Bitcoin futures are fiscal derivatives, fundamentally agreements to bargain oregon merchantability Bitcoin astatine a predetermined terms astatine a circumstantial date. These connection a mode for traders to speculate connected the aboriginal terms of Bitcoin. Open interest refers to the full fig of outstanding futures contracts that person not been settled. Futures contracts tin beryllium collateralized successful assorted ways, including utilizing the autochthonal coin of the declaration (BTC oregon ETH), USD, oregon USD-pegged stablecoins.

Monitoring the quality successful unfastened involvement successful crypto-margined and cash-margined futures is important for knowing marketplace dynamics. When Bitcoin futures contracts are collateralized with Bitcoin, the hazard of liquidation increases. If an capitalist is agelong Bitcoin with Bitcoin arsenic collateral and the marketplace experiences a crisp downturn, the nett nonaccomplishment of the presumption and the worth of the collateral alteration simultaneously. This dual nonaccomplishment makes the presumption much susceptible to being liquidated oregon stopped out.

In simpler terms, utilizing Bitcoin to backmost a agelong presumption connected Bitcoin amplifies the risks. If the terms of Bitcoin falls, not lone does the worth of the presumption decrease, but the collateral itself besides loses value, creating a compounded risk.

On the different hand, collateralizing futures contracts with USD oregon stablecoins tin importantly trim the hazard of ample leverage cascades during marketplace downturns. Using a unchangeable plus arsenic collateral, the worth of the collateral remains constant, adjacent if the underlying asset’s marketplace terms fluctuates. This stableness provides a buffer against abrupt marketplace movements and reduces the likelihood of forced liquidations.

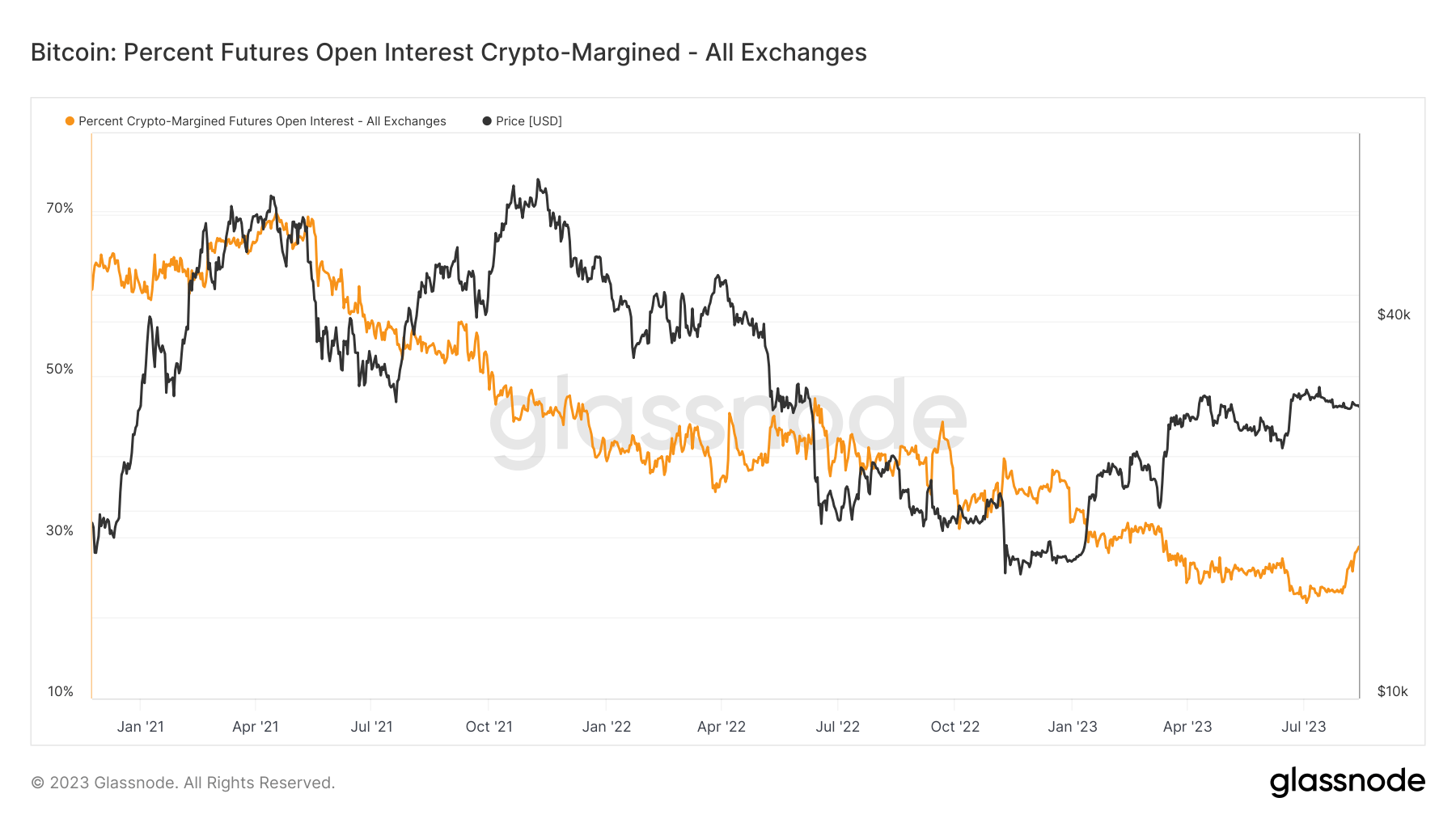

According to information from Glassnode, the percent of futures unfastened involvement that is margined successful the autochthonal coin of the declaration (e.g., BTC and ETH) presently stands astatine 28.8%. This fig reached an all-time debased connected July 3, dropping to 21.8%.

