Spent Lifespan Relative Value (SLRV) offers a lens into the property of coins transacted connected the Bitcoin network. Essentially, it helps differentiate the actions of semipermanent holders and short-term speculators, acting arsenic a measurement of marketplace sentiment.

The SLRV ribbons are a ocular practice of the SLRV ratio, plotted implicit antithetic clip frames, chiefly the 30-day moving mean (30DMA) and the 150-day moving mean (150DMA). Their value is underscored by their quality to offer a wide picture of marketplace trends.

The 30DMA, representing a shorter clip frame, captures the caller behaviour of traders, typically associated with short-term holders oregon speculators who respond to contiguous marketplace changes. On the different hand, the 150DMA, with its extended period, reflects the actions of semipermanent holders who basal their decisions connected prolonged marketplace trends and are little influenced by short-term marketplace fluctuations.

When the 30DMA is supra the 150DMA, it indicates a bullish sentiment, with semipermanent holders not selling their coins. Conversely, erstwhile the 30DMA falls beneath the 150DMA, it signals a imaginable bearish turn, with older coins entering the market.

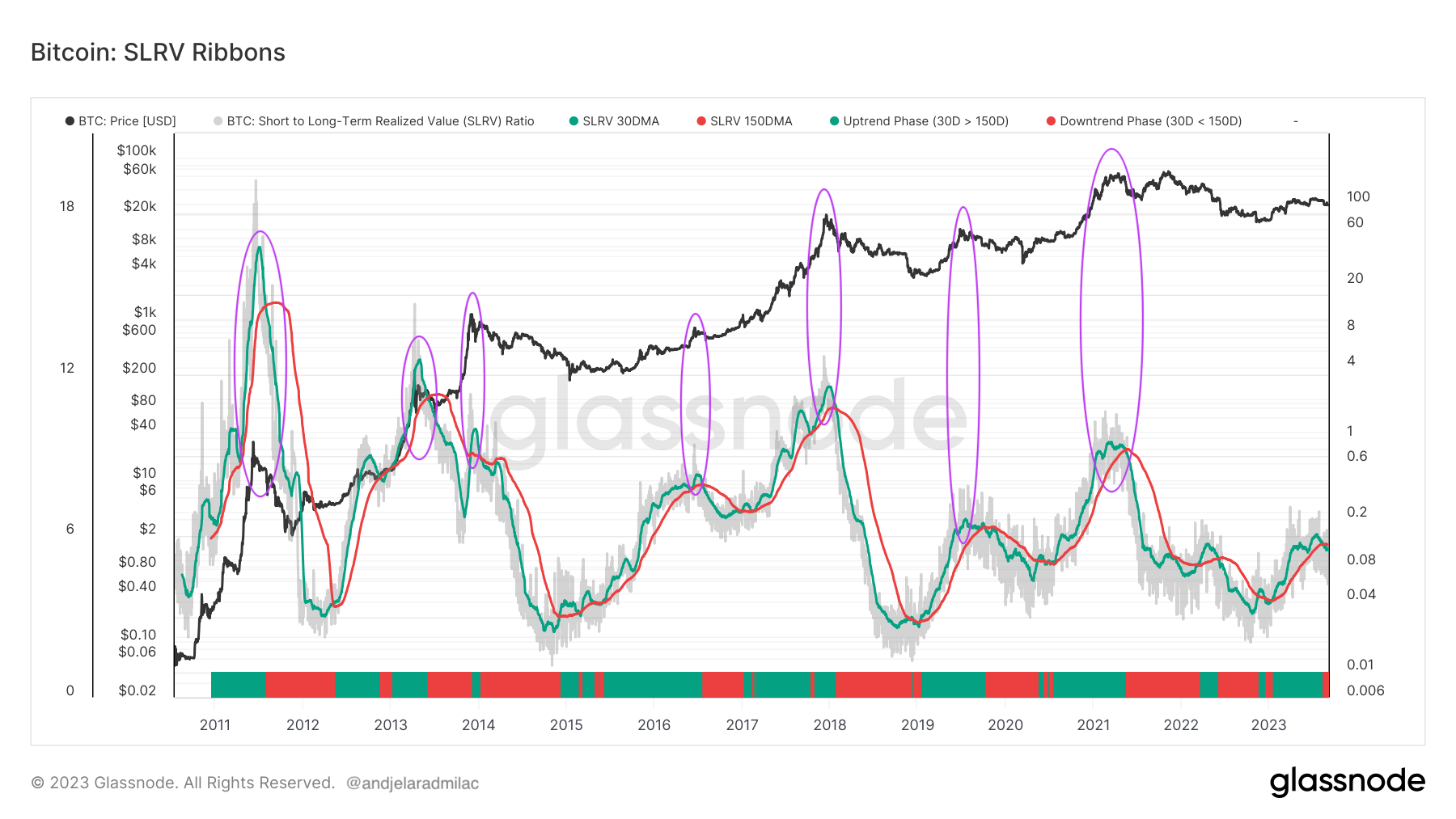

Historical information reveals a correlation betwixt the peaks of the SLRV 30-day moving mean (30DMA) and peaks successful the Bitcoin price. As the SLRV 30DMA increases, a important information of semipermanent holders are selling their coins, often starring to a terms peak. Following this, Bitcoin’s terms tends to driblet erstwhile the SLRV 30DMA dips beneath the SLRV 150DMA. This inversion of the ribbons acts arsenic a precursor to a imaginable marketplace downturn.

