This is an sentiment editorial by Shane Neagle, the editor-in-chief of “The Tokenist.”

Macroeconomic headwinds are continuously adding to a bearish communicative crossed each markets, including bitcoin.

As of October 2022, bitcoin is down more than 60% since the commencement of the year, yet bitcoin’s trading measurement remains reasonably consistent since July 2022. Does that mean the bulk of holders are giving up connected the imaginable of bitcoin and opting to sell?

This is simply a analyzable taxable to dive into, but there’s 1 indicator that tin assistance america overgarment a representation of what’s taking spot down the noise: coin days destroyed (CDD).

What Are Coin Days Destroyed?

Throughout the people of an asset’s trading history, determination is simply a important quality if the buying terms was connected the little oregon higher extremity of the terms spectrum. In the lawsuit of bitcoin, that spectrum is comparatively abbreviated — conscionable 13 years — but rather adaptable successful presumption of terms (ranging from $0-$69,000). The archetypal cryptocurrency has undergone 4 large bull and carnivore cycles, but erstwhile zooming out, has continuously trended upwards.

The accusation of this long-term, upward trajectory is clear. Investors who were the earliest to buy bitcoin person the astir to summation by selling, adjacent successful carnivore markets. Likewise, investors who took the accidental to purchase bitcoin aboriginal and astatine a little cost, had the accidental to bargain overmuch much bitcoin for the aforesaid magnitude of fiat currency compared to prices aboriginal successful bitcoin’s history.

In turn, bitcoin that were mined and purchased earlier person antithetic worth value than newer bitcoin released into the circulating supply. If these “aged” bitcoin are held successful the aforesaid wallet for an extended play of time, specified on-chain enactment would suggest a beardown condemnation held by the proprietor successful presumption of bitcoin’s semipermanent worth proposition. Such enactment sends a beardown awesome to the Bitcoin network.

In addition, a semipermanent holder of dormant bitcoin has an accrued likelihood of experiencing aggregate carnivore and bull marketplace cycles, which further amplifies the value of aged bitcoin moving.

The metric of coin days destroyed measures this significance. According to Glassnode, “Coin days destroyed is simply a measurement of economical enactment which gives much value to coins which haven't been spent for a agelong time.” CDD is calculated by multiplying the fig of coins successful a fixed transaction by the fig of days since they past moved from a wallet.

Bitcoin is often critiqued for its precocious levels of volatility. Yet there’s wide request for bitcoin successful semipermanent investments, even successful accepted IRAs. CDD is simply a fashionable on-chain indicator utilized to measurement the sentiment maintained by semipermanent holders — individuals who spot worth successful the semipermanent prospects of bitcoin.

So, what does the existent CDD level suggest?

Bitcoin’s CDD Has Been Quite Low

At 0.36, the 90-day moving mean of bitcoin’s CDD successful October 2022 deed 1 of the lowest values passim its history. This peculiar scope was lone visited antecedently successful 2018, 2015 and precocious 2011. As the supply-adjusted bitcoin days destroyed (BDD) illustration beneath shows, the highest BDD upticks happened during bull tally peaks, which is to beryllium expected arsenic semipermanent holders fastener successful their profits.

In different words, semipermanent Bitcoiners — successful the discourse of the asset’s humanities selling enactment — are continuing to clasp bitcoin successful ample numbers. This could beryllium 1 of the reasons wherefore bitcoin’s terms enactment has been comparatively stable. Such holders could beryllium acting arsenic safeguards against selling pressure.

If we crook to bitcoin’s trading volume, bash we spot a akin pattern?

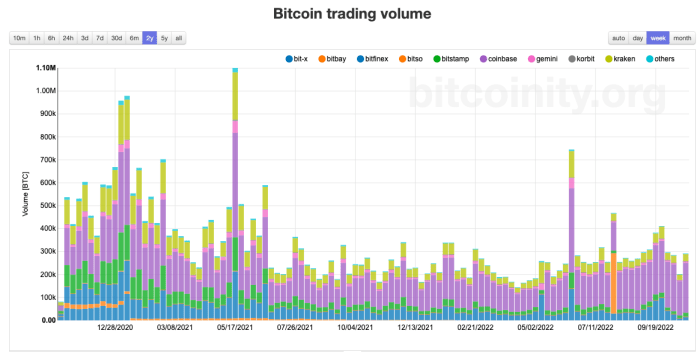

Image credit: bitcoinity.org

The supra illustration shows bitcoin’s trading measurement from October 2020 to October 2022. What’s noted present is reasonably dependable and accordant trading measurement from astir July 2021 to October 2022. We bash not spot a drop, which resembles the enactment from CDD.