Graph showing the percent of futures unfastened involvement that is crypto-margined from Nov. 2020 to Aug. 2023 (Source: Glassnode)

Graph showing the percent of futures unfastened involvement that is crypto-margined from Nov. 2020 to Aug. 2023 (Source: Glassnode)The caller summation successful crypto-margined unfastened involvement tin beryllium attributed to BitMEX, which saw an assertive spike successful August. The full magnitude of futures contracts unfastened involvement collateralized successful crypto accrued from 7,998 BTC connected July 31 to 38,712 connected August 12, representing a 384% increase.

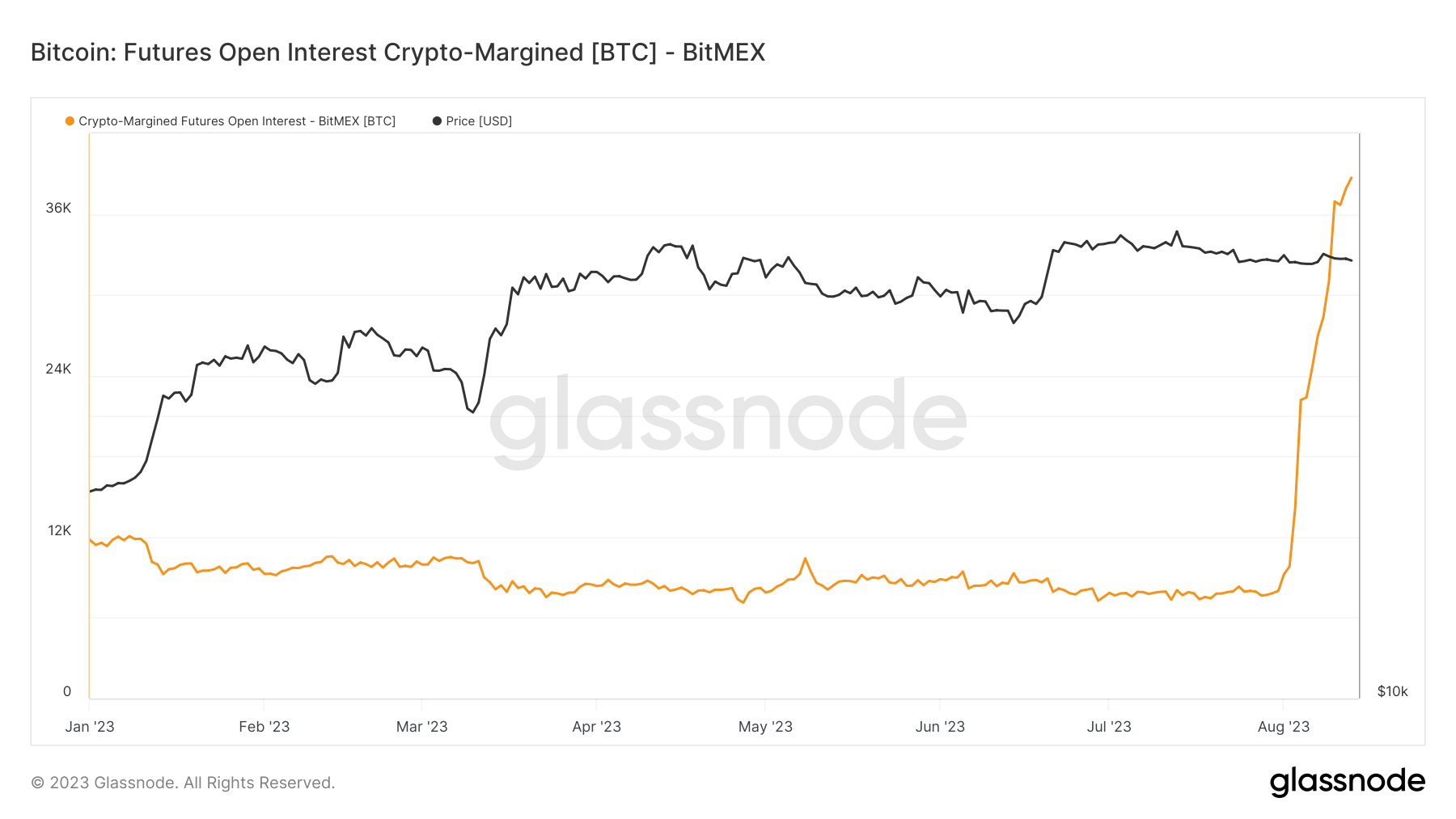

Graph showing the full magnitude of crypto-margined futures unfastened involvement connected BitMEX successful 2023 (Source: Glassnode)

Graph showing the full magnitude of crypto-margined futures unfastened involvement connected BitMEX successful 2023 (Source: Glassnode)Comparing the crypto-margined and cash-margined futures unfastened involvement reveals a discrepancy that has ne'er been higher. This divergence indicates a increasing marketplace penchant for stableness and hazard mitigation arsenic much traders opt for USD oregon stablecoin collateralization.

