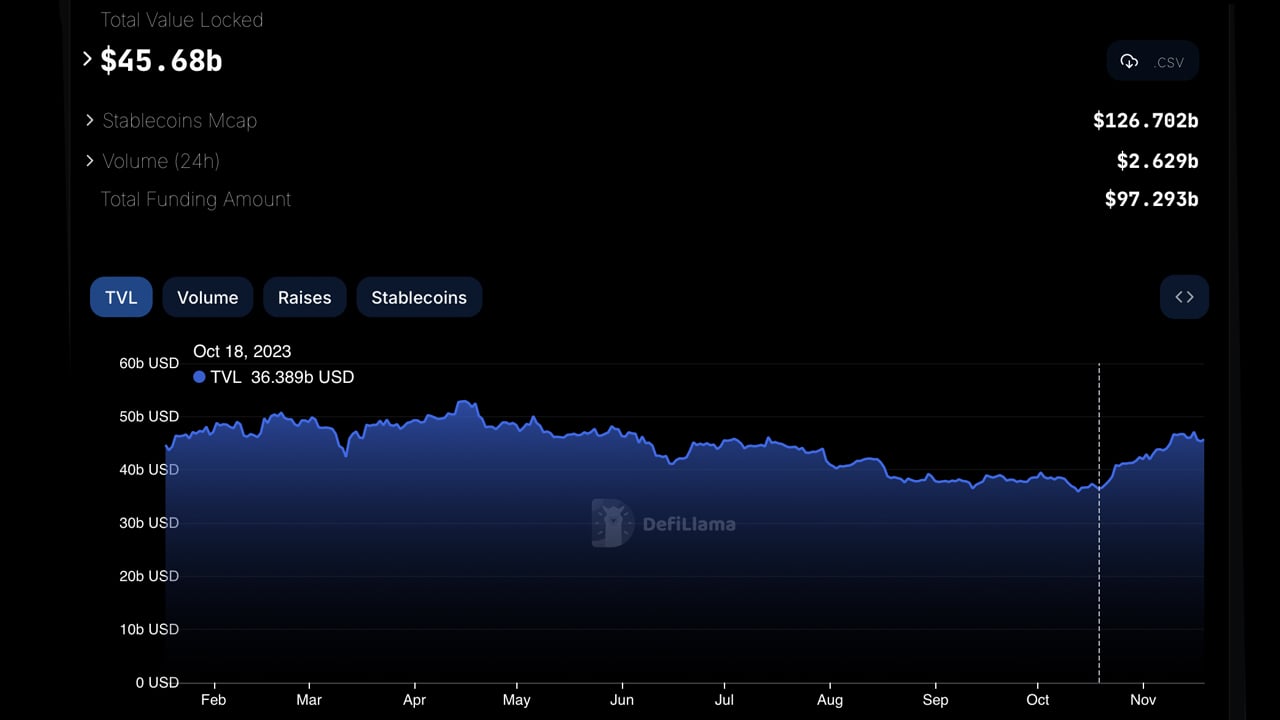

Since October 18, 2023, the aggregate worth locked successful decentralized concern (defi) has witnessed a important augmentation of $9.3 cardinal wrong a one-month span. Among the starring 10 defi protocols, Rocket Pool, known for its liquid staking services, achieved the astir notable growth, soaring by 26.94% during the preceding 30 days.

Defi TVL Swells by More Than 25% Since October 18

Approximately 32 days ago, the full worth locked (TVL) successful decentralized concern (defi) stood astatine astir $36.38 billion, escalating by $9.3 cardinal to the contiguous fig of $45.68 billion. This reflects a notable maturation of astir 25.56% successful the past month. Data reveals that each of the apical 10 defi protocols by TVL experienced maturation successful the past month, with Rocket Pool starring the battalion by surging 26.94%.

As of November 19, 2023, Rocket Pool’s TVL surpasses $2 billion, with implicit 1.02 cardinal ether committed to its liquid staking platform. At the forefront of the defi domain this play is Lido, with its ascendant presumption marked by 8.98 cardinal staked ether and a TVL hovering astir $17.71 billion.

Over the past month, Lido has seen its TVL swell by 21.76%. The runner-up successful presumption of TVL size is Makerdao, with $8.14 cardinal locked, noting a 3.28% summation implicit the month. Tron’s Justlend follows arsenic the 3rd largest defi protocol by TVL, presently sitting astatine $5.931 billion. The lending protocol roseate by 22.93% this month.

As of November 19, the Ethereum blockchain commands implicit 54% of the full worth locked successful defi, portion Tron accounts for 17.98%. Binance Smart Chain (BSC) holds astir 6.47%, with Arbitrum containing 4.56%. The infusion of worth into Ethereum’s TVL has leaped to 32.59% this month, with Tron experiencing a 21.92% upturn. BSC has grown by 11.96%, portion Arbitrum has seen a 27.11% increase.

Prominent liquid staking platforms contiguous see Lido, STRX, and Binance Staked, portion starring collateral indebtedness presumption (CDP) protocols diagnostic Makerdao, Juststables, and Helio. The apical lenders arsenic of this Sunday are Aave, Justlend, and Venus Core, and the foremost real-world plus (RWA) protocols are Makerdao, Stusdt, and Solv v2. In presumption of trading volumes, the apical decentralized exchanges (dexes) are Uniswap, Pancakeswap, and Thorchain.

The caller enlargement successful defi, marked by a $9.3 cardinal emergence successful TVL, highlights a rising assurance wrong the sector. Ethereum’s continued dominance, coupled with notable advancements by different blockchains specified arsenic Tron, further illustrates the ongoing diversification of the defi ecosystem. Yet, it remains to beryllium seen however agelong this upward inclination volition persist and whether the TVL volition yet reclaim the highest levels it antecedently attained 2 years ago.

What bash you deliberation astir the defi enactment implicit the past 30 days? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)