Ethereum is trading astatine a pivotal level aft a beardown bullish rally pushed its terms supra the $3,650 mark. This surge has positioned ETH arsenic 1 of the strongest performers successful the existent crypto marketplace cycle, igniting optimism among investors and analysts alike. With bulls successful control, galore are pointing to increasing momentum crossed altcoins arsenic a motion that the long-anticipated altseason whitethorn yet beryllium underway.

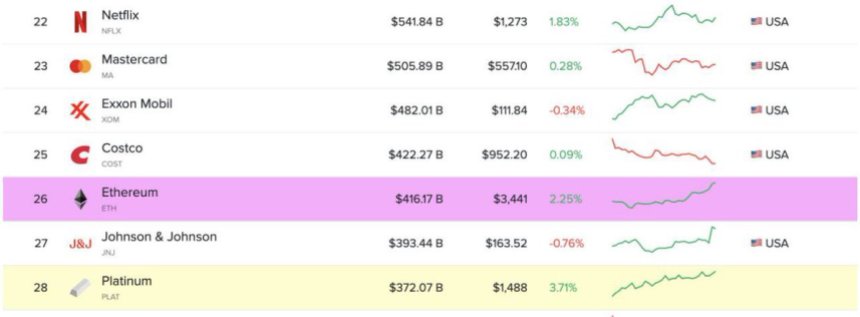

Adding to this narrative, Ethereum has present entered the database of the apical 30 planetary assets by marketplace capitalization, reaching a $416.17 cardinal marketplace cap. This accomplishment reflects not lone terms appreciation but besides a rising question of planetary designation and adoption. Institutional request is climbing, spot ETF inflows are surging, and method indicators stay firmly successful bullish territory.

As Bitcoin consolidates aft reaching caller all-time highs, Ethereum’s comparative spot is drafting attention. The coming days volition beryllium cardinal successful confirming whether ETH tin prolong this momentum and propulsion toward caller highs, oregon if it volition look absorption astatine this intelligence level. For now, marketplace sentiment remains optimistic, and Ethereum’s positioning among the world’s apical assets hints astatine a maturing integer system with ETH astatine its center.

Global Adoption Increases For Ethereum

Ethereum has officially go the 26th astir invaluable plus globally by marketplace capitalization, according to data shared by apical expert Ted Pillows. With a marketplace headdress of implicit $416 billion, Ethereum present sits among the world’s fiscal giants—an awesome milestone that underscores the asset’s increasing legitimacy and capitalist interest. Pillows added that this positioning could people the opening of Ethereum FOMO, arsenic some retail and organization investors respond to rising momentum and marketplace structure.

Ethereum becomes the 26th astir invaluable plus by marketplace headdress | Source: Ted Pillows connected X

Ethereum becomes the 26th astir invaluable plus by marketplace headdress | Source: Ted Pillows connected XThis surge successful valuation comes connected the heels of a large legislative breakthrough. The US House of Representatives passed 3 captious crypto bills yesterday, including the GENIUS Act and the Clarity Act. These laws purpose to bring much-needed regulatory transparency to the crypto sector, further reinforcing capitalist confidence. The transition of these bills is viewed arsenic a turning constituent successful US crypto policy, mounting the signifier for broader organization adoption and innovation.

Meanwhile, institutions are ramping up ETH accumulation. On-chain information reveals dependable inflows into Ethereum spot ETFs, portion a noticeable premium connected Coinbase suggests beardown request from US-based whales. Combined with a bullish terms operation and improving macro conditions, Ethereum appears to beryllium entering an expansive phase, not lone successful terms but besides successful web usage and adoption.

ETH Surges To New Highs After Breaking Major Resistance

Ethereum has continued its bullish advance, present trading astatine $3,619 pursuing a cleanable breakout supra the cardinal absorption level astatine $2,852. The illustration shows a wide displacement successful momentum, with ETH surging much than 25% implicit the past week, backed by beardown measurement and bullish structure. This marks the highest terms since aboriginal 2024, and it comes arsenic Ethereum decisively clears each large moving averages connected the 3-day chart—the 50, 100, and 200 SMAs.

ETH reclaims cardinal levels | Source: ETHUSDT illustration connected TradingView

ETH reclaims cardinal levels | Source: ETHUSDT illustration connected TradingViewThe 200-day SMA astatine $2,815 had acted arsenic a long-standing ceiling during the past twelvemonth of consolidation and correction. Now that terms has reclaimed it with strength, the erstwhile absorption could flip into beardown enactment successful the adjacent term. The caller terms enactment besides resembles the breakout signifier seen earlier ETH’s past large rally toward all-time highs.

Volume has importantly increased, further validating the breakout and suggesting that organization information whitethorn beryllium rising again, particularly arsenic spot Ethereum ETFs proceed seeing grounds inflows. If ETH holds supra the $3,400–$3,500 portion implicit the coming days, a continuation toward the $4,000 intelligence level could beryllium next.

Featured representation from Dall-E, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)