A crisp pullback crossed crypto markets connected Tuesday triggered astir $735 cardinal successful liquidations with bulls bearing the brunt.

Ether (ETH) and XRP tracked futures bets booked larger losses than bitcoin successful an antithetic move, indicative of the higher involvement toward altcoin traders successful the past week.

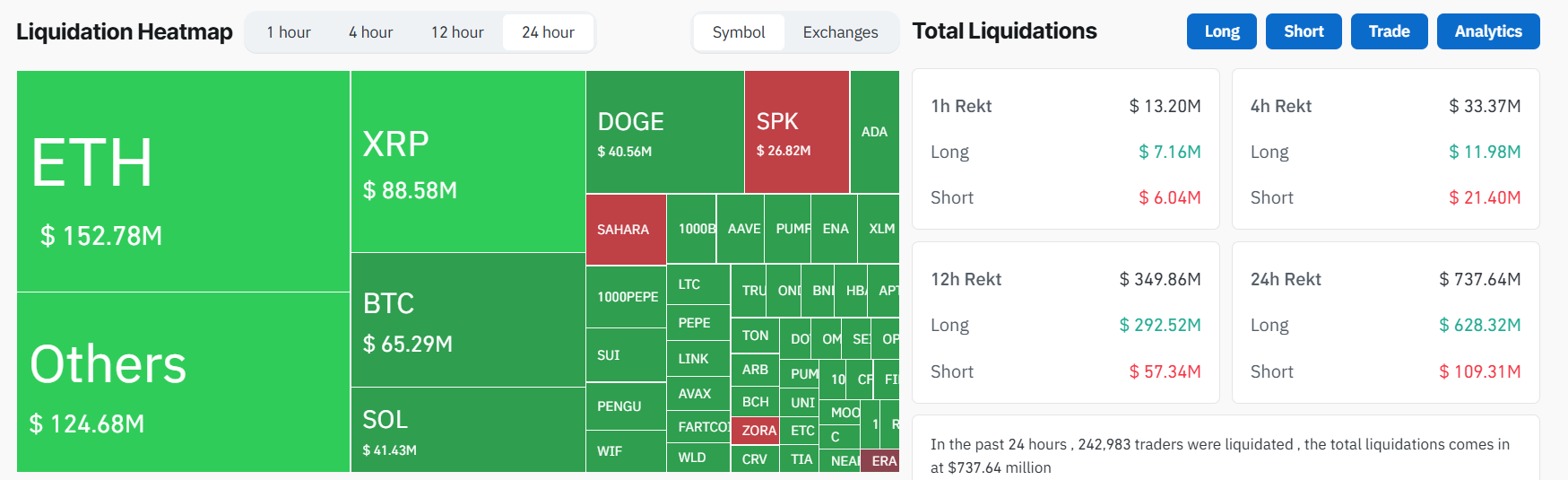

CoinGlass information shows ETH traders mislaid $152.78 million, the largest for immoderate asset, followed by $88.58 cardinal successful liquidations for XRP. Bitcoin came successful 3rd astatine $65.29 million, contempt its larger marketplace headdress and deeper liquidity.

While terms enactment crossed the majors was mostly down by lone a fewer percent points, the precocious leverage utilized by retail traders successful altcoins apt amplified their losses. In total, $625.5 cardinal of the liquidations were connected agelong positions, suggesting the selloff caught galore bulls disconnected defender aft weeks of upward momentum.

Other heavy deed tokens included Solana’s SOL astatine $41 million, dogecoin (DOGE) astatine $40 million, and smaller DeFi tokens similar SPK and PUMP seeing implicit $10 cardinal successful positions wiped.

The lack of a wide catalyst and profit-taking adjacent cardinal absorption levels whitethorn person exacerbated the selloff. Ether had precocious flirted with the $4,000 people portion Bitcoin traded supra $118,000 — levels that had already prompted nett booking from larger wallets.

As of writing, ETH is down astir 3.6% connected the time to commercialized adjacent $3,540, portion XRP fell 6% to $3.25, extending its play nonaccomplishment to implicit 12%. Bitcoin fared better, slipping conscionable nether 2% to hover astir $116,800.

Crypto liquidations hap erstwhile leveraged positions are forcibly closed owed to a terms determination beyond a trader’s borderline threshold. This typically results successful large losses and tin trigger cascade effects during volatile moves.

Traders usage liquidation information to gauge marketplace sentiment and positioning. Large agelong liquidations often awesome panic bottoms, portion abbreviated liquidations whitethorn precede a squeeze.

Spikes successful liquidations besides assistance place overcrowded trades and imaginable reversals. When paired with unfastened involvement and backing complaint data, liquidation metrics tin connection strategical introduction oregon exit points, particularly successful overleveraged markets prone to abrupt flushes oregon rallies.

3 months ago

3 months ago

English (US)

English (US)