Ethereum's ether (ETH), the 2nd largest crypto asset, is seeing renewed capitalist interest, with spot exchange-traded funds (ETFs) successful the U.S. signaling 1 of their strongest streak of momentum of their one-year history.

On Thursday, BlackRock’s iShares Ethereum Trust (ETHA) booked its largest regular inflow to date, with implicit $300 million, pushing its full assets nether absorption to $5.6 billion, information compiled by Farside Investors show.

That’s portion of a broader resurgence successful ether-backed concern products.

The 9 U.S.-listed ETH ETFs attracted a combined $703 cardinal successful nett inflows this week, according to crypto information supplier SoSoValue. Although Friday’s information is inactive pending, it has already marked the third-strongest play haul since the products launched past July.

Investor request has picked up lately adjacent arsenic ether’s terms has lagged down bitcoin this year, a caller study from plus manager Fineqia noted.

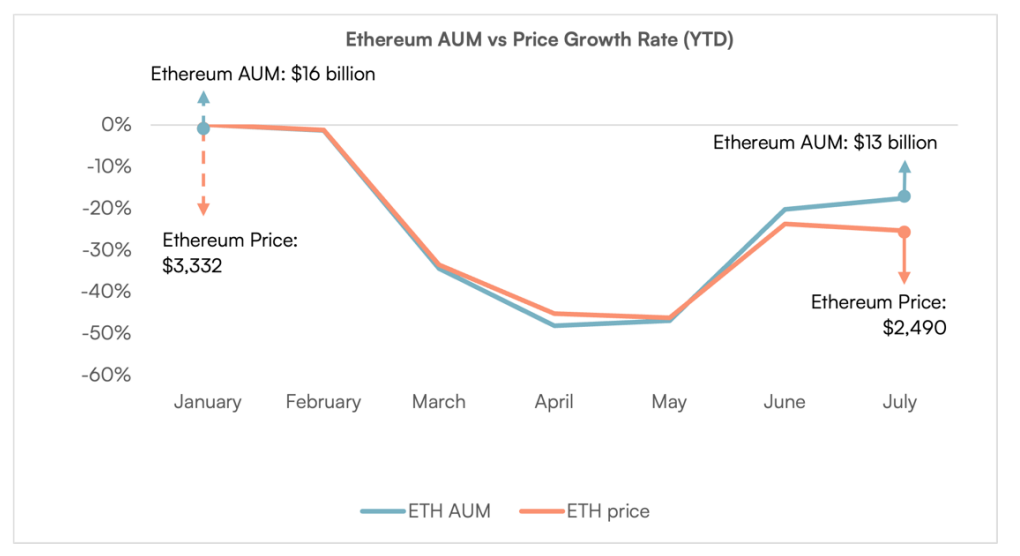

The AUM of ETH-backed exchange-traded products (ETPs) grew 61% faster successful the archetypal fractional of 2025 than the marketplace capitalization of the underlying asset, a motion of dependable inflows into the products, the study said.

The study notes that ETP request began to rebound by precocious April and continued into June, outpacing ETH's terms gain.

The superior flood helped substance ETH's rebound to $3,000, its highest terms successful much than 4 months.

Read more: Ethereum Foundation Sells 10,000 ETH to SharpLink successful First-Such OTC Deal

3 months ago

3 months ago

English (US)

English (US)