- The stablecoins that constitution Curve’s 3pool person seen accrued outflows since the hack.

- The request for CRV continues to fall, putting downward unit connected price.

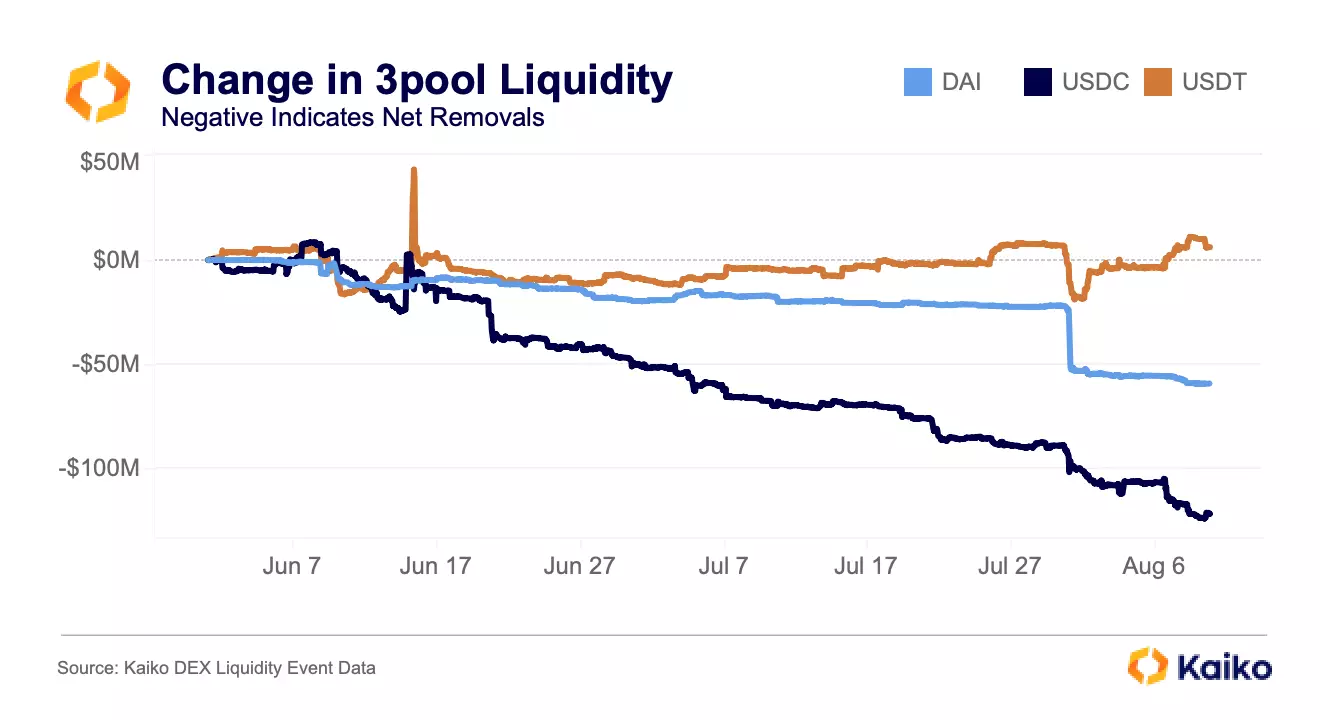

In the aftermath of Curve’s reentrancy exploit of July 30, 3pool, 1 of the decentralized exchange’s (DEX) salient liquidity pools, proceed to acquisition superior flight, probe steadfast Kaiko noted successful a caller report.

Source: Kaiko

Source: KaikoAccording to Kaiko, Curve’s 3pool represents 1 of its “most important sources of liquidity for DAI, USDC, and USDT” and has seen $175 cardinal since the hack.

USDC has seen the astir outflows of each the 3 stablecoins that marque up the currency reserves successful the pool. Since the exploit, liquidity providers person removed USDC coins worthy $125 cardinal from 3pool. DAI comes successful 2nd spot with outflows that totaled $60 million, “$25mn of which came successful conscionable 3 transactions connected July 31,” the study stated.

Regarding Tether’s USDT, Kaiko recovered that it has remained astir adjacent successful the Curve 3pool, contempt the accrued removal of the different stablecoins.

According to Kaiko, this suggests that investors are becoming much skittish astir USDT. This is due to the fact that USDT makes up a disproportionate magnitude of the pool, truthful a tally connected USDT could origin the excavation to depeg.

The information that users are incentivized to region USDT from the Curve 3pool is simply a motion that they are disquieted astir the stableness of USDT. This could pb to further outflows from the pool, which could enactment downward unit connected the terms of USDT.

