The futures and options market, a proxy for large money, is progressively backing ether ETH implicit bitcoin BTC successful a large marketplace shift.

Bitcoin, the starring cryptocurrency by marketplace capitalization, precocious reached grounds highs of implicit $ 110,000. According to CoinDesk data, the cryptocurrency has gained implicit 16% this year, drafting spot from the macroeconomic factors and persistent inflows into the spot bitcoin exchange-traded funds.

Meanwhile, ether has dropped 20% this twelvemonth contempt its genitor blockchain, Ethereum, maintaining its rod presumption successful the decentralized concern (DeFi) and tokenization markets.

The show gap, however, whitethorn beryllium closed successful the adjacent word arsenic the pursuing indicator shows a increasing bullish bias for ether.

Options bespeak bullish sentiment for ether

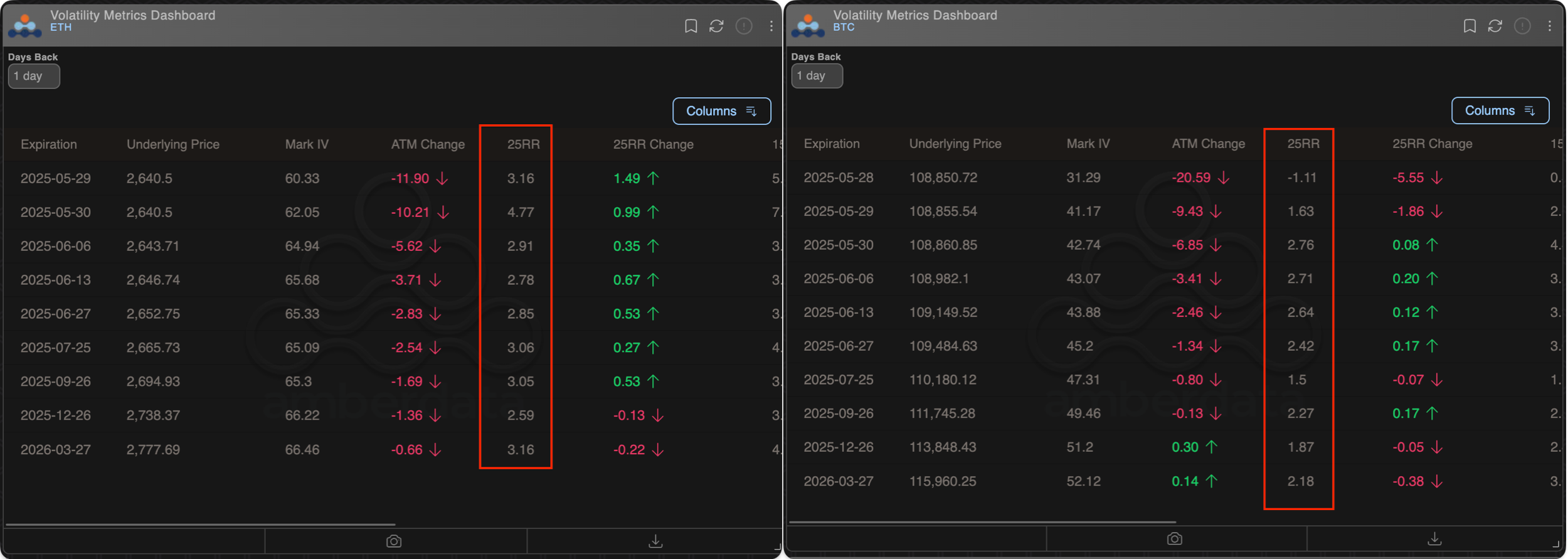

Options listed connected Deribit amusement a stronger bullish positioning for ether comparative to bitcoin.

Options are derivative contracts that springiness the purchaser the close but not the work to bargain the underlying plus astatine a predetermined terms connected oregon earlier a circumstantial date. A telephone enactment gives the close to bargain and represents a bullish stake connected the market, portion a enactment enactment provides extortion against terms drops.

As of writing, some BTC and ETH's 25-delta hazard reversals, a measurement of sentiment derived by examining the quality successful implied volatility (demand) betwixt calls and puts, were positive, reflecting a bias towards telephone options.

However, ETH hazard reversals were much costly than BTC. In different words, traders were comparatively much bullish connected ether compared to bitcoin.

