By Omkar Godbole (All times ET unless indicated otherwise)

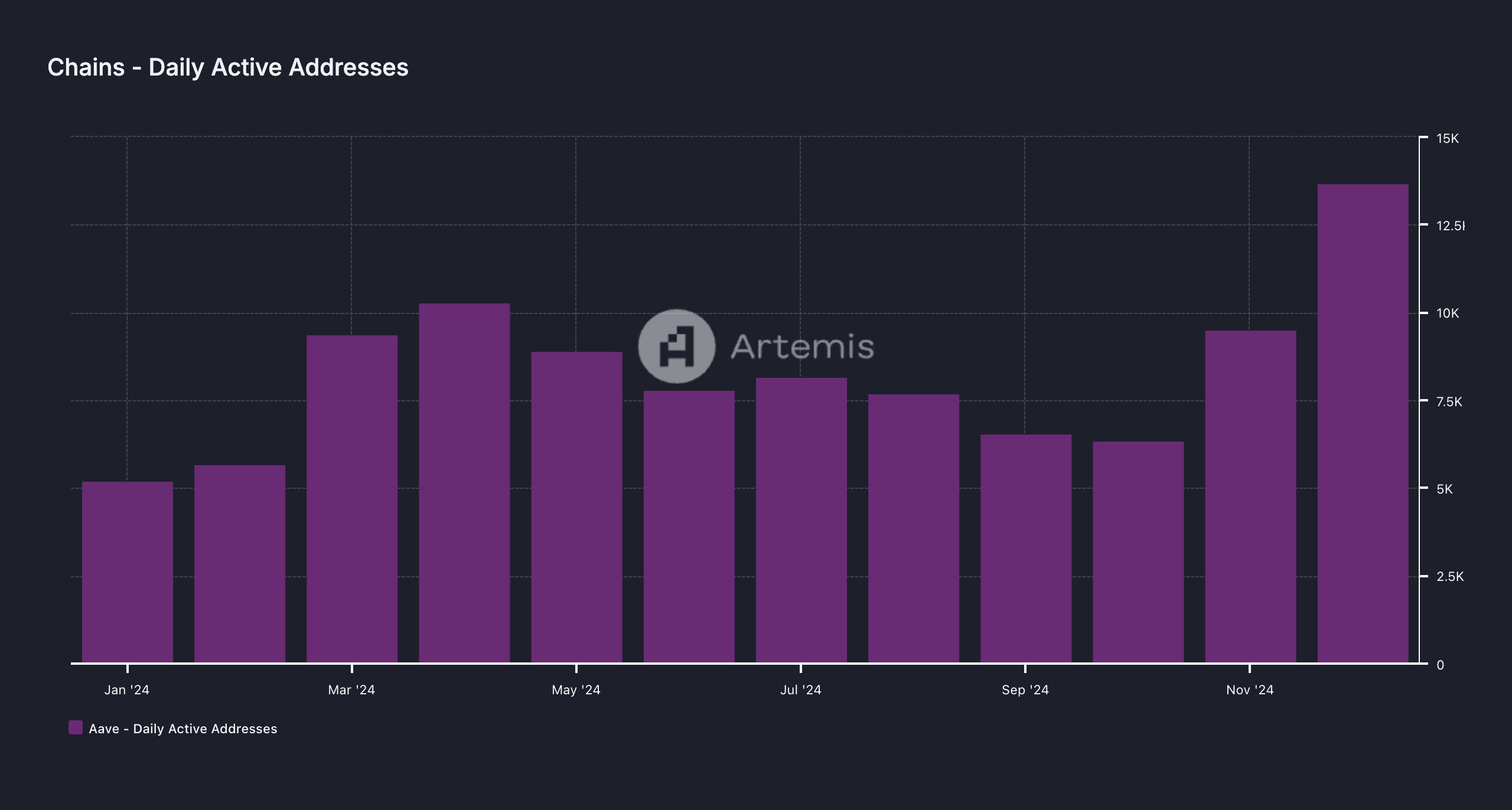

It was lone a substance of clip earlier the bitcoin bull marketplace reignited excitement successful the DeFi sector, and conjecture what? Chatter is heating up astir a imaginable “carry trade” that uses DeFi protocol Ethena's yield-bearing staked USDe (sUSDe) to get stablecoins similar USDC and USDT from the lending elephantine Aave.

Those stablecoins are past flipped backmost for USDe, yielding a saccharine instrumentality from the juicy dispersed betwixt sUSDe's adjacent 30% annualized output and AAVE's adaptable borrowing rates, presently little than 20%. The instrumentality is mode amended than ether's staking output of nether 4% and the U.S. 10-year Treasury's 4.24%.

