Ether (ETH), the second-largest cryptocurrency by marketplace value, witnessed a important spike successful volatility aboriginal Monday arsenic the renewed commercialized war betwixt the U.S. and its trading partners triggered broad-based hazard aversion successful fiscal markets.

The terms of ether tanked arsenic overmuch arsenic 24%, with sizeable dislocations crossed centralized exchanges. On Deribit, the terms deed a debased of $2,065, compared with $2,127 connected Kraken and $2,150 connected Coinbase (COIN), the lowest the Aug. 5 crash, according to TradingView and CoinDesk data.

According to CryptoQuant, the descent was the biggest since May 19, 2021. The token of the Ethereum blockchain fell for a 3rd consecutive day, losing 23% implicit the period, the astir since November 2022. BTC, meanwhile, fell conscionable implicit 5% to $91,200.

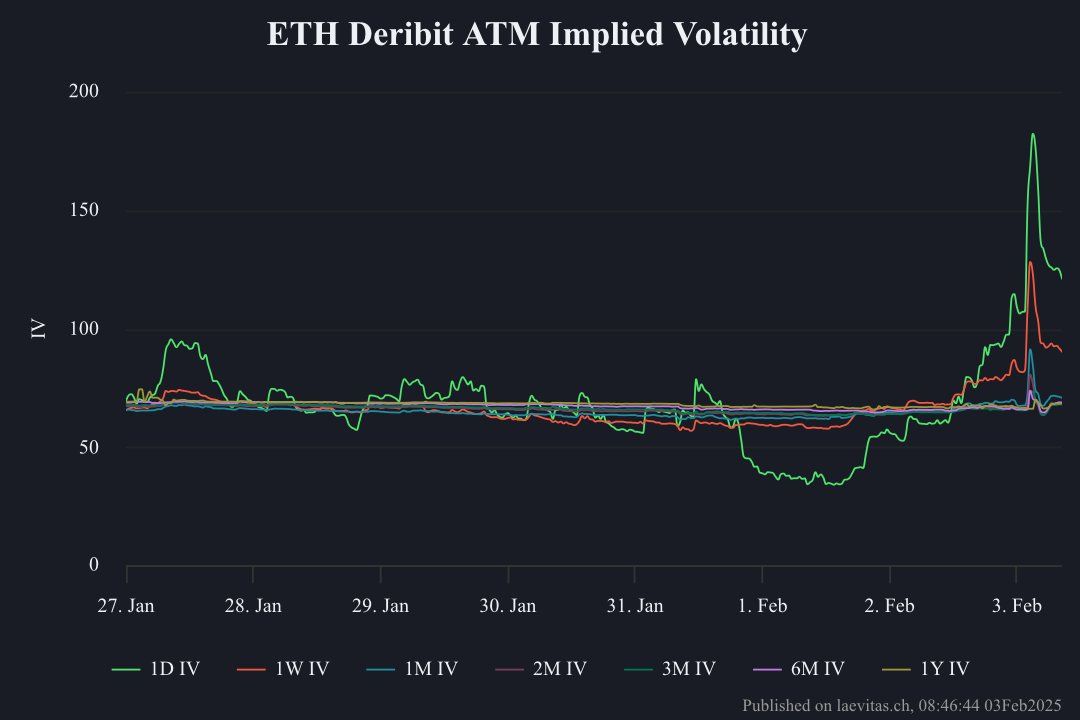

Ether's one-day at-the-money volatility jumped from an annualized 34% to 184% arsenic the terms dropped, according to Deribit's options information tracked by Presto Research.

Deribit's ether DVOL index, which measures the expected terms turbulence implicit the coming 4 weeks, besides surged, climbing to 101% from astir 67%, TradingView information show.

The leap came arsenic traders rushed to acquisition ETH enactment options, which connection downside protection, according to Presto Research.

"The move, which saw ETH perp prices connected Deribit plunge from $3,285 to $2,065, has triggered a important displacement successful marketplace positioning, arsenic evidenced by the put-call ratio surging from past week's comparatively calm 0.6 to supra 2.5 contiguous - indicating a unreserved for downside extortion among marketplace participants," Min Jung, an expert astatine Presto Research told CoinDesk.

At 1 point, hazard reversals, which measurement implied volatility premium (demand) for calls comparative to puts, flashed antagonistic values implicit 10%, an unusually beardown bias for puts.

Market makers added to volatility

That partially stemmed from marketplace makers pulling retired liquidity, a communal diagnostic during volatile trading conditions, according to Griffin Ardern, caput of options trading and probe astatine crypto fiscal level BloFin.

"Some marketplace makers chose to retreat liquidity nether precocious volatility, and their risk-averse behaviour affects options pricing," Ardern told CoinDesk.

According to Markus Thielen, caput of 10x Research, delta hedging by marketplace makers added to the downside volatility successful ETH.

"As marketplace makers and exchanges scrambled to offload futures, they sold astatine immoderate disposable bid, accelerating the sell-off," Thielen said successful a Monday report to clients.

Market makers are tasked with creating bid publication liquidity, and marque wealth from the bid-ask spread. They are terms agnostic and strive to support a nett marketplace (delta) neutral vulnerability done perpetually buying/selling futures. They typically merchantability into weakness oregon bargain into strength, adding to the momentum, erstwhile holding a short gamma exposure.

Trade warfare fears weigh

The gait of the ether terms sell-off has led to speculation that a ample fund/trader ETH-margined positioned successful derivatives oregon DeFi was liquidated, starring to an exaggerated terms slide.

Broadly speaking, however, the descent successful ETH and the broader marketplace looks to person been spurred by the renewed commercialized warfare betwixt the U.S. and Canada, Mexico and China. The interest is that it would inject ostentation into the planetary economy, making it harder for cardinal banks, including the Fed, to proceed lowering involvement rates to enactment economical growth.

Traditional markets suffered connected the backmost of these concerns arsenic well. Dow futures dropped much than 650 points aboriginal today, with European banal futures pursuing suit alongside an uptick successful the dollar.

9 months ago

9 months ago

English (US)

English (US)