Graph showing the SLRV ribbons from 2010 to 2023 (Source: Glassnode)

Graph showing the SLRV ribbons from 2010 to 2023 (Source: Glassnode)The SLRV 30DMA remained ascendant implicit the 150DMA for astir of the year.

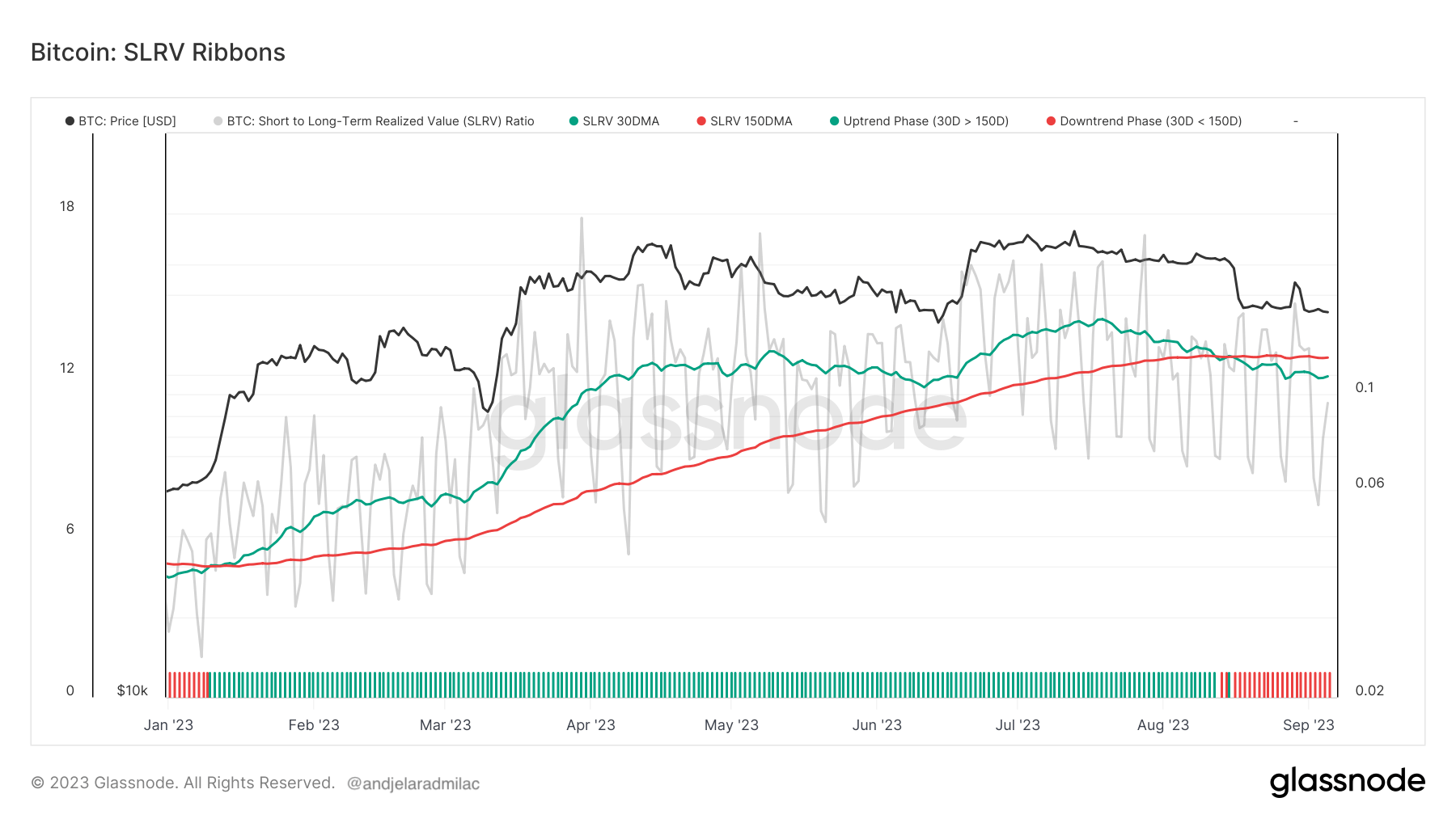

Graph showing the SLRV ribbons YTD (Source: Glassnode)

Graph showing the SLRV ribbons YTD (Source: Glassnode)However, a notable displacement occurred connected Aug.13, erstwhile the 150DMA concisely went supra the 30DMA. Bitcoin’s terms was oscillating astir the $29,200 people astatine the time, confined wrong a choky trading scope acceptable successful mid-June. By Aug. 15, the SLRV ribbons were afloat inverted, with the 30DMA plunging beneath the 150DMA. This inversion was mirrored successful Bitcoin’s price, which took a hit, dropping from $29,200 to $26,000.

