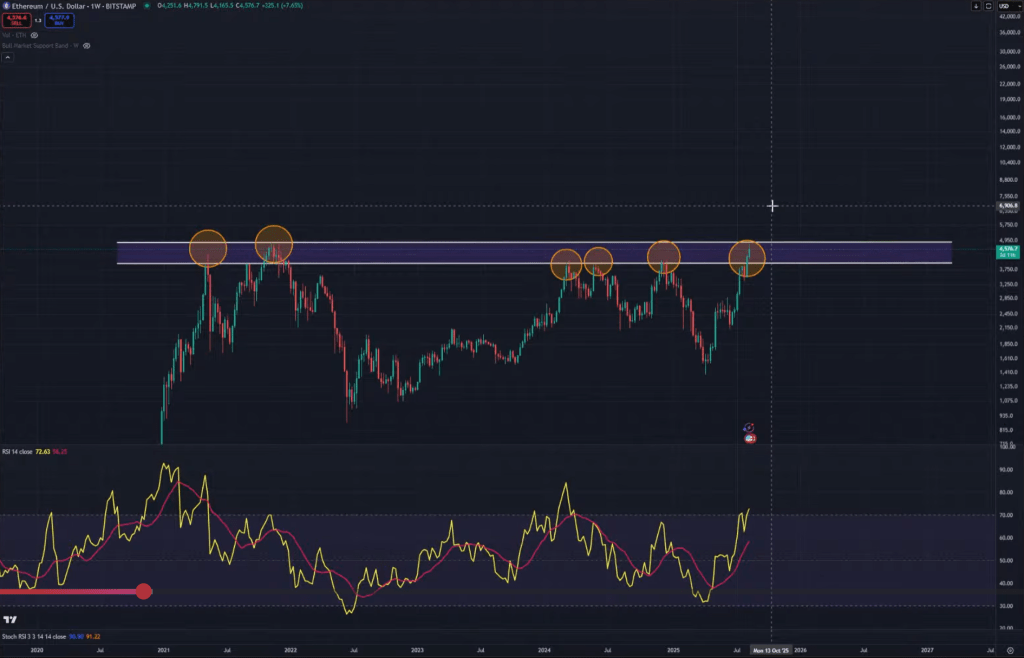

Ethereum has tally consecutive into its four-year ceiling, with terms enactment pressing the $4,700 set that Kevin (@Kev_Capital_TA) repeatedly calls “the level that decides everything.” His latest broadcast frames ETH’s setup arsenic binary: either a decisive interruption done this absorption — confirmed by a cleanable play adjacent and a interruption of the down-trending play RSI enactment — oregon different rejection that extends a months-long signifier of weakening rallies.

Ethereum Teeters astatine $4,700 — Breakout Oor Bloodbath?

“The catch-up is over,” Kevin said, noting ETH has “finally caught up to fundamentally wherever Bitcoin is at… it’s astatine its large resistance.” In his read, the $4,700 country is not a azygous tick but a proviso portion defined by the anterior cycle’s highest and reinforced by a “weekly downtrend connected the RSI” that has capped each beforehand since aboriginal 2024. “Break absorption and the existent bull volition begin,” helium added. Until that happens, helium characterizes this set arsenic the “line successful the sand.”

Ethereum terms investigation | Source: X @Kev_Capital_TA

Ethereum terms investigation | Source: X @Kev_Capital_TAMomentum into the trial was real. Kevin described wealth travel improving and “nice patterns forming connected immoderate altcoins” — including “textbook inverse caput and shoulders” — earlier the follow-through failed and ETH stalled close astatine resistance. He pointed to the Asia session’s deficiency of continuation and, much forcefully, to a macro astonishment that deed arsenic the marketplace was leaning long.

That daze was the US Producer Price Index. “The PPI came successful importantly hotter than expected,” Kevin said, emphasizing some the magnitude and wherever the unit showed up: month-over-month +0.9% versus +0.2% expected, year-over-year 3.3% versus 2.5%, with halfway PPI +0.9% m/m versus +0.2% and 3.7% y/y versus 3.0%.

In his view, this reflects tariff-driven costs being “brunted by the producer,” which is wherefore the spike surfaced successful PPI alternatively than CPI. The unfastened question — and the hazard to ETH astatine absorption — is whether those costs “trickle into the CPI” and, by extension, PCE. He underscored however rapidly rate-cut probabilities whipsawed connected the FedWatch instrumentality intraday: September inactive heavy favored, October mostly intact, and December “pricing retired a 3rd complaint cut” earlier flipping backmost toward it arsenic the time progressed. “This has been volatile this morning… fto it settee out,” helium cautioned, adding that next week’s Jackson Hole remarks from Chair Powell are the adjacent large macro catalyst.

Technically, Kevin’s checklist for Ethereum does not alteration with 1 information print. He stresses 2 confirmations: instrumentality retired the horizontal proviso astir $4,700 with authorization and “break the play downtrend connected the RSI” to nullify the bearish divergence that has persisted since Q1 2024. “Resistance is absorption until it’s not,” helium said. Fail there, and ETH risks different corrective limb arsenic precocious longs are forced retired astatine the worst imaginable spot. Succeed, and “the full speech changes,” opening a way to what helium calls a “real bull” successful ETH and, by knock-on effect, successful the broader alt market.

He ties ETH’s destiny to broader marketplace operation without diluting the focus. Total2 — his ETH-plus-alts proxy — “came up to 1.69 trillion” against a well-telegraphed breakout trigger astatine “1.72 trillion,” portion tapping its ain play RSI downtrend. The inability to propulsion that past fewer twelve billions alongside the PPI daze explains the abrupt reversal crossed ETH and alts. Kevin besides flagged stablecoin dynamics and seasonal liquidity arsenic inheritance variables, noting USDT dominance remains elevated and that September “usually” isn’t a large period arsenic accepted funds instrumentality from summer, negociate taxes, and hole for Q4 risk.

TOTAL investigation | Source: X @Kev_Capital_TA

TOTAL investigation | Source: X @Kev_Capital_TAOperationally, helium argues that the close commercialized determination was down us, not astatine resistance. “There’s nary crushed to beryllium buying up successful these brainsick levels,” helium said, advising patience for anyone positioned from lower. His model is elemental and strict: ticker the play ETH chart, the $4,700 band, and the RSI trendline. If macro “stays steady,” helium expects the break; if it deteriorates, he’ll reassess. Either way, the pivot won’t travel from lower-timeframe sound but from ETH yet resolving its four-year wall.

“Focus connected these charts and thing else,” Kevin concluded. For Ethereum, that means 1 test, 1 level, and 1 signal: wide $4,700 and discontinue the divergence — oregon wait.

At property time, ETH traded astatine $4,619.

ETH hovers beneath $4,700, 1-week illustration | Source: ETHUSDT connected TradingView.com

ETH hovers beneath $4,700, 1-week illustration | Source: ETHUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 month ago

1 month ago

English (US)

English (US)