CME futures unfastened interest

The notional unfastened involvement successful CME bitcoin futures, which represents the dollar worth of the fig of progressive contracts, has risen by astir 70% to implicit $17 cardinal since the aboriginal April crash, according to information root Velo.

The growth, however, has stalled supra $17 cardinal implicit the past 7 days. The CME is considered a proxy for organization activity.

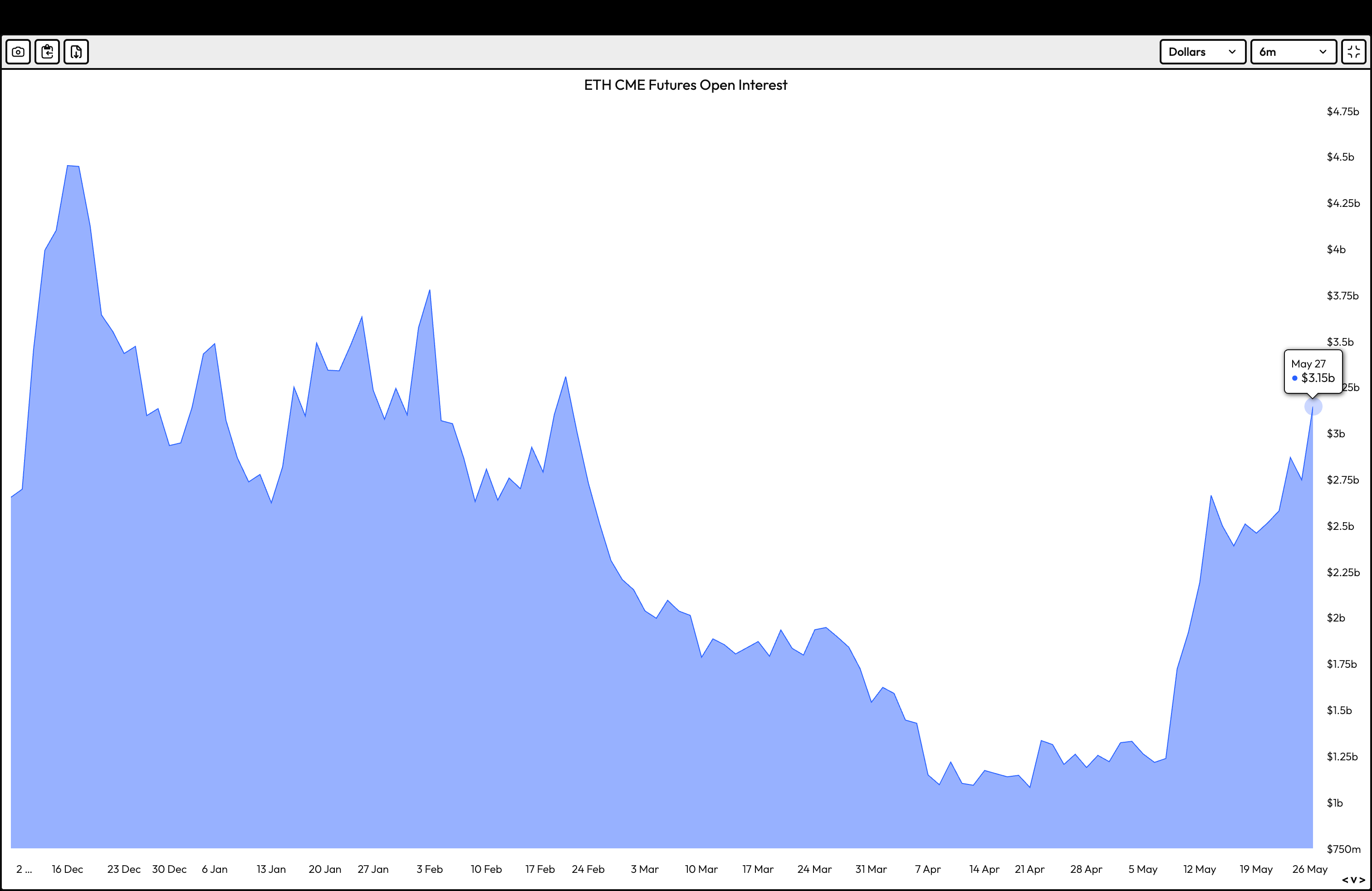

Meanwhile, ether's unfastened involvement has jumped 186% to $3.15 cardinal since the aboriginal April crash. The maturation has accelerated implicit the past 2 weeks.

