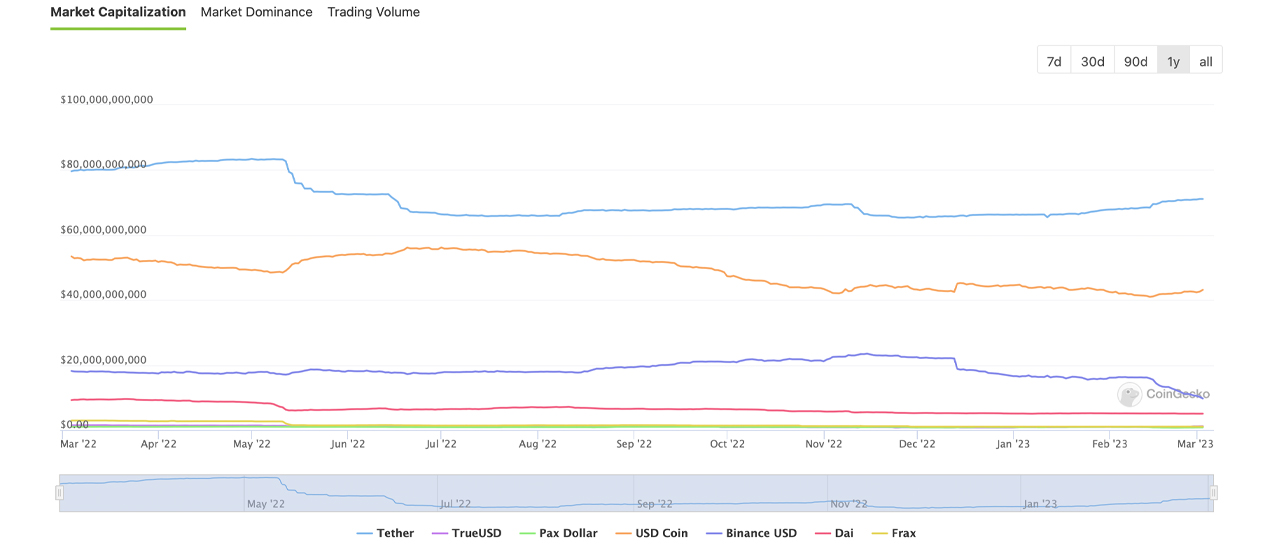

The realm of stablecoins is an ever-evolving scenery and the fig of coins successful circulation for the stablecoin BUSD has fallen beneath the 10 cardinal people to astir 9.68 cardinal connected March 3, 2023. Over the past 30 days, BUSD’s token proviso has dropped 40% lower. In contrast, the fig of tethers successful circulation has accrued by 4.7% to 71.11 cardinal successful the past month.

BUSD Slips Below $10 Billion, Tether Supply Rises by 4.7% to Over $71 Billion

In the stablecoin economy, currency proviso fluctuations are cardinal drivers of change. As of Friday, March 3, 2023, the stablecoin system has a valuation of $136 billion, and stablecoins relationship for $47 cardinal of the world’s commercialized measurement implicit the past 24 hours. The proviso of BUSD has dropped importantly and present stands astatine 9.68 billion, representing astir 0.901% of the full crypto economy’s nett value. In contrast, the apical 2 largest stablecoins by marketplace capitalization, USDT and USDC, person seen increases successful presumption of coins successful circulation implicit the past 30 days, portion BUSD’s proviso continues to plummet.

This month, the proviso of tether (USDT) has risen 4.7%, surpassing 71 cardinal coins. Usd coin (USDC) has besides seen a 1.7% increase, with 43.16 cardinal coins successful circulation. However, the proviso of 3 different apical stablecoins, namely DAI, pax dollar (USDP), and gemini dollar (GUSD), has diminished. DAI’s proviso has decreased by 2.1% this month, portion USDP has dipped 20.2% lower. Similarly, GUSD’s proviso has besides slid 2% little implicit the past 30 days. In contrast, trueusd’s (TUSD) proviso has accrued by 22.5% implicit the past month, reaching 1.16 cardinal coins.

USDD and FRAX person besides experienced increases, with USDD rising somewhat by 0.2% implicit the past period and FRAX climbing by 1.1% compared to the erstwhile month. Together, each 9 aforementioned stablecoin assets marque up 70.22% of the 24-hour trading volume. Before the Terra stablecoin depegging event, the stablecoin marketplace was much predictable and exhibited dependable growth. The declines successful caller times, however, show the existent unpredictable quality of the stablecoin market.

Tags successful this story

Blockchain, BUSD, BUSD supply, Crypto, Cryptocurrency, cryptocurrency market, DAI, Decentralized, depegging, Digital Assets, Digital Currency, Digital Tokens, Economy, Finance, Financial Technology, fluctuation, FRAX, GUSD, investment, Market Capitalization, Peer-to-peer, Stablecoin Economy, Stablecoin Tokens, Stablecoins, Supply, Terra, Trading Volume, tusd, USDC, USDD, USDP, USDT, valuation, Virtual Currency

What bash you deliberation the aboriginal holds for stablecoins successful airy of caller proviso fluctuations? Share your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)