Amid the 2023 carnivore market, 1 can’t assistance but bespeak connected the game-changing moments that person shaped this industry.

The ‘DeFi Summer’ of 2020 was a turning constituent successful the blockchain industry, arsenic CryptoSlate remembers. This play saw the debut of respective DeFi projects, signaling the dawn of a caller epoch successful finance. DeFi’s improvement during this play didn’t conscionable marque waves; it catalyzed a paradigm shift, positioning itself arsenic the bold trailblazer of this unprecedented movement.

Having been astir successful conception since 2015 done projects specified arsenic MakerDAO, DeFi experienced a monumental surge during the bull tally of 2021, redefining accepted concern and making its people arsenic a important subordinate successful the market. Yet, today, with token prices down up to 90% arsenic we navigate the murky waters of the existent carnivore market, we look astatine the velocity of DeFi adoption and the interaction of marketplace cycles connected adoption.

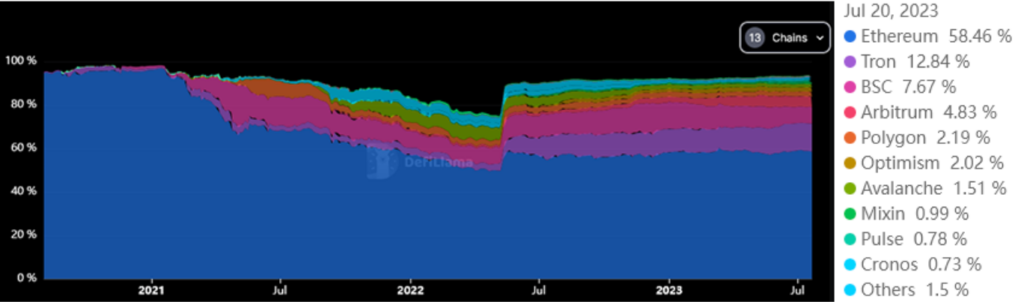

DeFi TVL investigation by concatenation since 2017

Against this backdrop, our investigation focuses connected information collected from 2018 to 2023, with an accent connected adoption crossed chains specified arsenic Ethereum, Tron, BNB Chain (BSC), Arbitrum, Polygon, Optimism, Avalanche, Mixin, Pulse, Cronos, Solana, Cardano, and Osmosis.

Source: DefiLlama

Source: DefiLlamaThe array beneath shows the chains analyzed, the day the concatenation reached its all-time precocious for TVL (as tracked by DefiLlama,), the clip it took to get its all-time precocious since motorboat (velocity), its all-time precocious (ATH), and the existent TVL.

Chain Activity start* ATH Date ATH TVL Velocity Current TVL| Ethereum | November 2017** | November 2021 | $108.92B | 1280 days | $25.73B |