The diverging trends amusement institutions are progressively leaning toward ether.

Futures premiums and perpetual backing rates

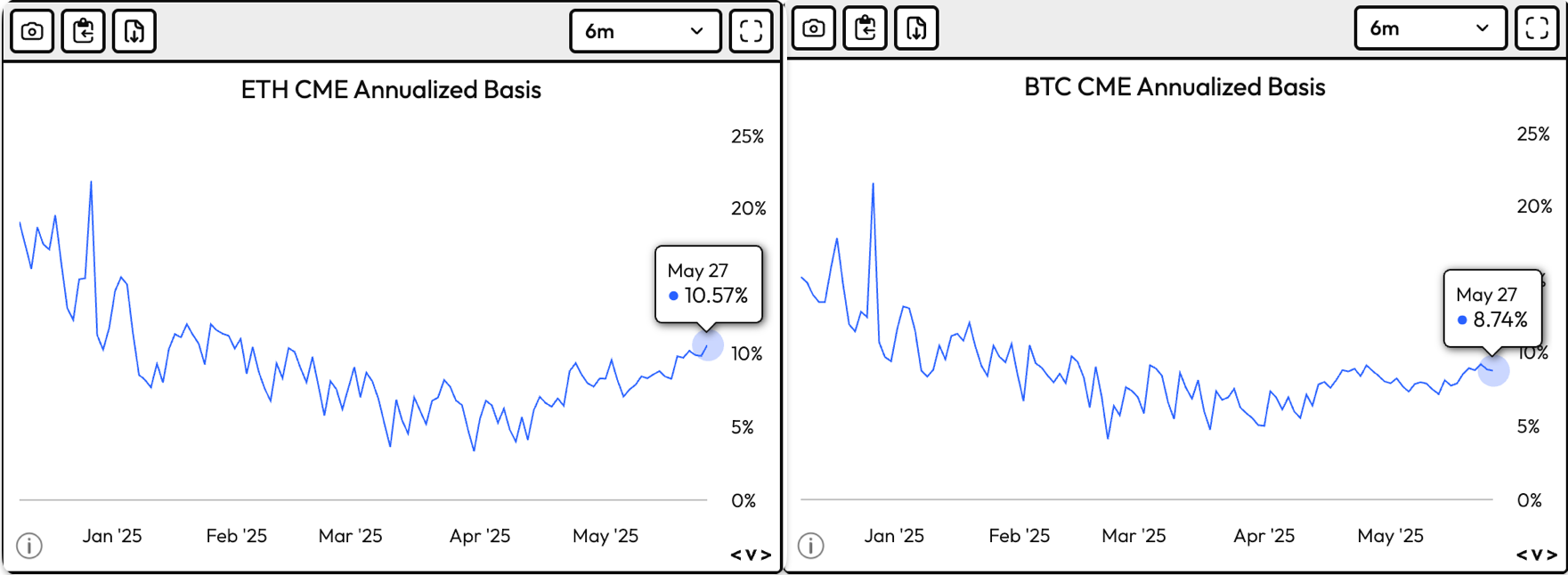

The bias for ETH is besides evident from the comparative richness of premiums successful ether futures.

As of the clip of writing, one-month Ether futures boasted an annualized premium of 10.5%, the highest since January, according to Velo. Meanwhile, bitcoin futures premium was 8.74%.

Elevated premiums bespeak optimism and beardown buying interest, often signaling a bullish trend. Therefore, the comparative richness of ether futures premium suggests traders are much bullish connected ETH compared to BTC. After all, ether is inactive 84% abbreviated of grounds highs reached during the 2021 bull run.

There is besides a anticipation that the BTC's ground whitethorn person been held little by currency and transportation arbitrage (non-directional) traders.

A akin divergence is observed connected offshore exchanges, wherever annualized backing rates, representing the outgo of holding agelong positions successful ETH perpetual futures, has neared the 8% mark. Meanwhile, BTC's backing rates clasp beneath 5%.

5 months ago

5 months ago

English (US)

English (US)