In our erstwhile probe report titled Bitcoin’s Liquidity Trifecta: Unpacking Liquidity Across On-Chain Data, Market Microstructure and Macro Drivers, we explored however assorted liquidity indicators could uncover underlying superior flows and liquidity conditions for bitcoin. Applying that aforesaid model to ether (ETH) gives america invaluable penetration into its existent liquidity illustration — some on-chain and successful the broader market. In this update, we besides item the increasing relation of integer plus treasuries (DATs) which person emerged arsenic a cardinal operator down ETH’s caller rally.

Webinar alert: On September 9 astatine 11:00am ET articulation Michelle Noyes from AIMA and Andy Baehr from CoinDesk Indices arsenic they sermon gathering a sustainable concern successful the cyclical markets of crypto. Register today. https://aima-org.zoom.us/webinar/register/4917558078322/WN_3jAGIrqMTK2z7e74q5bkWg#/registration

Event alert: CoinDesk: Policy & Regulation successful Washington D.C. connected September 10th. The docket includes elder officials from the SEC, Treasury, House, Senate and OCC, positive backstage roundtables and unparalleled networking opportunities. Use codification COINDESK15 to prevention 15% connected your registration. http://go.coindesk.com/4oV08AA.

1. Realized cap: measuring caller superior inflows

Realized headdress tracks the nett USD-denominated superior invested successful a token, reflecting the cumulative outgo ground of each holders. Since the rhythm debased successful November 2022, ETH has absorbed over $81 billion successful caller superior inflows, pushing its realized headdress to a caller all-time precocious of $266 billion arsenic of August 8th, 2025.

For context, this represents a 43% increase for ETH implicit the play — substantial, but inactive good beneath bitcoin’s 136% emergence successful realized cap. The slower maturation complaint suggests that portion ETH has been attracting meaningful caller investment, determination whitethorn inactive beryllium ample country for enlargement arsenic organization involvement accelerates.

2. Unhedged spot ETH ETF demand: tracking organization allocation

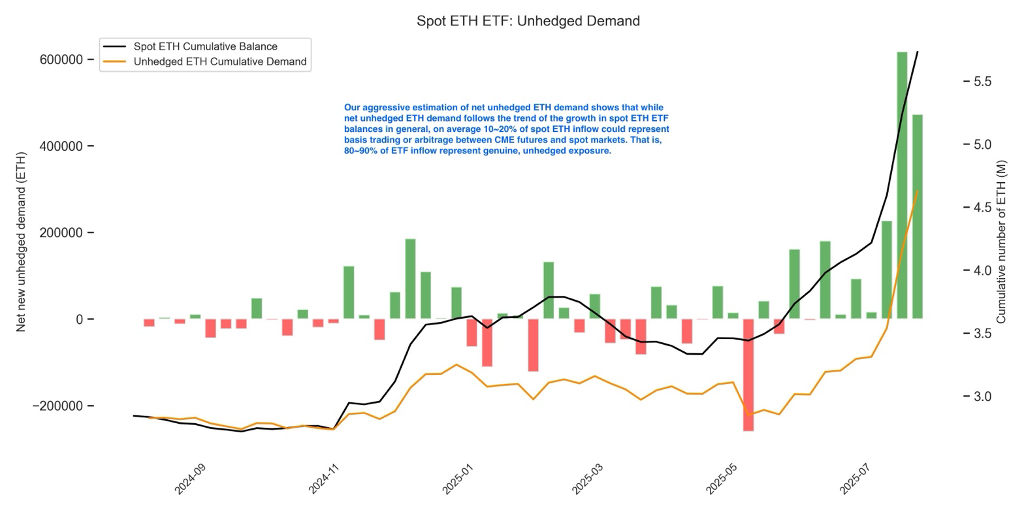

In our bitcoin study, we developed a method to estimation genuine organization request by isolating ETF inflows not tied to hedged arbitrage trades. Applying this model to ETH shows that 80–90% of spot ETH ETF inflows are apt genuine organization allocations, with the remainder driven by arbitrage strategies — agelong spot positions hedged via CME futures to seizure terms differentials.