| Tron | August 2020 | November 2021 | $6.74B | 470 days | $5.69B |

| BSC | October 2020 | May 2021 | $21.94B | 186 days | $3.36B |

| Arbitrum | August 2021 | May 2023 | $2.53B | 614 days | $2.12B |

| Polygon | October 2020 | June 2021 | $9.89B | 249 days | $0.97B |

| Optimism | July 2021 | August 2022 | $1.15B | 393 days | $0.92B |

| Avalanche | February 2021 | December 2021 | $11.41B | 302 days | $0.66B |

| Mixin | December 2021 | June 2022 | $0.59B | 182 days | $0.44B |

| Pulse | May 2023 | May 2023 | $0.49B | 5 days | $0.34B |

| Cronos | November 2021 | April 2022 | $3.22B | 145 days | $0.32B |

| Solana | March 2021 | November 2021 | $10.03B | 236 days | $0.31B |

| Cardano | January 2022 | March 2022 | $0.33B | 81 days | $0.18B |

| Osmosis | June 2021 | March 2022 | $1.83B | 253 days | $0.13B |

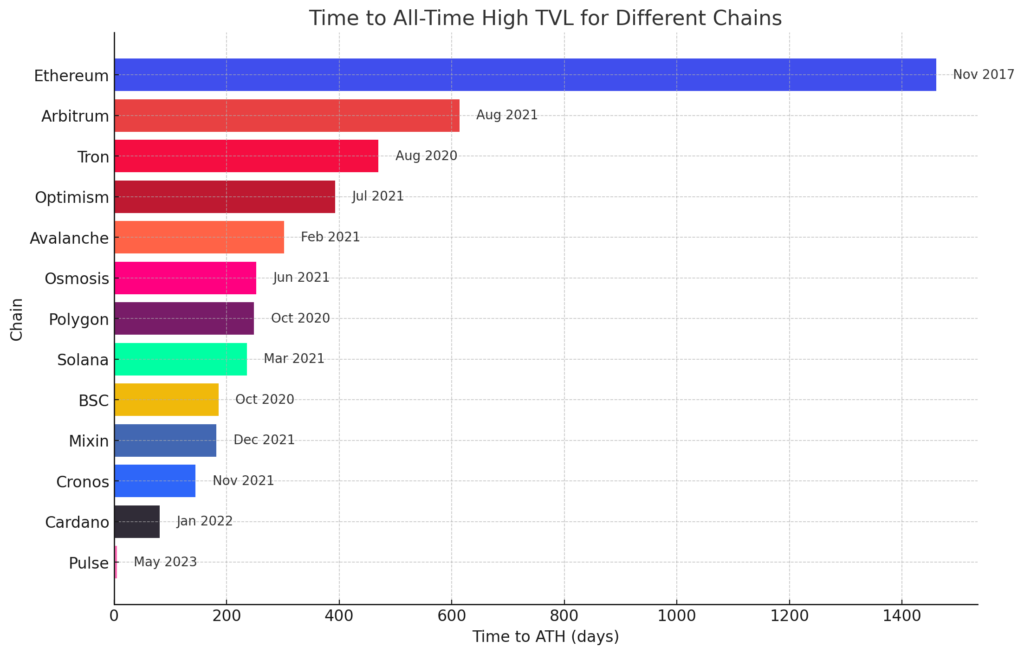

The illustration beneath visualizes the velocity of each concatenation successful reaching its all-time precocious successful TVL. The DeFi pioneer, Ethereum, has technically had DeFi enactment since 2017, and frankincense it stands retired arsenic the slowest adoption, fixed its all-time precocious was not reached until Nov. 2021.

Interestingly, November 2021 coincides with the all-time precocious for Bitcoin and apt impacted DeFi connected Tron and Solana, which besides saw peaks astatine this time.

