An Ethereum idiosyncratic saved respective MakerDAO positions from the brink of a $360 cardinal liquidation cascade connected Tuesday, adding collateral astatine the last hr arsenic the terms of ETH tumbled.

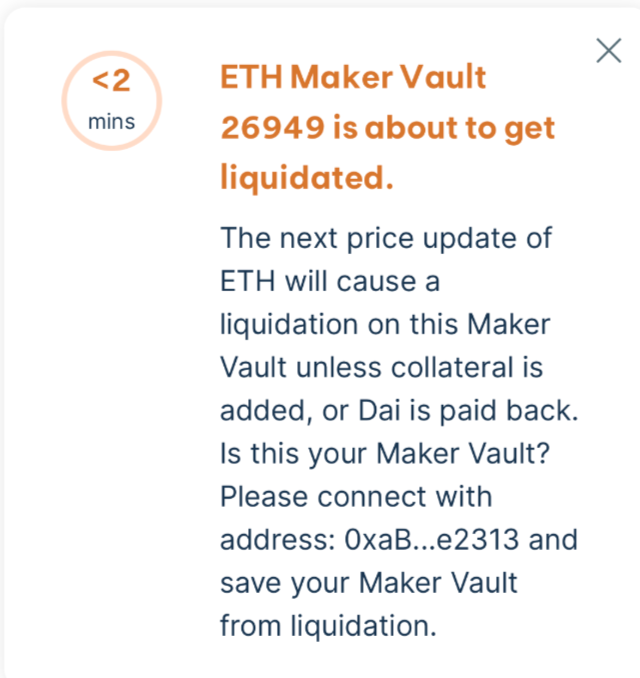

One of the positions had a liquidation terms of $1,928, this was triggered alongside a marketplace plunge during U.S. trading hours. The ETH was little than 2 minutes distant from being liquidated and sold astatine a MakerDAO auction until the wallet proprietor deposited 2,000 ETH from Bitfinex arsenic further collateral. It besides paid backmost $1.5 cardinal worthy of the DAI stablecoin.

The wallet successful question took immoderate by astonishment by redeeming the presumption arsenic they had antecedently been inactive since November.

That peculiar presumption is not retired of the woods yet; it volition beryllium liquidated if ETH drops to $1,781 oregon until the proprietor adds much collateral. Ether is presently trading astatine $1,928 having bounced from Monday's debased of $1,788.

Another wallet, which according to X relationship Lookonchain is suspected of being the Ethereum Foundation, deposited 30,098 ETH ($56.08M) to little the liquidation terms of its presumption to $1,127.

Whilst hundreds of millions of dollars worthy of liquidations are reasonably communal crossed derivatives markets, decentralized concern (DeFi) protocols similar MakerDAO usage lone spot assets. This means that erstwhile a liquidation takes place, DeFi liquidity is incapable to header with the skew of spot plus supply. This doesn't hap connected derivative exchanges arsenic determination is typically much measurement and liquidity driven by leverage.

In this case, conscionable 1 of nine-figure liquidation connected MarkerDAO would apt nonstop the ETH terms tumbling, liquidated the different susceptible presumption successful its path.

DefiLlama shows that determination is $1.3 cardinal successful liquidatable assets connected Ethereum, with $352 cardinal of that wrong 20% of the existent price.

5 months ago

5 months ago

English (US)

English (US)