Crypto traders should stay vigilant for an ether (ETH) terms driblet beneath $4,200, which could trigger millions successful agelong liquidations and summation marketplace volatility.

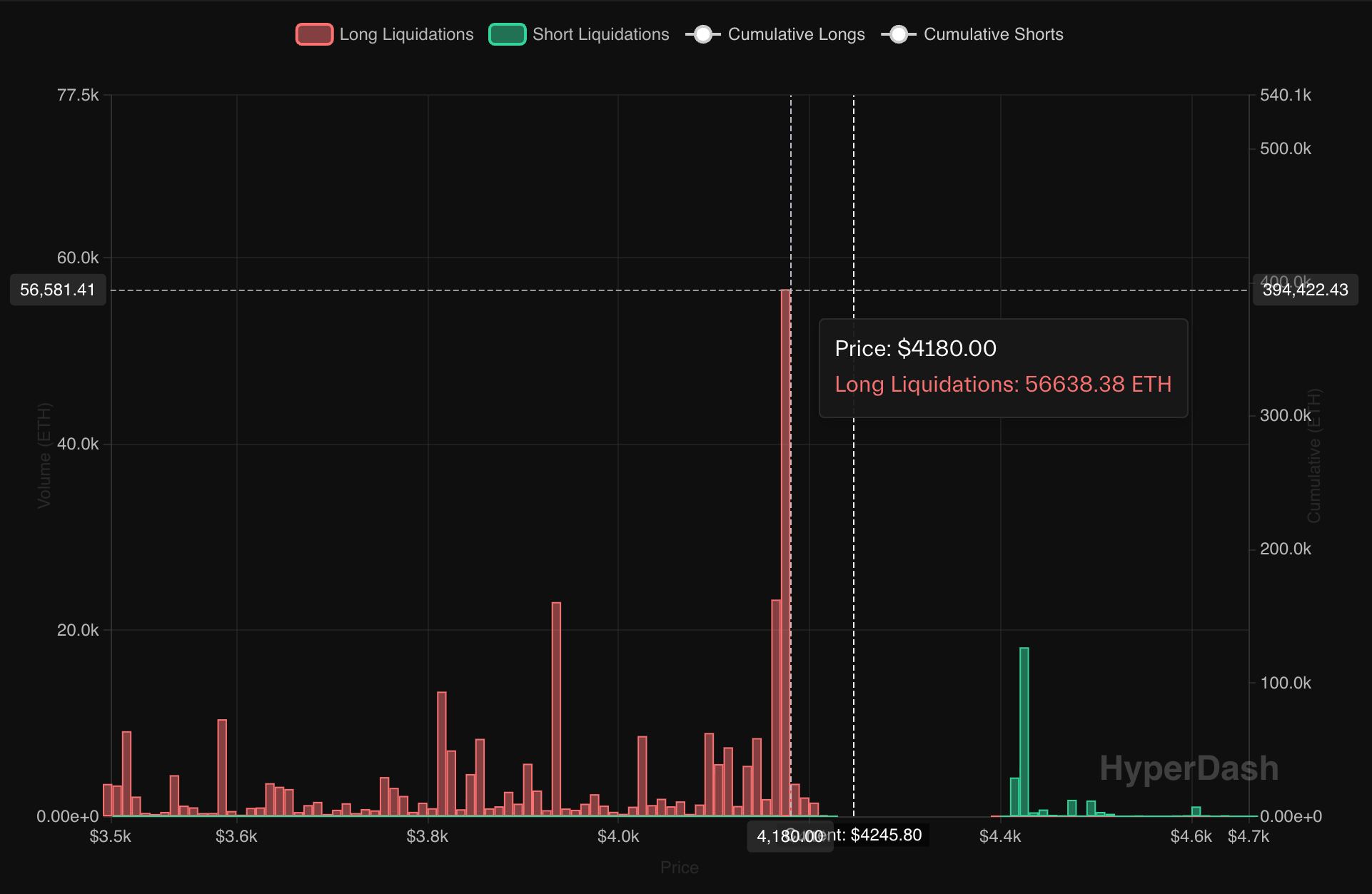

As of writing, implicit 56,638 ETH successful bullish agelong positions – valued astatine $236 cardinal – faced liquidation hazard connected the decentralized perpetual speech Hyperliquid successful lawsuit of an ether terms driblet to $4,170, according to information from Hyperdash.

The information besides showed a hazard of sizable liquidations astatine $2,150-$2,160 and $3,940. At property time, ether changed hands astatine $4,260, down astir 5% connected the day, according to CoinDesk data.

Andrew Kang, laminitis of the crypto task superior steadfast Mechanism Capital, stated connected X that ample agelong liquidations could perchance thrust ether prices down to $3,600.

"[I] would estimation we're astir to deed $5b successful ETH liquidations crossed exchanges, taking america down to $3.2k - $3.6k," Kang said.

Liquidations, oregon the forced closure of leveraged bets, hap erstwhile a trader's presumption falls abbreviated of the borderline requirements acceptable by the exchange.

The borderline shortage typically occurs erstwhile the marketplace moves against the trader's position, causing their relationship equity to autumn beneath the minimum attraction margin. This prompts the speech to automatically adjacent the presumption to forestall further losses and guarantee borrowed funds are recovered.

Largely agelong liquidations origin a abrupt surge successful selling pressure, which pushes prices adjacent lower, creating a cascading effect that tin trigger further liquidations. This antagonistic feedback loop tends to amplify marketplace volatility.

2 months ago

2 months ago

English (US)

English (US)