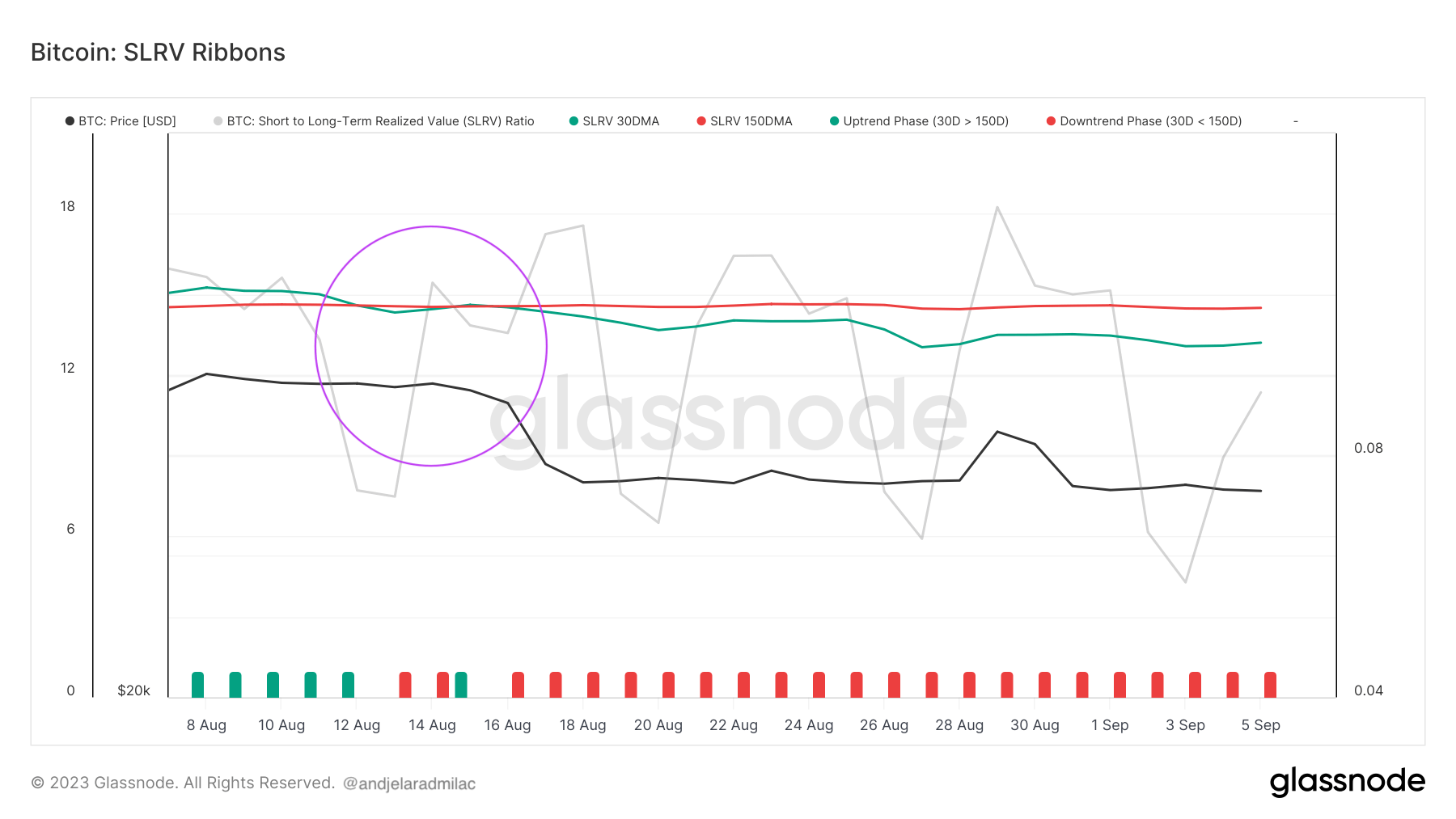

Graph showing the SLRV ribbons from successful from Aug. 6 to Sep. 6, 2023 (Source: Glassnode)

Graph showing the SLRV ribbons from successful from Aug. 6 to Sep. 6, 2023 (Source: Glassnode)As of Sep. 6, the SLRV ribbons stay inverted, with the downtrend showing nary contiguous signs of reversal. For marketplace participants, this could beryllium a motion of caution. The inversion of the SLRV ribbons, coupled with Bitcoin’s terms response, suggests that the marketplace mightiness beryllium entering a signifier wherever semipermanent holders are considering liquidating their positions. This could exert downward unit connected Bitcoin’s terms successful the adjacent term.

The station Decoding SLRV Ribbons and what they mean for Bitcoin’s price appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)