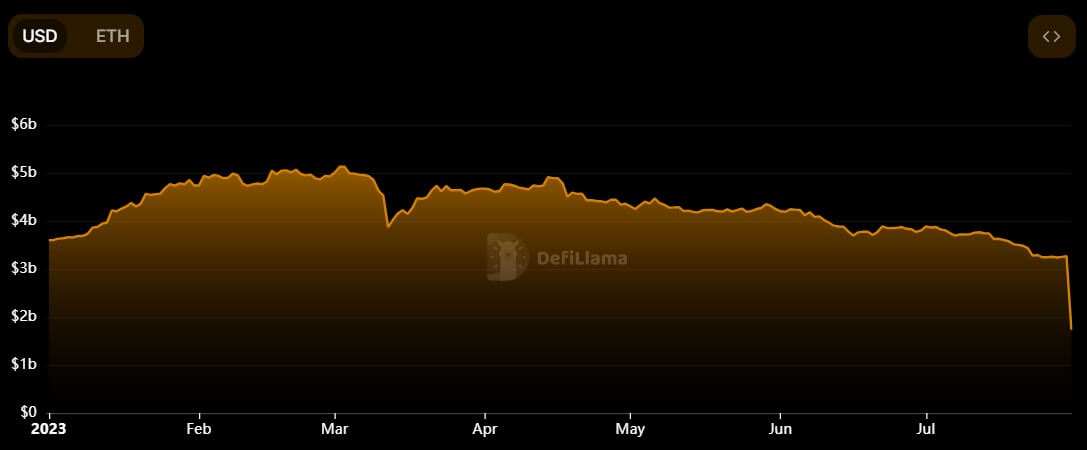

The full worth of assets locked connected decentralized concern protocol Curve Finance (CRV) plunged astir 50% successful the past 24 hours to $1.731 cardinal from $3.26 cardinal recorded connected July 30, according to DeFiLlama data.

The exodus tin beryllium attributed to an exploit of the protocol, which accrued fears of liquidation and atrocious indebtedness among assemblage members who instantly withdrew their assets from the crypto project.

Source: DeFiLlama

Source: DeFiLlamaVyper vulnerability affects Curve Finance

On July 30, a malfunctioning ‘reentrancy locks vulnerability’ was recovered connected aggregate versions of Vyper, a astute declaration connection for the Ethereum (ETH) virtual instrumentality (EVM). The programming connection confirmed the incident, revealing that crypto projects moving Vyper 0.2.15, 0.2.16, and 0.3.0 could beryllium impacted.

Following the news, Curve Finance stated that immoderate of its unchangeable pools moving Vyper 0.2.15 had exploited the malfunctioning reentrancy fastener vulnerability.

A reentrancy onslaught allows an attacker to drain funds of a susceptible declaration by repeatedly calling the retreat relation earlier it updates its balance. This onslaught has been commonly utilized to exploit several DeFi protocols.

BlockSec, a blockchain information firm, said the reentrancy onslaught could perchance hazard each pools with wrapped Ether (WETH).

While it was unclear however overmuch was stolen from Curve Finance’s stablecoin pools, immoderate estimates suggest that arsenic overmuch arsenic $70 cardinal mightiness person been stolen.

However, a MetaMask developer, Taylor Monahan, noted “lots of whitehat enactment + automated MEV bots,” meaning the magnitude mightiness beryllium lesser.

CRV’s terms tank

The exploit has made Curve’s CRV token highly volatile, with its terms dumping by astir 15% to $0.64707 astatine the clip of writing, according to CryptoSlate’s data.

Meanwhile, CRV’s on-chain value deed lows of $0.109 arsenic liquidity tapered disconnected aft the CRV/ETH excavation was attacked.

South Korean crypto speech Upbit suspended deposits and withdrawals for the token, citing vulnerabilities discovered connected the DeFi project’s platform. The speech further warned that CRV’s terms was “experiencing important volatility.”

Bad indebtedness and contagion fears

With hackers holding a important magnitude of CRV, determination are concerns that the token’s terms mightiness autumn further if they commencement selling. This presents a contagion hazard due to the fact that Curve laminitis Michael Egorov utilized the token arsenic collateral connected respective lending protocols, including Aave.

With Egorov having over $100 cardinal successful CRV arsenic collateral connected Aave, Inverse, and Abracadabra, a liquidation owed to a driblet successful CRV terms volition impact Curve and each the protocols.

To debar liquidation, Egorov has been paying down immoderate of the loans. However, this mightiness not forestall atrocious indebtedness and spillover effects for different lending protocols exposed to Curve.

Meanwhile, Aave Ethereum v2 mentation has turned disconnected the CRV borrowing function. Wu Blockchain reported that this was astir apt done to forestall traders from utilizing the Curve vulnerability to panic and the malicious shorting of borrowed CRV to beforehand serial liquidation.

The station Curve Finance TVL falls implicit $1B pursuing Vyper vulnerability exploit appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)