The DeFi assemblage has experienced a important summation successful some enactment and token prices, chiefly driven by Bitcoin’s October rally. Central to knowing this scenery is the conception of Total Value Locked (TVL) and decentralized speech (DEX) volumes, 2 captious metrics that connection insights into the wellness and trajectory of DeFi protocols.

TVL, the aggregate worth of assets deposited successful DeFi protocols, serves arsenic a barometer for assemblage wellness and capitalist sentiment. CryptoSlate investigation recovered an absorbing maturation signifier crossed assorted chains. Ethereum, the frontrunner with $25.336 cardinal successful TVL, has seen a 31.14% summation implicit the past month, cementing its ascendant presumption successful the DeFi space. Solana, though little successful wide TVL, showed the highest maturation complaint astatine 89.31%. Notably, each chains recorded affirmative maturation implicit the month, indicating a robust enlargement crossed the sector.

The fig of progressive users connected these chains offers further insights. Despite its little TVL, Tron boasts a importantly larger progressive idiosyncratic basal of 1.69 million, which could effect from a much retail-oriented idiosyncratic landscape. Conversely, Ethereum’s little progressive idiosyncratic number than its TVL mightiness bespeak a higher engagement of organization oregon sophisticated, high-net-worth investors.

The marketplace headdress to TVL ratio is different captious metric, shedding airy connected the market’s cognition of a chain’s value. Ethereum’s ratio of 9.72 suggests a mature market. In contrast, Solana’s higher ratio of 43.49 indicates either imaginable maturation opportunities oregon an undervalued ecosystem, warranting person capitalist scrutiny.

| 1.Ethereum | 946 | 304,493 | -0.12% | +6.50% | +31.14% | $25.473b | $64.929b | $1.718b | $7.27m | 9.63 |

| 2.Tron | 26 | 1.69m | -1.34% | +5.04% | +25.14% | $8.291b | $47.455b | $11.33m | $1.66m | 1.13 |

| 3. BSC | 663 | 945,060 | +0.22% | +1.70% | +12.58% | $2.996b | $4.992b | $429.32m | $348,294 | 12.62 |

| 4.Arbitrum | 481 | 133,870 | -0.38% | +10.90% | +25.21% | $2.095b | $1.844b | $925.94m | 0.66 | |

| 5.Polygon | 488 | +1.28% | +8.10% | +21.93% | $852.6m | $1.17b | $369m | $87,858 | 10.06 | |

| 6.Optimism | 197 | 91,508 | -0.12% | +11.94% | +25.87% | $739.39m | $576.85m | $109.27m | 2.11 | |

| 7.Avalanche | 344 | 33,880 | -1.04% | +12.63% | +28.18% | $615.82m | $1.07b | $140.2m | $36,244 | 9.73 |

| 8.Solana | 115 | -1.55% | +23.58% | +89.31% | $530.8m | $1.513b | $425.62m | $108,773 | 42.62 |

Table showing the TVL, progressive users, volume, and marketplace headdress to TVL ratio for the 8 largest L1 chains connected Nov. 14, 2023 (Source: DeFi Llama)

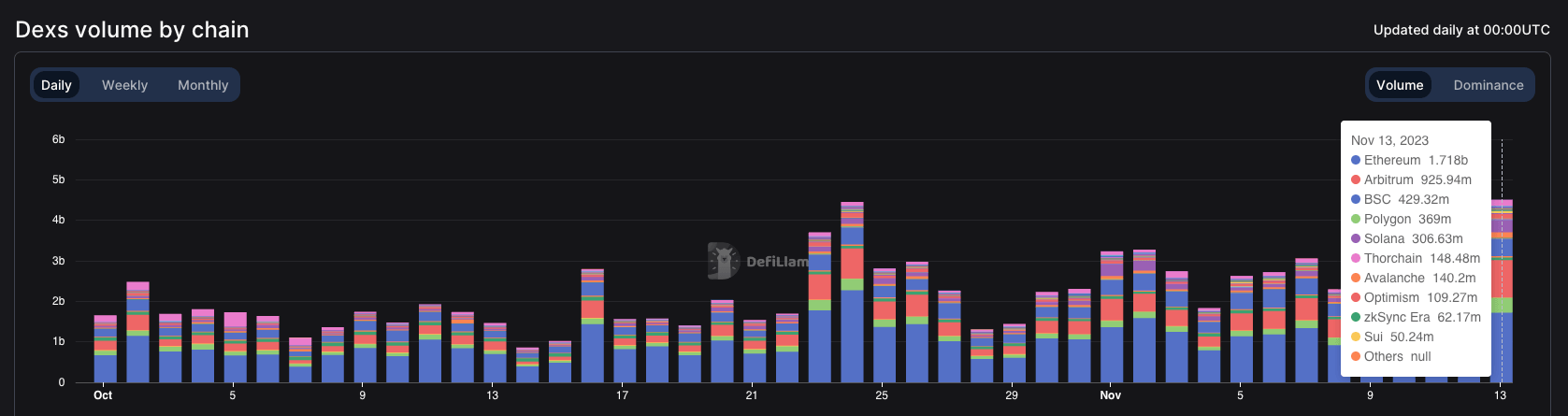

DEX volumes supply a lens into the trading enactment wrong these ecosystems. Ethereum leads with a 24-hour measurement of $1.718 billion, accounting for a important information of the full market. The accelerated maturation successful DEX volumes connected platforms similar Solana and Polygon, with increases of 81.35% and 86.32%, respectively, reflects increasing idiosyncratic adoption and confidence.

Chart showing the trading measurement connected decentralized exchanges (DEXs) crossed assorted L1 chains from Oct. 1 to Nov. 14, 2023 (Source: DeFi Llama)

Chart showing the trading measurement connected decentralized exchanges (DEXs) crossed assorted L1 chains from Oct. 1 to Nov. 14, 2023 (Source: DeFi Llama)| 1. Ethereum | +27.29% | $1.718b | $10.65b | 5.941b | 37.12% | $1.888t |

| 2. Arbitrum | +58.15% | $925.94m | $4.415b | 1.127b | 20.00% | $138.902b |

| 3. BSC | +7.54% | $429.32m | $2.752b | 1.577b | 9.27% | $757.4b |

| 4. Solana | +81.35% | $425.62m | $2.571b | 185.78m | 9.19% | $54.616b |

| 5. Polygon | +86.32% | $369m | $1.711b | 0 | 7.97% | $101.421b |

Table showing trading volumes and full worth locked for decentralized exchanges (DEXs) crossed the 5 largest L1 chains connected Nov. 14, 2023 (Source: DeFi Llama)

The observed trends successful TVL, progressive users, and DEX volumes amusement a marketplace booming with activity. Ethereum continues to lead, some successful presumption of TVL and DEX volume, signaling beardown capitalist assurance and marketplace dominance.

However, the accelerated maturation of newer platforms similar Solana and Polygon suggests a diversifying landscape, with antithetic chains catering to varied idiosyncratic needs and concern profiles. The marketplace headdress to TVL ratios further confirms the maturation imaginable of little marketplace headdress chains, with Solana and Polygon positioning themselves for aboriginal growth.

The station Ethereum and Solana pb DeFi surge arsenic TVL and DEX enactment soar appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)