Since April 18, 2023, the full worth locked (TVL) successful decentralized concern (defi) has been fluctuating conscionable beneath the $50 cardinal threshold. As of today, the TVL amounts to $49.31 billion, registering a 1% summation wrong the past 24 hours.

TVL successful Defi Shows Signs of Improvement, Yet to Surpass Previous Record of $53 Billion

Currently, the combined TVL crossed each defi platforms stands astatine $49.31 billion arsenic of May 6, 2023, with Lido Finance starring the battalion by commanding a 24.82% stock of $12.24 cardinal connected Saturday. Over the past month, Lido’s TVL has grown by 9%, portion posting a mean 2.42% summation successful the preceding week. The remaining apical 5 candidates successful today’s defi scenery see Makerdao, Aave, Curve Finance, and Uniswap; 3 retired of these 4 experienced monthly downturns, with Uniswap being the objection by posting a 3.48% summation implicit the past 30 days.

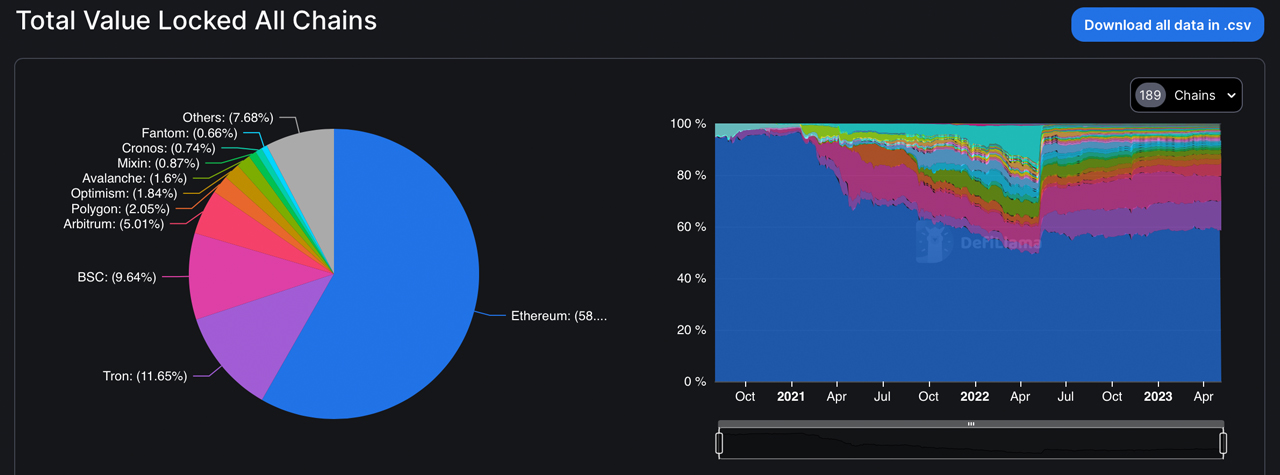

Total worth locked successful defi connected May 6, 2023, according to defillama.com stats.

Total worth locked successful defi connected May 6, 2023, according to defillama.com stats.Ethereum takes the lion’s stock of this TVL with its $28.66 billion accounting for implicit 58% of the defi marketplace cap. Following Ethereum are different contenders specified arsenic Tron, BSC, Arbitrum, and Polygon who boast comparatively ample TVL statistics. Both Tron and Arbitrum person recorded monthly gains of 7.77% and 9.98%, respectively. However, BSC stands arsenic the apical defi-chain loser successful presumption of TVL losses from past period with a alteration of astir 6.52%.

Total worth locked connected each blockchains connected May 6, 2023, according to defillama.com stats.

Total worth locked connected each blockchains connected May 6, 2023, according to defillama.com stats.A sizable $16.416 cardinal worthy of ETH (8,550,940 ETH) is locked successful liquid staking platforms retired of the full $49.31 cardinal magnitude locked successful defi systems today. The ascendant liquid staking platforms for Ethereum are Lido, Coinbase, Rocket Pool, Frax, and Stakewise. Rocket Pool and Frax person witnessed awesome 30-day increases of 29.75% and 39.49%, respectively. Furthermore, the largest fig of defi applications belongs to Ethereum with 771 protocols successful total.

While Binance Smart Chain and Polygon travel Ethereum’s protocol number with 593 and 409 applications, respectively, Tron — the second-biggest defi blockchain — has lone 18 associated protocols. However, Tron boasts the highest idiosyncratic basal among the apical 5 defi platforms with 2,538,896 participants. Ethereum’s progressive idiosyncratic number for its defi apps is astir 332,548. Although the TVL successful defi has shown signs of betterment successful 2023, it has yet to surpass its erstwhile grounds of $53 billion.

Tags successful this story

What are your thoughts connected the existent authorities of the defi market? Do you deliberation it volition proceed to turn and surpass its erstwhile record, oregon volition it look challenges successful the coming months? Share your insights successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 7,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)