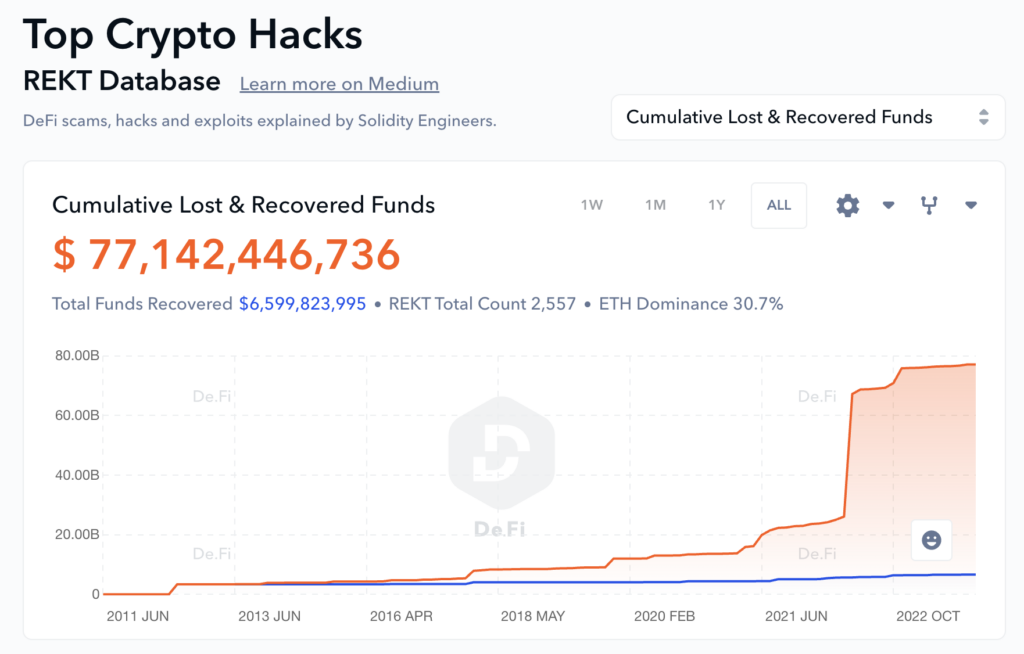

De.Fi’s Rekt Database reports that July saw $389.82 cardinal successful DeFi losses related to hacks and exploits, pushing the cumulative full worth of each of to transverse the threshold of $77 billion.

Ethereum emerged arsenic the astir targeted, losing $350 cardinal crossed 36 incidents. Multichain, however, suffered the astir terrible single-case nonaccomplishment of $231 cardinal owed to an entree power exploit, according to the De.Fi analysis.

Source: De.Fi

Source: De.FiCriminals’ divers arsenal of exploits crossed DeFi.

Access power issues led to 3 important cases resulting successful a staggering nonaccomplishment of $287 million. Rugpulls, adjacent though the astir communal with 38 reported cases, resulted successful importantly little losses totaling $36 million. Reentrancy attacks, though little predominant with six cases, inactive led to important losses of $58 million.

Among the antithetic categories of targets, tokens were the astir often attacked, with 39 cases reported starring to losses totaling $35.9 million. Borrowing and lending protocols were targeted once, with a nonaccomplishment of $3.4 million. The Bridge class was deed hardest, reporting a nonaccomplishment of $241 cardinal from 2 incidents.

The Multichain exploit was astatine the apical of the exploit list, with $231.1 cardinal mislaid owed to entree power issues. The Vyper Compiler saw losses of $50.5 cardinal owed to a reentrancy attack, portion the BALD Token lost $23.1 cardinal owed to a token rugpull. De.Fi provided CryptoSlate with a database of the apical exploits successful July, shown below.

| 1 | Multichain | $231.1m | Access Control |

| 2 | Vyper Compiler | $50.5m | Reentrancy |

| 3 | BALD Token | $23.1m | Token Rugpull |

| 4 | AlphaPo | $22.8m | CeFi, Access Control |

| 5 | Poly Network | $10.2m | Access Control |

According to the Rekt Database, the betterment of exploited funds successful July was notably low. A specified $7 cardinal was recouped from the immense loss, continuing the unfortunate inclination of debased betterment rates successful caller months.

July marks the tallness of DeFi’s losses for 2023, with adjacent to $1 cardinal present mislaid successful full for the year. There was $73 cardinal much mislaid successful July than the adjacent highest month, which occurred successful March.

Source: De.Fi

Source: De.FiThese figures service arsenic a sobering reminder of the inherent risks and vulnerabilities of the existent DeFi landscape. While the committedness of decentralized concern is compelling, the reality, arsenic evidenced by the $77 cardinal cumulative full lost, is not without its challenges.

De.Fi’s Rekt Database allows further investigation crossed galore chains. It includes the $40 cardinal nonaccomplishment from the Terra collapse successful 2022, on with different notable incidents involving Silk Road, Africrypt, PlusToken, and galore more. Each incidental is explained by solidity engineers giving a furniture of further transparency to the mean investor.

According to the database, the Terra illness inactive stands gangly astatine the apical of the achromatic chapeau pile, with 10 times much mislaid than the Africrypt rugpull successful 2nd place, which saw $3.8 cardinal mislaid successful 2021.

The station DeFi full losses breach $77B arsenic July records largest nonaccomplishment of 2023 with $389M stolen appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)