Interestingly, the proportionality of arbitrage-related flows is overmuch higher for ETH than bitcoin, wherever lone astir 3% of spot ether ETF inflows are estimated to beryllium arbitrage-based. This highlights that organization allocation to ETH inactive lags down BTC, though we expect this spread to adjacent gradually with the caller influx of organization involvement successful the cryptocurrency.

Data source: Avenir, CFTC, Glassnode

3. Futures and options unfastened interest: gauging derivatives growth

As of July 21st, combined unfastened involvement (OI) successful ETH futures and options stood astatine $71 billion. However, dissimilar bitcoin — wherever OI successful perpetual futures and options is astir balanced — ETH options OI remains little than fractional of perpetual futures OI.

Given that options are much often utilized by nonrecreational traders and institutions, this imbalance indicates that organization derivatives information successful ETH inactive has important country to grow.

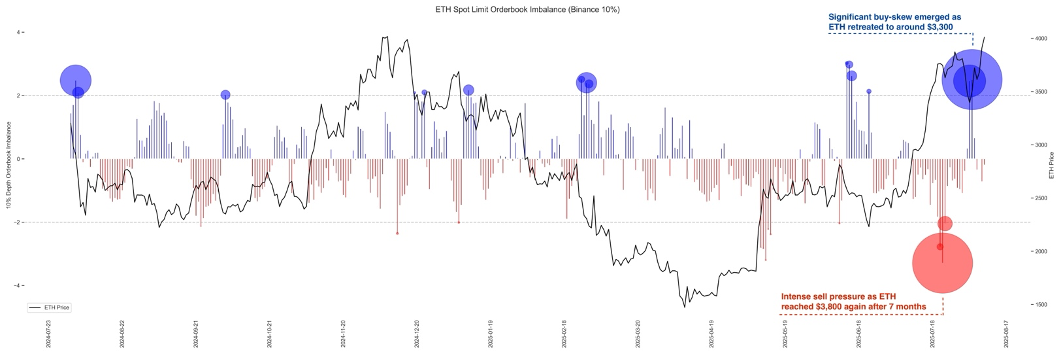

4. Limit bid publication imbalance: speechmaking marketplace sentiment

Order publication investigation reveals notable sentiment shifts. When ETH regained $3,800 successful July aft 7 months, a beardown sell-side skew emerged connected the bounds bid books (LOB), suggesting intense, long-awaited profit-taking. But arsenic the terms retraced toward $3,300, buy-side extent accrued significantly, signaling “buy-the-dip” behaviour astatine that level. Since then, the bid publication has shown a much balanced supply-demand profile, suggesting nary utmost positioning from the marketplace astatine present.

Data source: Avenir, Binance

5. Digital plus treasuries (DATs): increasing structural buyers of ETH

A caller and progressively important root of request for ETH comes from DATs — corporations that diversify into ETH by holding it connected their equilibrium sheets. For example, Bitmine and Sharplink are 2 of the astir notable representatives of this trend.

Since April, DATs person accumulated astir 4.1 cardinal ETH ($17.6 billion), representing astir 3.4% of the circulating supply; Bitmine unsocial accounts for 1.3%. For context, U.S. spot ETH ETFs presently clasp 5.4% of ETH full supply. This highlights the standard of these structural allocations from DATs.

What sets DAT flows isolated is their long-duration nature. Unlike futures traders oregon ETF arbitrage inflows, treasury allocations are little apt to rotate superior frequently, making them a root of sticky structural demand.

Conclusion

Across on-chain and off-chain liquidity metrics, 1 taxable is clear: ETH’s organization information is inactive successful the aboriginal stages compared to bitcoin. Realized headdress growth, ETF inflow creation and derivatives marketplace operation each constituent to important untapped potential.

At the aforesaid time, DAT allocations are becoming a almighty operator of sustained ETH flows, overmuch similar however firm equilibrium expanse strategies specified arsenic Strategy created a caller structural request transmission that helped substance bitcoin’s rally successful precocious 2024.

If organization adoption of ETH follows a trajectory akin to bitcoin’s, the coming months could spot meaningful superior inflows, and with them, the imaginable for outsized performance.

2 months ago

2 months ago

English (US)

English (US)