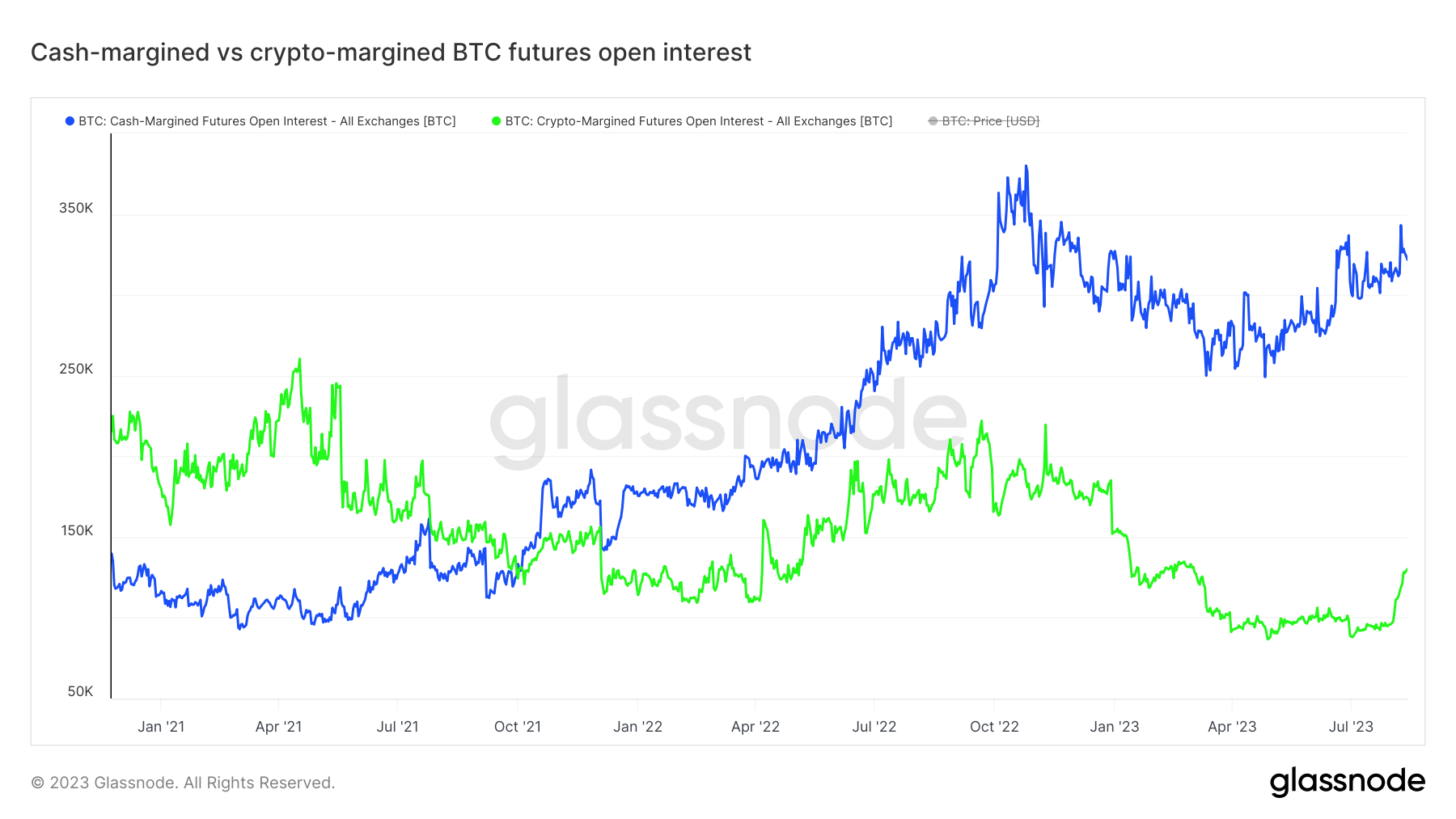

Graph comparing the full unfastened involvement for cash-margined and crypto-margined futures unfastened involvement crossed each exchanges from Nov. 2020 to Aug. 2023 (Source: Glassnode)

Graph comparing the full unfastened involvement for cash-margined and crypto-margined futures unfastened involvement crossed each exchanges from Nov. 2020 to Aug. 2023 (Source: Glassnode)The displacement towards cash-margined futures whitethorn awesome marketplace participants’ new, much cautious approach, reflecting concerns implicit imaginable volatility and the tendency to minimize vulnerability to liquidation risks.

The station Decline successful crypto-margined futures whitethorn awesome marketplace maturity appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)