With conscionable a four-day model to go, the U.S. Federal Reserve appears primed to rise the national funds complaint by 25-basis-points (bps) astatine the forthcoming Federal Open Market Committee (FOMC) gathering scheduled for Wednesday. The marketplace presently maintains the condemnation that this quarter-point uptick is inevitable, and a radical of 106 economists, according to a canvass conducted by Reuters, are of the presumption that this volition signify the concluding escalation of the ongoing tightening cycle.

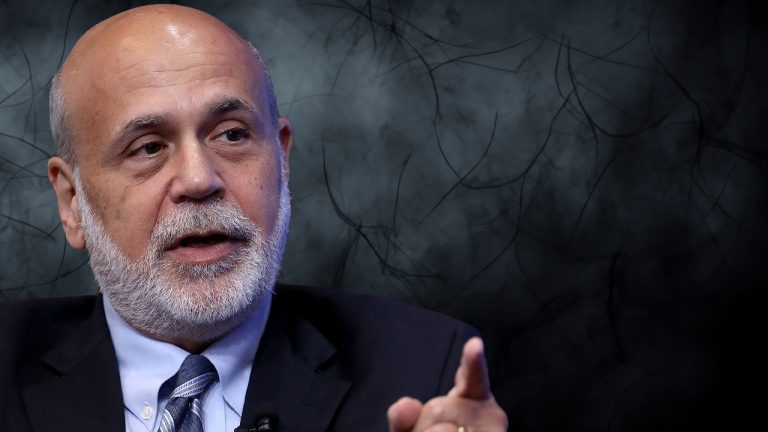

Former Fed Chair Ben Bernanke and Polled Economists Echo Anticipation of Final Federal Rate Hike

This Wednesday, each eyes are connected the U.S. cardinal slope arsenic it stands connected the threshold of a imaginable 25bps boost to the pivotal slope rate, pushing it to hover wrong the 5.25%-5.50% spectrum. The marketplace has preemptively accepted the likelihood of this quarter-point advancement.

To illustrate, information from CME Group’s Fedwatch instrumentality arsenic of Saturday, July 22, 2023, signals a near-certain 99.2% probability of this 25bps escalation. On the different extremity of the spectrum, the aforesaid Fedwatch instrumentality from CME conveys a comparatively minuscule 0.8% accidental for the complaint to stay static.

Moreover, a survey published by Reuters connected July 19, a bulk of 106 economists suggest it volition beryllium the past national funds complaint summation for the tightening cycle. The poll’s participants surveyed betwixt July 13-18 amusement that the cognition that rates volition stay precocious for a longer play of clip has increased.

Jan Nevruzi, the U.S. rates strategist astatine Natwest Markets said that “despite the brushed CPI print, we inactive expect a hike successful July … (and) portion we anticipation the softness successful ostentation persists, it is unwise from a policymaking standpoint to slope connected that.” The Natwest strategist added:

We bash not privation to unreserved up and accidental the combat against ostentation has been won, arsenic we person seen head-fakes successful the past.

Former Federal Reserve seat Ben Bernanke shares a akin presumption with the economists polled by Reuters. At a webinar lawsuit held by Fidelity Investments, Bernanke suggested that the 25bps emergence successful July could precise good beryllium the last hike. “It looks precise wide that the Fed volition rise different 25 ground points astatine its adjacent meeting,” Bernanke said connected Thursday. “It’s imaginable this summation successful July mightiness beryllium the past one.”

The erstwhile cardinal slope seat believes ostentation volition proceed to driblet and told investors helium expects the ostentation complaint to scope betwixt 3% to 3.5%. While Bernanke acknowledged that the United States could spot a slowdown successful economical growth, helium doesn’t envision a monolithic recession successful the future.

“What we’ll spot is simply a precise humble summation successful unemployment and a slowing of the economy,” Bernanke explained during the webinar. “But I’d beryllium precise amazed to spot a heavy recession successful the adjacent year.” While the Fed’s “dot-plot” shows the national funds complaint could scope 5.50%-5.75%, Reuters’ canvass shows that lone 19 economists retired of the 106 surveyed fishy it volition get that high.

How bash you foresee the predicted last complaint hike impacting the broader economy? Do you hold it’s the past one? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)