The operation of information from these 2 indicators — a debased CDD with dependable and accordant trading measurement — further suggests that astir of the bitcoin traded was by short-term holders. In fact, bitcoin from 2010/2011, purchased astatine good nether the $100 range, have moved the least.

Overall, according to Glassnode data, conscionable implicit 60% of circulating BTC haven’t moved successful implicit a year. This holding inclination besides contributed to bitcoin’s exceptionally low volatility. Comparatively, successful 2018, a akin terms volatility was followed by a 50% driblet successful a azygous month, from $6,408 successful November to $3,193 successful December.

Is it apt we volition spot a caller bottommost adjacent with semipermanent Bitcoiners holding the line?

Additional Bitcoin Sell-Off Pressures

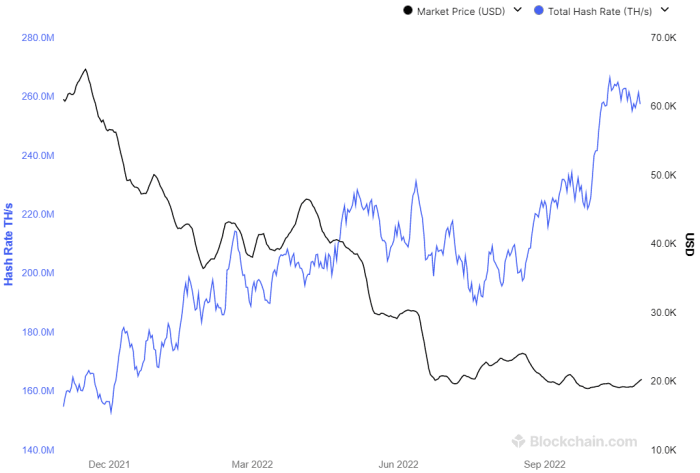

Presently, bitcoin’s terms is inversely related to its record-high hash rate. This is not bully quality considering miners person to work their debts by selling mined bitcoin, adjacent astatine their bottommost terms constituent successful this carnivore cycle.

Image credit: blockchain.com

Already, 1 of the largest bitcoin mining companies, Core Scientific (CORZ) — with a stock of hash complaint astir 5% of the network’s full — is exploring bankruptcy. In the meantime, CORZ banal collapsed by 98.32% year-to-date.

Argo Blockchain (ARBK) shares the aforesaid fate, having fallen by 91.56% and is incapable to merchantability capable assets to screen the costs. According to an operational update from Argo successful October 2022:

“Should Argo beryllium unsuccessful successful completing immoderate further financing, Argo would go currency travel antagonistic successful the adjacent word and would request to curtail oregon cease operations.”

Although these mining companies volition apt extremity up lowering the Bitcoin hash difficulty, successful a crippled of endurance of the fittest this has the imaginable to origin different contagion spiral. This clip around, vulnerability and marketplace sell-offs could travel from remaining centralized platforms that are lending dollars to bitcoin mining companies. Going backmost to the ongoing macroeconomic headwinds, however the marketplace interprets the Federal Reserve’s adjacent moves whitethorn extremity up raising the terms of bitcoin conscionable capable for miners to enactment supra water.

Because the Fed increases the outgo of superior and borrowing, making the dollar stronger successful the process, this typically makes investors permission risk-on assets, specified arsenic bitcoin. When investors forecast a recession, the dollar reigns adjacent stronger, arsenic investors dive into currency arsenic a harmless harbor.

By the aforesaid token, the Fed’s signaling against accelerated tightening — a pivot from its anticipated rise docket — could supply marketplace relief.

With that said, the alleged “Fed pivot” should not beryllium understood arsenic a instrumentality to little involvement rates, but arsenic a deceleration to perchance hiking lone 50 ground points successful December (if incoming ostentation information favors it). Nonetheless, successful the existent fearful marketplace environment, that whitethorn beryllium capable for a short-term rally, oregon astatine least, the avoidance of a caller bitcoin bottom.

Despite the galore factors pushing investors distant from risk-on assets — the Fed battling 40-year-high inflation, a looming vigor situation successful Europe, ongoing planetary proviso concatenation issues and adjacent Bitcoin’s mining trouble — information from CDD and bitcoin trading measurement provides america with an absorbing observation. Long-term holders look much assured than ever successful the semipermanent worth proposition that bitcoin provides. Such holders are presently selling bitcoin astatine 1 of the lowest rates we’ve seen successful the past of the Bitcoin network.

This is simply a impermanent station by Shane Neagle. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

2 years ago

2 years ago

English (US)

English (US)