If the commercialized becomes popular, the arbitrage model could yet close, with borrowing rates perchance matching the output connected sUSDe, according to the pseudonymous perceiver Clouted. Keep an oculus connected this one.

As for marketplace person bitcoin, the largest cryptocurrency has bounced backmost to astir $97,000 arsenic of penning — a level we've seen respective times since mid-November — aft investigating dip request astir $93,500 connected Tuesday. Prices connected Korean exchanges are backmost successful sync with their planetary counterparts aft Tuesday's flash clang caused by the announcement of martial law.

Traders are eagerly awaiting Fed Chairman Powell's code aboriginal today, positive Friday's nonfarms payroll report, hoping for a boost successful bitcoin terms volatility. With BTC's Coinbase premium returning, the lawsuit for renewed bullishness looks promising unless Powell throws acold h2o connected December rate-cut expectations.

Meantime, beware of engagement farming connected societal media. Some X accounts are buzzing astir grounds abbreviated positions successful CME's ether futures, claiming it's suppressing ether prices. That mightiness not beryllium so. Most of those shorts could beryllium a portion of the fashionable price-neutral cash-and-carry arbitrage strategy that includes agelong positions successful the spot marketplace oregon spot ETFs. It's nary coincidence that Farside Investors information shows there's been a nett inflow of $714 cardinal into U.S.-listed ether ETFs successful the past 7 trading days.

Looking astatine the broader market, Aptos has deed a milestone with its DeFi full worth locked surpassing $1 billion, a staggering 19-fold maturation year-on-year. The fig of transactions and the mean outgo to transact connected the Avalanche C-Chain are astatine their highest since April and August, conscionable arsenic the Avalanche9000 upgrade approaches, according to information root Artemis.

Tron's TRX token and the on-chain perpetual options protocol GammaSwap's GS token person reached grounds highs, portion a whale sold a whopping 240 cardinal PEPE, according to Lookonchain data. Decentralized speech PancakeSwap has launched "PancakeSwap Springboard" to make and database tokens, taking the leafage retired of Pumpfun's book. Expect much speculative froth.

In accepted markets, support your oculus connected risk-off signals. The yen remains upbeat and Wall Street executives are aggressively reducing their stocks, driving the ratio of insider sellers to buyers to astir 6x, according to the Kobeissi Letter. So enactment alert retired there!

What to Watch

Crypto:

Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

Macro

Dec. 4, 10:00 a.m.: The Institute for Supply Management (ISM) releases November’s Services ISM Report connected Business. Services Purchasing Managers Index (PMI) Est. 55.5 vs Prev. 56.0.

Dec. 4, 1:40 p.m.: Fed Chair Jerome H. Powell is taking portion successful a moderated treatment astatine The New York Times DealBook Summit successful New York City.

Dec. 4, 2:00 p.m.: The Fed releases the Beige Book, an economical summary utilized up of FOMC meetings.

Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

Nonfarm Payrolls (NFP) Est. 183K vs Prev. 12K.

Unemployment Rate Est. 4.1% vs Prev. 4.1%.

Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

Average Hourly Earnings YoY Prev. 4%.

Token Events

Governance votes & calls

Ethereum staking level RocketPool to clasp monthly assemblage telephone astatine 10 a.m.

Autonolas (OLAS) connection to motorboat caller bonding products connected Base blockchain ends 3 p.m.

Qubic lowers token transaction fees from 1 cardinal QUBIC tokens to 100 QUBIC, worthy fractions of a penny.

Unlocks

Taiko unlocked 11% of circulating supply, worthy implicit $10 cardinal astatine existent rates, astatine 5 a.m.

Token Launches

StrawberryAI is to motorboat mainnet connected Dec. 5, clip unspecified.

Conferences:

Dec. 3 - 4: FT’s Global Banking Summit (London)

Dec. 4 - 5: India Blockchain Week 2024 Conference (Bangalore, India)

Dec. 4 - 5: W3N 2024 (Narva, Estonia)

Dec. 6: Digital Finance Summit Summit 2024 (Brussels)

Dec. 7: Bitcoin Baden 2024 (Baden, Switzerland)

Dec. 9 - 12: Abu Dhabi Finance Week 2024 (Abu Dhabi, UAE)

Dec. 9 - 13: Luxembourg Blockchain Week 2024

Dec. 12 - 13: Global Blockchain Show (Dubai)

Dec. 12 - 14: Taipei Blockchain Week 2024 (Taipei, Taiwan)

Dec. 16 - 17: Blockchain Association’s Policy Summit (Washington)

