Digital plus concern products globally faced $147 cardinal successful nett outflows past week, according to the latest play CoinShares report.

This marks the archetypal nett outflow week successful the past 4 weeks aft a period of accordant inflows.

Despite the outflows, integer plus products experienced a 15% summation successful trading volumes, adjacent arsenic the broader crypto marketplace saw reduced activity.

James Butterfill, CoinShares’ Head of Research, attributed the outflow to stronger-than-expected economical data released successful the United States. He noted:

“Higher than expected economical information past week, reducing the probabilities for important complaint cuts are the apt crushed for the weaker sentiment amongst investors.”

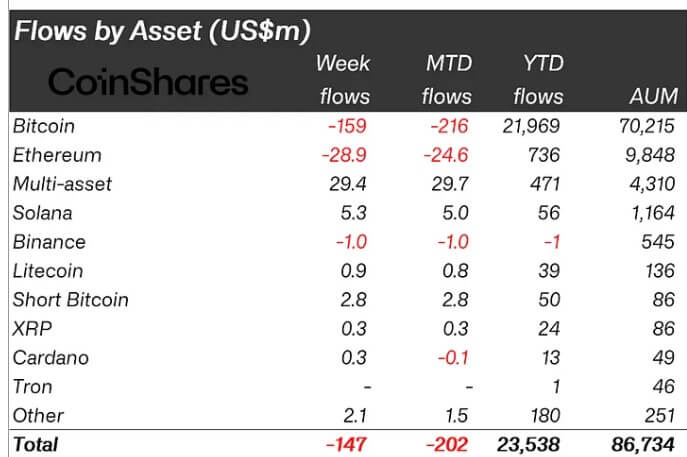

Regionally, Canada and Switzerland maintained a bullish trend, signaling inflows of $43 cardinal and $35 million, respectively. Conversely, the US, Germany, and Hong Kong experienced important outflows, with $209 million, $8.3 million, and $7.3 million, respectively.

Investors absorption connected Bitcoin and Ethereum

The study noted that Bitcoin remained a cardinal focus, with outflows of $159 cardinal for Bitcoin-related products, coinciding with caller terms fluctuations.

However, short-Bitcoin products saw inflows of $2.8 million, reflecting bearish sentiment toward Bitcoin’s terms movement.

According to CryptoSlate’s data, Bitcoin is trading astatine astir $63,000, a 2% summation implicit the past 24 hours. Last week, the starring integer plus dropped to a low of little than $60,000 earlier rebounding to its existent value.

Crypto Assets Weekly Flows. (Source: CoinShares)

Crypto Assets Weekly Flows. (Source: CoinShares)Ethereum, which had conscionable ended a five-week outflow streak, returned to outflows totaling $29 cardinal past week. Butterfill commented that capitalist involvement successful Ethereum remained subdued. In contrast, Solana was the lone altcoin to pull notable inflows, reaching $5.3 cardinal for the week.

Meanwhile, multi-asset concern products, offering vulnerability to aggregate integer assets, defied the wide inclination with nett inflows of $29.4 million.

This marks their 16th consecutive week of affirmative flows, bringing their full to $431 million. Butterfill added that multi-asset products person go a favourite among investors since June, representing 10% of assets nether absorption astatine planetary crypto money managers.

The station Digital plus products globally spot $147 cardinal outflow but trading surges 15% appeared archetypal connected CryptoSlate.

10 months ago

10 months ago

English (US)

English (US)