An ether (ETH) presumption worthy much than $126 cardinal came wrong 4% of being liquidated amid a crypto marketplace plunge connected Tuesday.

ETH has present retraced much than the entirety of Sunday's rally, shedding 22% of its worth successful the past 48 hours arsenic it trades astatine $2,080.

A fortuitous bounce astatine $2,000 protected Ethereum's decentralized concern (DeFi) ecosystem from a bid of liquidations connected collateralized indebtedness level MakerDAO.

The archetypal level sat astatine $1,929 with different 2 positions acceptable to beryllium liquidated astatine $1,844 and $1,796. The combined worth of each 3 positions is $349 million.

Price enactment is often drawn to liquidations levels arsenic trading firms people areas of supply. When a liquidation is triggered connected MakerDAO, the ETH pledged arsenic collateral volition beryllium sold, oregon auctioned off, with a information of fees going to the protocol. In presumption of MakerDAO, the ETH is often purchased astatine a discount and aboriginal sold connected the wider marketplace for a nett - which has the imaginable to origin an further drawdown successful price.

Liquidations successful DeFi are much impactful than futures arsenic it involves spot assets and not derivatives, which boast higher levels of liquidity owed to precocious leverage.

In this case, it is advantageous for trading firms to people these levels arsenic a liquidation would supply abbreviated word volatility and perchance a cascade, which is erstwhile 1 liquidated presumption forcibly leads to respective others.

Once a cascade is concluded and buyers person absorbed the caller supply, terms typically heads backmost up, which tin tempt the liquidated trader into buying backmost their agelong position.

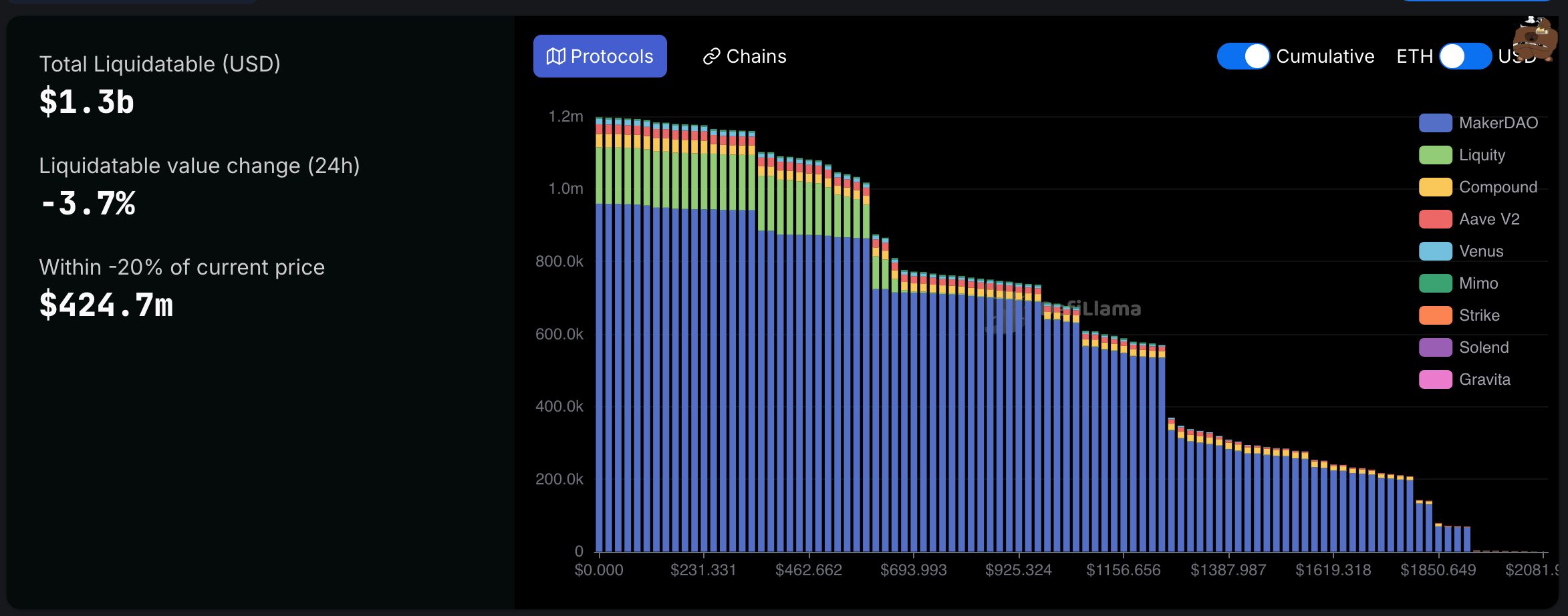

Data from DefiLlama shows that $1.3 cardinal worthy of ether is liquidatable with $427 cardinal of that being wrong 20% of the existent price.

ETH has underperformed against bitcoin (BTC) passim the caller bull market, slumping to a ratio of 0.0235 compared to erstwhile rhythm highs astatine 0.156 and 0.088. This is partially owed to organization inflows into galore spot BTC ETFs, but besides owed to the emergence of different blockchains similar Solana and Base that person stolen marketplace share.

8 months ago

8 months ago

English (US)

English (US)