Token Talk

By Shaurya Malwa

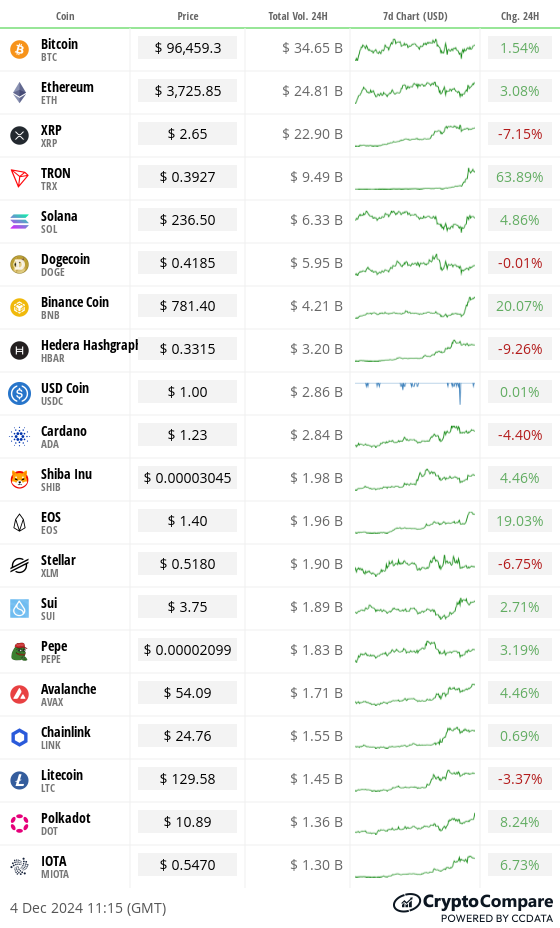

"Dino coins" from arsenic agelong agone arsenic 2018 are catching a bid successful a refreshing determination distant from memecoins.

Several tokens popularized backmost during what was arguably the archetypal altcoin bull marketplace are pursuing XRP's 400% terms rally implicit the past 30 days with rallies of their ain for nary instantly evident reason.

Stellar (XLM), bitcoin cash, eos (EOS), tron (TRX) and Hedera (HBAR) person gained astatine slightest 50% implicit the past week, CoinGecko information shows, successful a determination that has outperformed bitcoin and astir each "new" token that is being promoted oregon hyped connected Crypto Twitter.

The word "dino coins" reflects a communicative displacement wherever older cryptocurrencies are nary longer seen arsenic outdated but arsenic resilient, seasoned projects. This displacement tin beryllium attributed to their endurance done aggregate marketplace cycles, which gives them a definite credibility among newer, less-proven offerings.

Derivatives Positioning

The bitcoin and ether annualized three-month futures ground connected offshore exchanges stay level astatine astir 15%. On the CME, ETH boasts a somewhat higher ground astatine 17%, with BTC astatine 14%, offering charismatic returns to currency and transportation traders.

Positioning successful ETH remains elevated, with planetary futures and perpetual unfastened involvement astatine a grounds precocious of 338,680. The BTC marketplace has cooled, with unfastened involvement pulling backmost to 609,470, down 8% from the highest of 663,710 seen past month.

On decentralized options protocol Derive, a trader collected $1.66 cardinal successful premiums by selling bitcoin March expiry calls astatine strikes successful the $105,000 to $130,000 range.

Short-term BTC calls are trading astatine a flimsy discount to puts, but semipermanent options proceed to amusement a bull bias. ETH calls are costly comparative to puts crossed the curve. (Data source: Amberdata, VeloData, Derive, Deribit)

Market Movements:

BTC is up 0.9 % from 4 p.m. ET Tuesday to $96,460.42 (24hrs: +0.64%)

ETH is up 3.46% astatine $3,734.92 (24hrs: +3.22%)