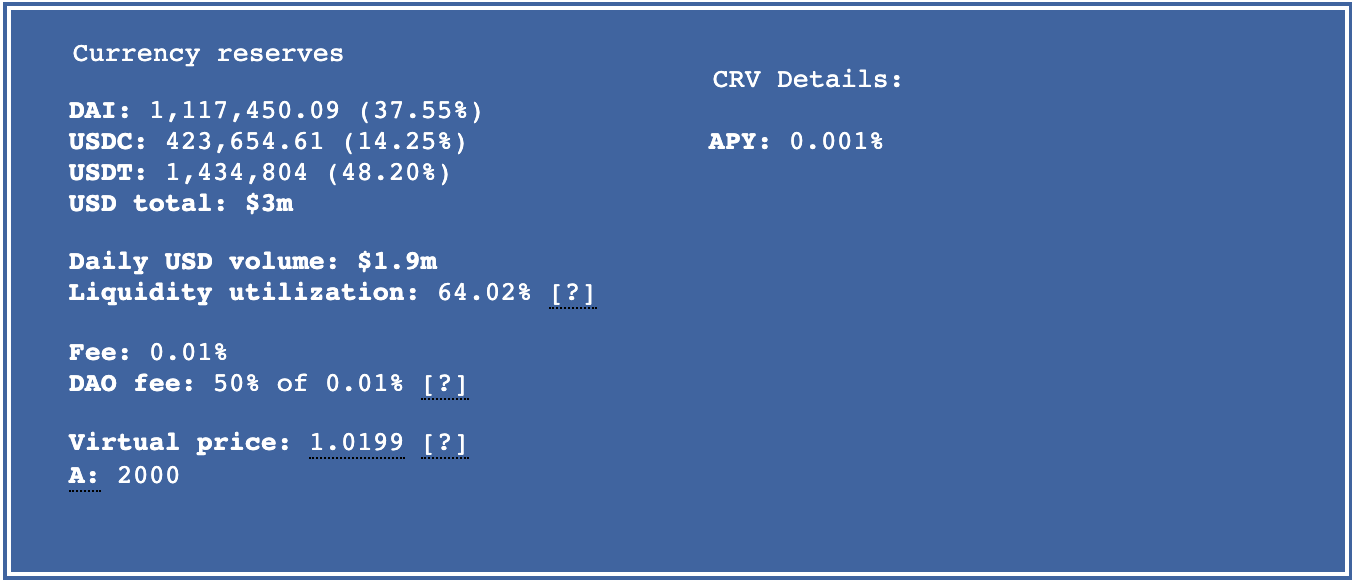

The full currency reserves successful Curve’s 3pool astatine property clip was $3 million. USDT accounted for the largest stock of the reserves, with $1.43 million, oregon 48.20%. USDC was the second-largest reserve, with $423,654, oregon 14.25%. DAI was the third-largest reserve, with $1.11 million, oregon 38%.

Source: Curve Finance

Source: Curve FinanceCRV continues to dwindle amid accrued sell-offs

At property time, CRV exchanged hands astatine $0.5597. According to CoinMarketCap, the altcoin’s worth has plummeted by 32% successful the past month.

Source: CoinMarketCap

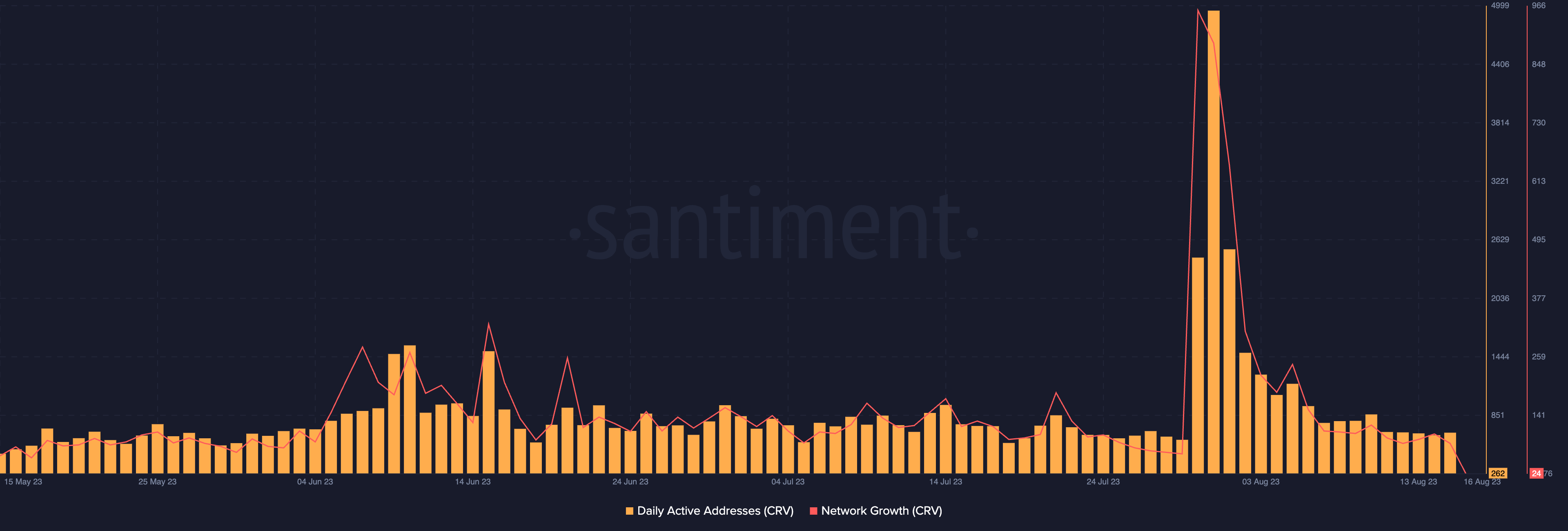

Source: CoinMarketCapAmid the fearfulness of a implicit liquidation of Michael Egorov’s collateral connected Aave pursuing the hack, the number of transactions involving CRV has dropped since 30 July. According to Santiment, the number of regular progressive addresses that commercialized CRV has declined by 94% since the hack.

Likewise, CRV has failed to gully successful caller request arsenic radical proceed to adjacent their trading positions. Data from Santiment revealed a 90% alteration successful the fig of caller addresses that person been created to commercialized CRV since the hack.

Source: Santiment

Source: Santiment

2 years ago

2 years ago

English (US)

English (US)