Source Data: DefiLlama**

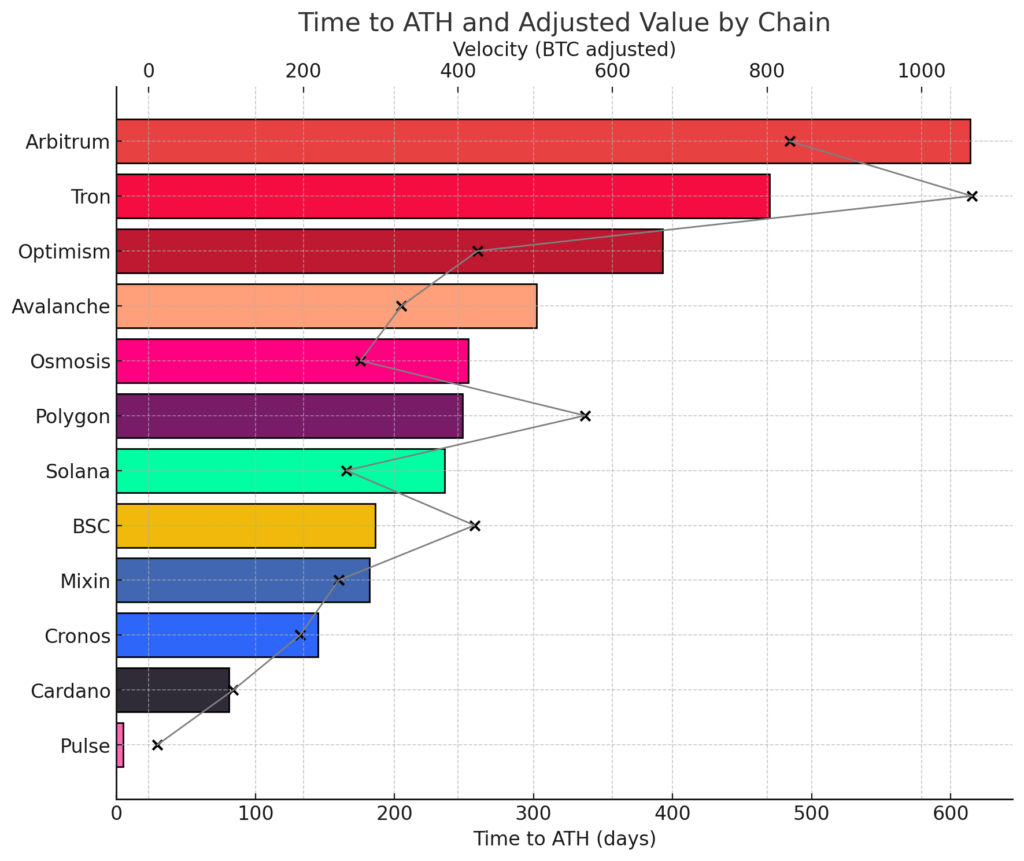

Source Data: DefiLlama**Bitcoin adjusted velocity

As Bitcoin is seen arsenic a barometer for the wide wellness of the cryptocurrency market, the velocity of DeFi adoption was adjusted based connected Bitcoin’s terms astatine each chain’s DeFi launch.

CryptoSlate cross-referenced the terms of Bitcoin with the all-time precocious information to make a Bitcoin-adjusted velocity (BaV) for each chain.

The illustration below’s grey enactment and crippled points correspond the BaV for each chain. The illustration reveals that the DeFi ecosystems of Tron, Polygon, and BSC were each positively impacted by Bitcoin’s terms and the supporting bullish sentiment of the market.

Source Data: DefiLlama***/ Yahoo Finance

Source Data: DefiLlama***/ Yahoo FinanceAnalysis of concatenation velocity

Ethereum was removed from the supra illustration for readability arsenic it recorded a monolithic 7,936 velocity people compared to the adjacent closes, with Tron astatine 1,065 and Arbitrum astatine 829.

With the carnivore marketplace factored in, Pulse’s velocity reduced, giving it a people of conscionable 10.98, arsenic it reached its ATH successful conscionable 5 days. The adjacent lowest was Cardano astatine 109, immoderate 10 times greater.

Using the BaV metric, it appears the best-performing chains were Pule, Cardano, Cronos, Solana, and Osmosis. While Ethereum, Tron, and Arbitrum stood retired arsenic having the slowest velocity.

Tron is 1 of the chains presently closest to its ATH, with a beardown show successful 2023. Should it walk its ATH of $6.47 cardinal from its existent level of $5.6 billion, it whitethorn surpass Ethereum connected the BaV and modular measures of velocity.

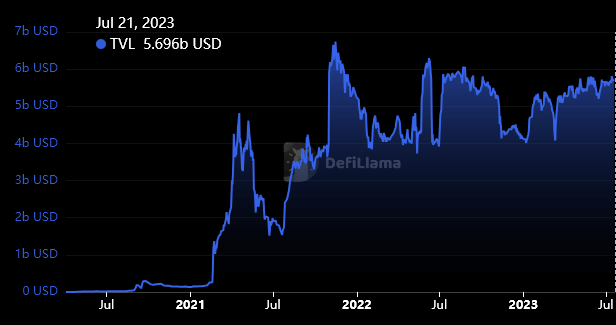

Source: DefiLlama

Source: DefiLlamaThe divers trajectories of DeFi adoption crossed antithetic blockchain networks underscore the value of timing, marketplace conditions, and the inherent advantages of being an aboriginal mover successful the space. However, arsenic the singular lawsuit of Pulse shows, adjacent newcomers tin execute accelerated maturation with the close factors aligning.

Understanding the data

The velocity astatine which you scope the all-time precocious successful TVL is simply a analyzable metric. Some whitethorn reason that the faster you spell up, the quicker you travel down, and that is decidedly the lawsuit for immoderate chains.

However, the cardinal factors nether investigation present interest momentum and adoption. Further, each the projects listed recorded astatine slightest $330 cardinal locked, with astir implicit $1 billion. These are not projects with debased marketplace headdress and debased liquidity.

The projects analyzed successful this nonfiction are captious to identifying the strengths and weaknesses of the humanities DeFi onboarding process. The mean clip it took for a concatenation to scope its ATH was astir 338 days, meaning, outliers aside, astir chains instrumentality astir a twelvemonth to highest successful DeFi activity.

* Launch day refers to the day of the archetypal information tracked by DefiLama for each chain**

** Using MakerDAO’s DAI motorboat arsenic the day for the Ethereum DeFi motorboat and information according to CoinmarketCap’s humanities data.

*** Additional information included owed to DefiLlama 2020 cut-off date.

The station DeFi adoption varies crossed chains, BTC terms affects velocity appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)