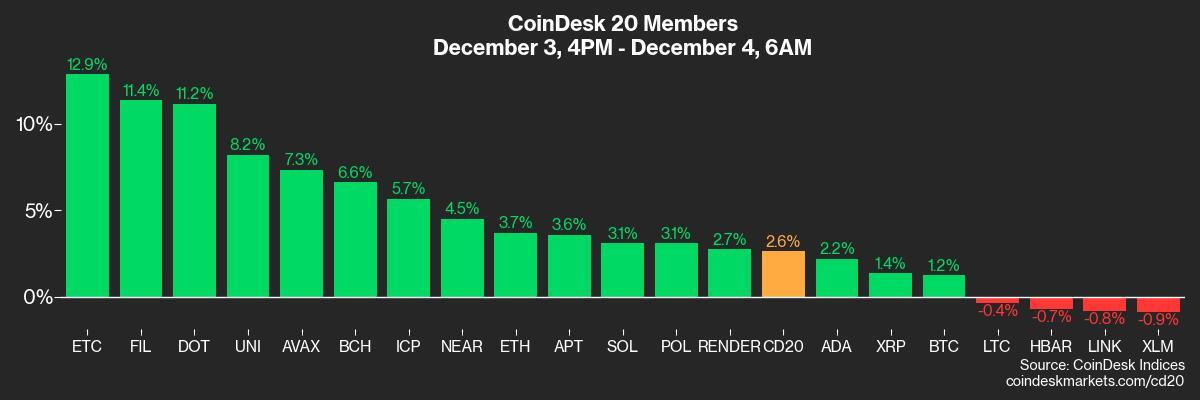

CoinDesk 20 is up 2.39% to 3,954.73 (24hrs: +2.54%)

Ether staking output is up 30 bps to 3.46%

BTC backing complaint is astatine 0.0264% (28.9% annualized) connected Binance

DXY is up 0.13% astatine 106.46

Gold is unchanged astatine $2,646.45/oz

Silver is down 0.41% to $30.86/oz

Nikkei 225 closed unchanged astatine 39,276.39

Hang Seng closed unchanged astatine 19,742.46

FTSE is down 0.43% astatine 8,323,87.87

Euro Stoxx 50 is up 0.4% astatine 4,897.96

DJIA closed -0.17% to 44,705.53

S&P 500 closed unchanged astatine 6,049.88

Nasdaq closed +0.83% astatine 19,480.91

S&P/TSX Composite Index closed +0.18% astatine 25,635.73

S&P 40 Latin America closed +0.44% astatine 2,327.36

U.S. 10-year Treasury was unchanged astatine 4.22%

E-mini S&P 500 futures are up 0.24% to 6078.50

E-mini Nasdaq-100 futures are up 0.56% to 21405.00

E-mini Dow Jones Industrial Average Index futures are up 0.48% astatine 45016

Bitcoin Stats:

BTC Dominance: 55.17% (-0.61%)

Ethereum to bitcoin ratio: 0.0383 (1.78%)

Hashrate (seven-day moving average): 729 EH/s

Hashprice (spot): $61.013

Total Fees: 15.5 BTC/ $1.5 million

CME Futures Open Interest: 185,485 BTC

BTC priced successful gold: 36.5 oz

BTC vs golden marketplace cap: 10.40%

Bitcoin sitting successful over-the-counter table balances: 423,902

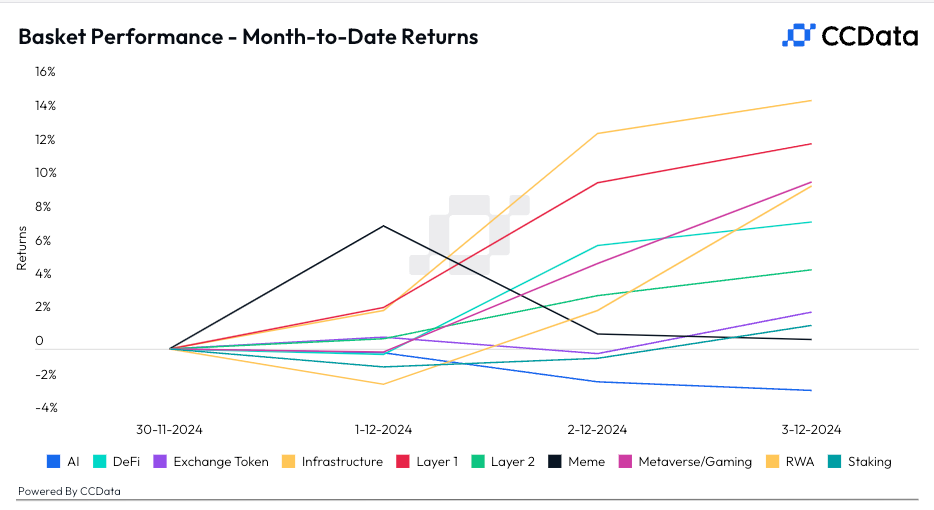

Basket Performance

Technical Analysis

XRP's regular illustration shows that portion prices acceptable a caller precocious Tuesday, the MACD histogram, a momentum indicator, did not corroborate the move, diverging bearishly. It indicates that the bullish momentum has weakened and prices whitethorn crook lower.

TradFi Assets

MicroStrategy (MSTR): closed connected Tuesday astatine $373.43 (-1.81%), up 3.23% astatine $385.50 successful pre-market.

