The upcoming mentation volition harvester aspects of an automated marketplace shaper (AMM) and wealth market.

Own this portion of past

Collect this nonfiction arsenic an NFT

Thetanuts Finance, a decentralized concern (DeFi) protocol offering crypto options contracts, has raised $17 cardinal to connection a buy-side marketplace and expanded database of coins, according to an April 24 announcement from the team.

Thetanuts Finance has completed a $17M organization backing circular led by @Polychain, @HyperchainC & @Magnus_fund, supporting our ambition to make a thriving two-way altcoin enactment marketplace and proceed to propulsion the boundaries for structured DeFi products.https://t.co/BH4aOUEckd pic.twitter.com/mmGBuCmBHu

— Thetanuts Finance (@ThetanutsFi) April 24, 2023The backing circular was led by crypto concern firms Polychain Capital, Hyperchain Capital and Magnus Capital.

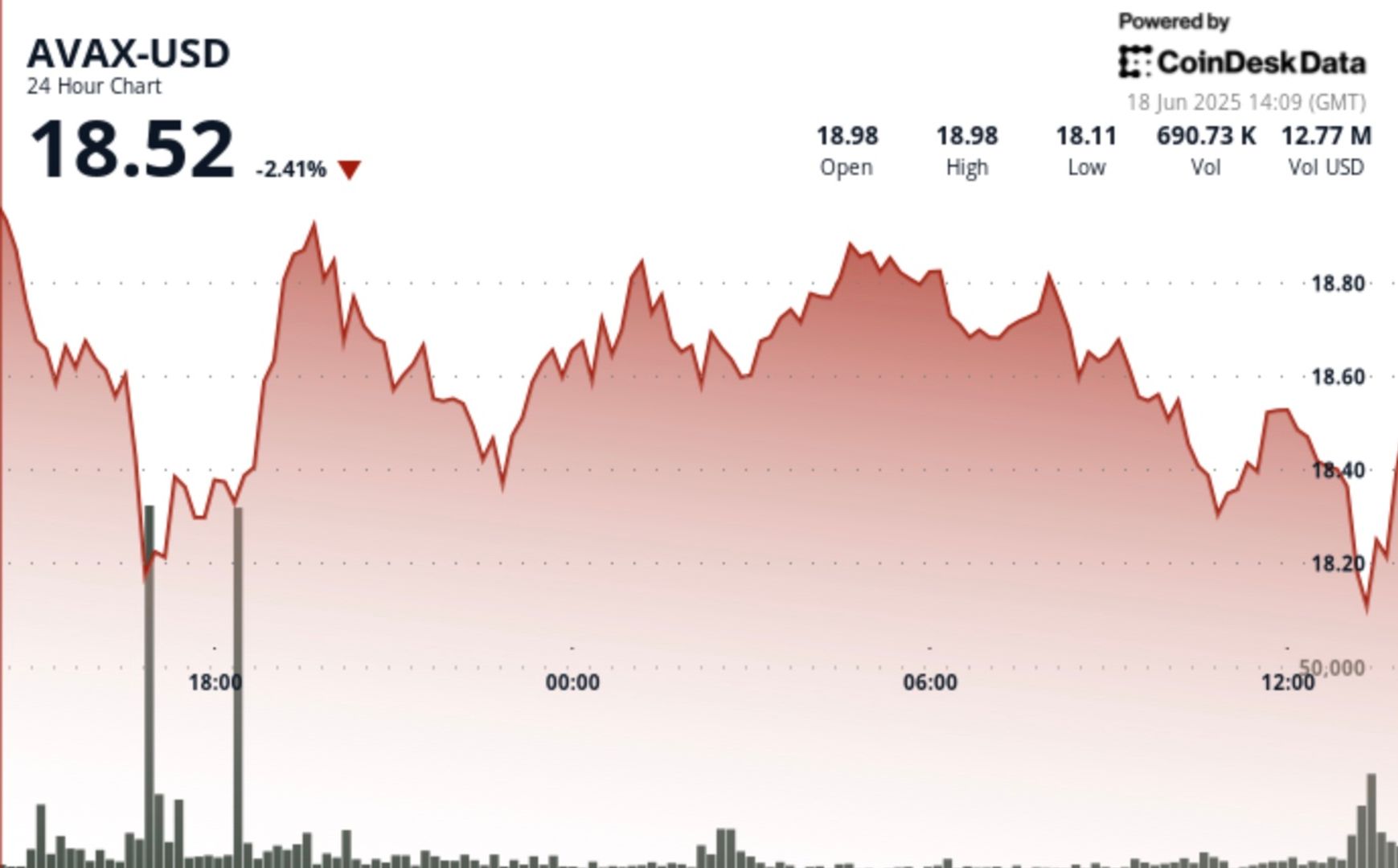

Thetanuts presently offers DeFi Options Vaults (DOVs), which are astute contracts allowing investors to merchantability telephone oregon enactment options connected Ether (ETH), Wrapped Bitcoin (WBTC), Fantom (FTM), Avalanche (AVAX), and different cryptocurrencies.

The squad plans to employment the caller funds to nutrient a “buy-side altcoin options market” to pull options purchasers. The announcement stated that, until now, DeFi options protocols person focused connected attracting sellers looking for dependable income alternatively of options traders looking for leverage. Using the recently raised funds, the developers anticipation to beryllium 1 of the archetypal protocols to supply capable products for the bargain broadside of the options market.

They besides anticipation to grow coin offerings to see much “altcoins” oregon coins with smaller marketplace caps, including tokens from networks that don’t usage the Ethereum Virtual Machine (EVM). The caller options marketplace volition harvester aspects of an Automated Market Maker (AMM) protocol and accepted wealth marketplace to nutrient a unsocial strategy for trading options. It volition beryllium disposable successful beta “soon.”

Related: CME to grow Bitcoin and Ether enactment expiries aft grounds regular volume

Josh Rosenthal, portfolio manager astatine Polychain Capital, said the upcoming marketplace would enactment a unchangeable fiscal marketplace arsenic the satellite transitions to Web3. "Functional derivatives are a cardinal constituent of a steadfast fiscal market," helium said.

The accepted futures and options marketplace traded implicit 60.6 cardinal contracts successful the archetypal 9 months of 2022, according to probe conducted by planetary commercialized enactment FIA. As such, crypto firms are progressively pivoting to the futures market. On April 20, Coinbase announced it is developing a Bermuda-based crypto derivatives exchange. On April 22, Gemini announced that it would also beryllium offering Bitcoin (BTC) and Ether options connected a non-U.S. speech successful the adjacent future.

2 years ago

2 years ago

English (US)

English (US)