Ether (ETH) acceptable a caller all-time precocious astatine $4,946 earlier this week, but the substance from on-chain concern looks weaker than successful anterior cycles.

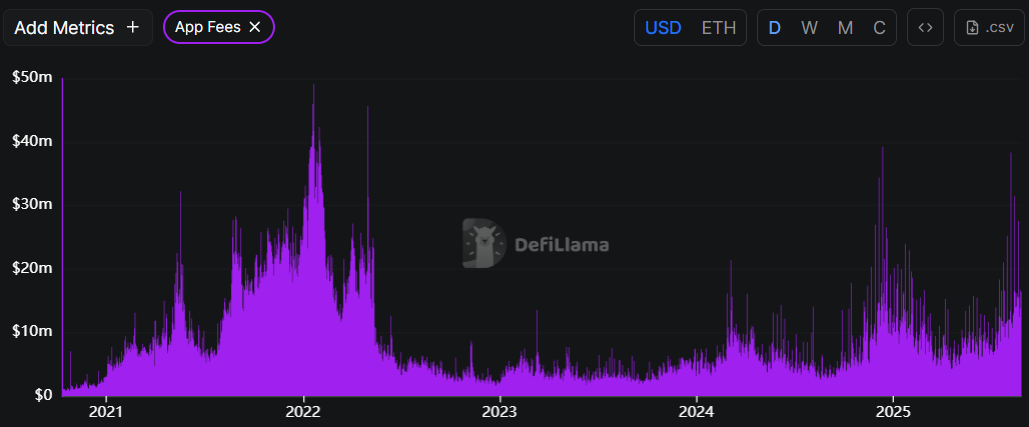

However, the full worth locked (TVL) crossed the network's decentralized concern (DeFi) ecosystem stalled astatine $91 billion, importantly beneath the $108 cardinal grounds acceptable successful November 2021, according to DefiLlama data.

In ETH terms, the spread is sharper: conscionable nether 21 cardinal ETH are locked connected Tuesday, compared to 29.2 cardinal ETH successful July 2021. Even earlier this year, the fig topped 26 cardinal ETH. That means less tokens are actively tied up successful DeFi than astatine immoderate constituent since the protocol deed its terms highs.

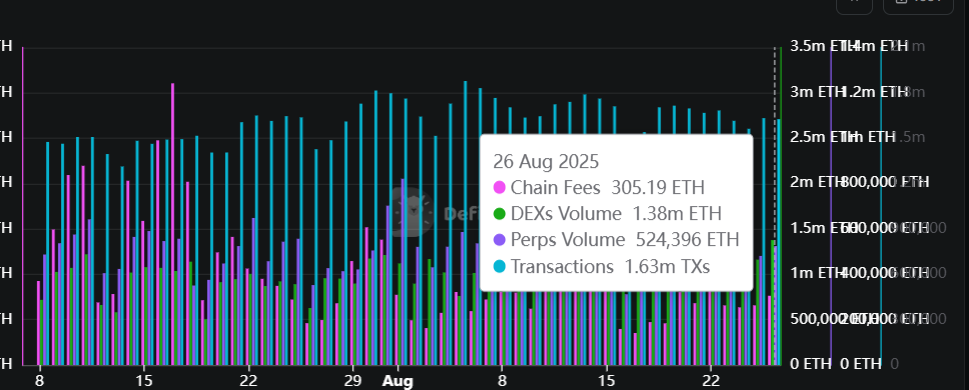

Charts amusement the disconnect. DEX volumes and perps flows stay active, but they person not returned to past peaks adjacent with prices breaking caller records.

Layer 2s scoop up liquidity

Part of the displacement is structural arsenic furniture 2s gully inflows. Coinbase-backed Base's DeFi TVL is lasting gangly astatine $4.7 billion, alongside the maturation of Arbitrum and Optimism. Capital ratio has besides changed the equation, with staking protocols similar Lido ore liquidity without requiring the aforesaid bulk deposits that erstwhile inflated earthy TVL.

“Despite ETH reaching grounds caller highs, its TVL remains beneath past records owed to a operation of much businesslike protocols and infrastructure, arsenic good arsenic accrued contention from different chains amid a lull successful retail participation,” said Nick Ruck, manager astatine LVRG Research, successful a Telegram message.

“To reclaim those TVL peaks, we'd request a resurgence successful retail DeFi engagement, broader adoption of Ethereum-native output opportunities, and a slowdown successful superior migration to competing chains oregon off-chain investments. Ethereum's scaling solutions besides request to equilibrium ratio with incentivizing robust on-chain liquidity to thrust TVL growth,” Ruck added.

Back successful 2020 and 2021, TVL was the market’s favourite maturation metric. “DeFi Summer” turned output farming into a speculative loop, with tokens flooding into Maker, Aave, Compound, and Curve successful hunt of double- and triple-digit returns.

The accelerated ascent successful TVL became a shorthand for Ethereum’s dominance and yet a awesome of terms momentum. But that dynamic looks weaker this cycle. Volumes connected DEXs and perpetuals stay steady, but they haven’t returned to levels that erstwhile defined Ethereum’s breakout.

Structural shifts deed DeFi

Part of the displacement is structural. The emergence of liquid staking protocols similar Lido has made superior much efficient, concentrating liquidity without requiring the bulk deposits that erstwhile inflated TVL.

The divergence besides reflects however this rhythm is being driven. ETF inflows, organization allocations, and macro positioning person been the ascendant catalysts for ETH’s grounds price, with nett assets connected specified products jumping from $8 cardinal successful January to implicit $28 cardinal arsenic of this week.

Retail DeFi activity, the substance of anterior booms, has yet to follow. That leaves ETH looking little similar the halfway of grassroots crypto speculation and much similar a macro asset.

For ETH bulls, the anticipation is that grounds prices yet reignite on-chain experimentation and propulsion superior backmost into DeFi.

Until then, the spread betwixt token worth and protocol usage serves arsenic a reminder that this rhythm is unfolding differently. If on-chain engagement doesn’t return, ETH’s grounds prices could extremity up leaning connected thinner foundations than bulls would similar to admit.

2 months ago

2 months ago

English (US)

English (US)