Coinbase Global (COIN): closed astatine $309.35 (+2.3%), up 1.62% astatine $314.36 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$26.08 (+5.03%)

MARA Holdings (MARA): closed astatine $25.13 (-1.95%), up 2.03% astatine $25.65 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.14 (+0.33%), up 0.66% astatine $12.22 successful pre-market.

Core Scientific (CORZ): closed astatine $16.42 (+2.24%), up 0.53% astatine $17.67 successful pre-market.

CleanSpark (CLSK): closed astatine $13.95 (-3.93%), unchanged successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $27.56 (-0.25%), up 2.58% astatine $28.27 successful pre-market.

Semler Scientific (SMLR): closed astatine $63.63 (+4.81%), up 2% astatine $64.90 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett inflow: $676 million

Cumulative nett inflows: $31.70 billion

Total BTC holdings ~ 1.080 million.

Spot ETH ETFs

Daily nett inflow: $132.6 million

Cumulative nett inflows: $733.6 million

Total ETH holdings ~ 3.077 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

December's tally of the regular unsocial on-chain wallets interacting with AAVE surpassed 13,000, the astir since November 2021.

The summation comes amid accrued involvement successful borrowing stablecoins.

While You Were Sleeping

South Korean Lawmakers Move to Impeach President (Financial Times): South Korea’s absorption initiated proceedings connected Wednesday to region President Yoon Suk Yeol aft his failed martial instrumentality declaration deepened a governmental crisis. Around 190 lawmakers program to statement the impeachment question connected Thursday and ballot by the weekend, which could suspend Yoon if two-thirds of parliament supports the move.

Amid Political Chaos, Bank of Korea Says It Will Boost Short-Term Liquidity and Deploy Measures to Stabilize the FX Market (CNBC): South Korea’s cardinal slope pledged to heighten liquidity and stabilize the currency marketplace aft lawmakers overturned President Yoon’s martial instrumentality order. Following an exigency gathering Wednesday morning, the slope announced impermanent loans arsenic Korean stocks swung sharply, with the MSCI South Korea ETF concisely hitting a 52-week low.

DCG Confirms Reports Foundry Layoffs, Says It's 16% of U.S. Employees (CoinDesk): Foundry, a Bitcoin mining excavation owned by Digital Currency Group (DCG), laid disconnected 16% of its U.S. unit and a tiny squad successful India, correcting earlier reports of larger cuts. The bitcoin hashprice scale remains importantly down year-over-year, but has improved somewhat successful caller months, supported by the cryptocurrency's rising price.

Grayscale Files to Convert Solana Trust Into ETF (CoinDesk): Grayscale filed to person its $134M Solana Trust (GSOL) into an ETF, becoming the 5th steadfast successful the Solana ETF contention aft Bitwise, VanEck, 21Shares and Canary Capital. The filing follows Grayscale's palmy conversion of its Bitcoin and Ethereum trusts into ETFs earlier this year.

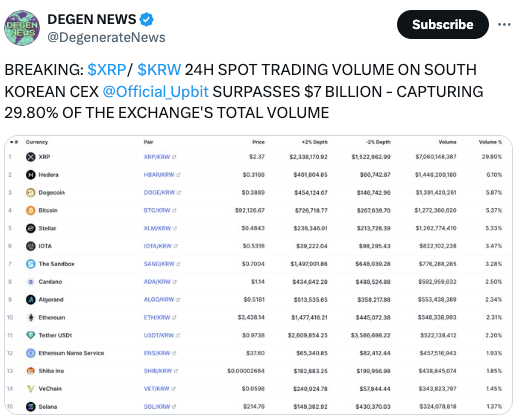

Move Over XRP's Korea Narrative, The 400% Price Rally Has Support of Coinbase Whales (CoinDesk): XRP has surged implicit 400% successful 30 days to $2.60, with U.S. investors driving a Coinbase premium of 3%–13% implicit Binance and Upbit, reflecting stronger buying pressure. However, trading volumes stay overmuch higher successful South Korea, wherever XRP/KRW accounts for 26% of enactment connected Upbit.

What to Expect arsenic France’s Government Faces No Confidence Vote (The New York Times): French Prime Minister Michel Barnier faces a apt no-confidence ballot that would topple his government, making it the shortest-lived successful France’s Fifth Republic. If ousted, Barnier would service successful a caretaker relation portion President Macron appoints a caller premier minister, with the rejected fund forcing impermanent fiscal measures to support the authorities running.

In the Ether

8 months ago

8 months ago

English (US)

English (US)