Ethereum’s (ETH) latest terms rally has sparked renewed statement implicit whether the marketplace is nearing a captious turning point. Analysts are looking intimately astatine past cycles for insight, with immoderate suggesting that past whitethorn beryllium repeating itself. If the patterns clasp true, ETH could beryllium lone weeks distant from a cycle peak, making this a decisive infinitesimal for investors to see erstwhile it mightiness beryllium clip to merchantability everything.

Ethereum’s Cycle Top Signals When To Exit

Crypto expert Jackis has shared insights into Ethereum’s caller terms movements, indicating erstwhile investors should exit the marketplace entirely. In a caller X societal media post, the expert noted that the ETH terms action is intimately mirroring its behaviour from erstwhile marketplace cycles.

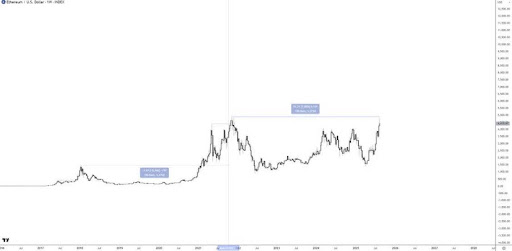

Looking astatine the chart, Ethereum had deed 1 of its large rhythm tops successful January 2018, followed by different peak successful November 2021. Moreover, some instances were preceded by a crisp upward trajectory that culminated successful dense corrections. Jackis besides points retired that successful those earlier cycles, ETH was trading importantly supra anterior highs earlier topping out. This time, however, the altcoin has not adjacent breached into a caller all-time high yet, though it is presently approaching that captious resistance.

Notably, the timing of ETH’s existent setup is significant, arsenic the four-year rhythm theory suggests that the cryptocurrency could beryllium conscionable 4 weeks distant from a large top. Jackis noted that this model aligns with September, which could service arsenic a captious infinitesimal for investors to reassess risks and see whether “selling everything” is warranted.

Source: Jackis connected X

Source: Jackis connected XThe expert further highlighted that portion Ethereum’s operation shows strength, astir altcoins are lagging acold behind. Cryptocurrencies specified arsenic Binance Coin (BNB), XRP, and Dogecoin (DOGE) person already established their tops successful 2021 and stay acold beneath those levels.

Jackie stated that their terms enactment suggests a marketplace situation much accordant with ETH trading astir $2,200, alternatively than its existent level beneath $4,500. Bitcoin, meanwhile, has continued to march higher since its November 2022 lows, forming higher lows and higher highs successful a textbook bull market structure.

ETH Panic Selling Or Pre-Breakout Opportunity?

In different news, crypto marketplace adept Ether Wizz argues that the existent panic selling of Ethereum mirrors the aforesaid mistake traders made with Bitcoin successful past cycles. At the time, aboriginal sellers underestimated the spot of organization request and semipermanent buyers, lone to ticker BTC surge acold beyond expectations.

The expert highlighted a caller rebound successful the Ethereum terms supra the 50-week Simple Moving Average (SMA), which historically has signaled the opening of explosive rallies. The examination betwixt Ethereum’s 2025 illustration and its 2017 breakout besides highlights a similarity. In some cases, the cryptocurrency consolidated, reclaimed its moving average, and past accelerated higher.

Notably, Ether Wizz points retired that Ethereum could inactive acquisition a short-term correction of 5% to 10%. However, helium argues it is misguided to presume ETH has already peaked, maintaining alternatively that the cryptocurrency is successful the aboriginal stages of a determination that could yet thrust its terms toward a caller all-time precocious of $10,000.

Featured representation from Pixabay, illustration from Tradingview.com

1 month ago

1 month ago

English (US)

English (US)