A cryptocurrency capitalist turned a $125,000 involvement into a multimillion-dollar nett trading Ether connected a decentralized exchange, adjacent arsenic whales began locking successful gains aft the caller rally.

The savvy trader turned an archetypal concern of $125,000 into implicit $43 cardinal astatine its highest successful conscionable 4 months earlier the latest marketplace downturn deed his Ether (ETH) agelong position.

Despite the marketplace downturn, the savvy trader closed each his positions, locking successful a nett net of $6.86 cardinal connected Monday, generating an awesome 55-fold instrumentality connected his archetypal investment, according to blockchain information level Lookonchain.

After depositing the archetypal $125,000 onto decentralized exchange Hyperliquid, the trader “masterfully compounded his profits, rolling each dollar of summation backmost into his $ETH agelong to physique a massive” $303 cardinal position, said Lookonchain successful a Sunday X post.

The transaction patterns of whales, oregon ample investors, are often monitored by traders to gauge the short-term momentum of the underlying cryptocurrency, arsenic these investors tin clasp market-moving amounts of capital.

Related: Ether treasuries swell arsenic large firms motorboat grounds superior raises: Finance Redefined

Whale moves and ETF flows

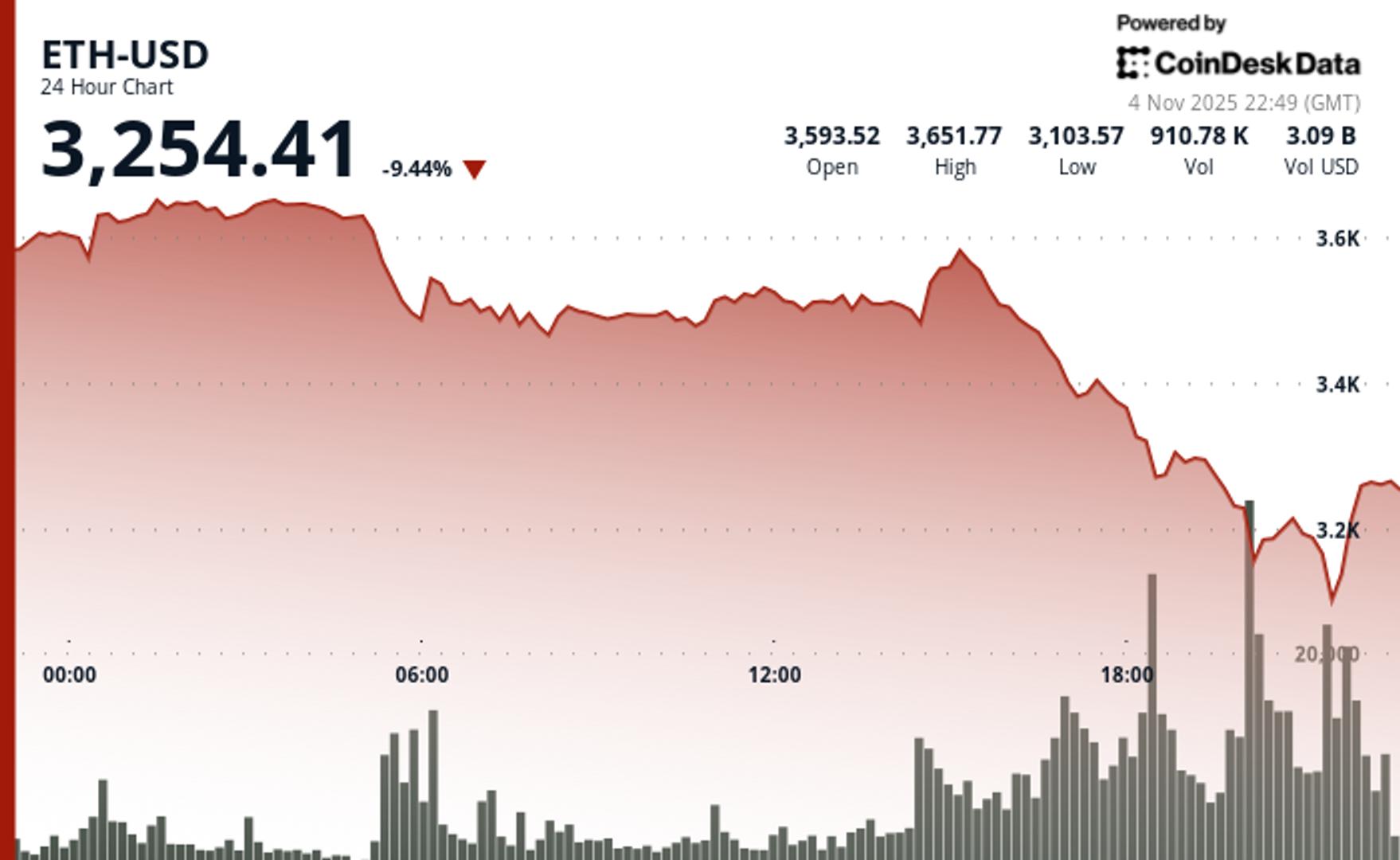

Heading into past weekend, US spot Ether exchange-traded funds (ETFs) saw $59 cardinal worthy of outflows connected Friday, interrupting 8 consecutive days of nett affirmative inflows, Farside Investors data shows.

Following Friday’s ETF outflows, much Ether whales person started locking successful nett successful anticipation of a imaginable correction during the remainder of the August recess period.

On Monday, the wallet labeled “0x806,” 1 of the apical 100 Ether traders tracked by Nansen, sold implicit $9.7 cardinal worthy of Ether — the second-largest Ether merchantability during the past 24 hours — information from Nansen shows.

Another apical 100 Ether trader, wallet “0x34f,” besides sold $1.29 cardinal worthy of Ether, and galore different whales sold millions worthy of the world’s second-largest cryptocurrency.

Related: Bitcoin concisely flips Google marketplace headdress arsenic investors oculus rally supra $124K

“Ethereum’s beardown tally has invited immoderate profit-taking, which whitethorn bounds contiguous upside momentum and alternatively acceptable the signifier for consolidation,” according to Ryan Lee, main expert astatine Bitget exchange.

Bitcoin (BTC) and Ether stay “vulnerable to sharper swings connected immoderate displacement successful sentiment,” owed to the increasing unfastened involvement that illustrates the magnitude of leverage successful the existent marketplace environment, Lee told Cointelegraph.

Investors should beryllium cautious astir immoderate “hawkishness” from the US Federal Reserve oregon a hold successful complaint chopped expectations, which stay the superior operator of the crypto market, added Lee.

Markets are pricing successful an 82% accidental that the Fed volition support involvement rates dependable during the adjacent Federal Open Market Committee gathering connected Sept. 17, according to the latest estimates of the CME Group’s FedWatch tool.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

2 months ago

2 months ago

English (US)

English (US)