Non-fungible tokens proceed to play a important relation successful processing the Web3 ecosystem, contempt the enthusiasm astir them having subsided since its highest successful 2021.

Unquestionably, these distinctive integer assets person been a important unit down the NFT transformations that person taken place. Despite the wide assortment of NFT collections and their accomplishments, it is important to admit that immoderate peculiar ones person precocious been severely affected by marketplace pressures and are present opening to autumn from their lofty positions.

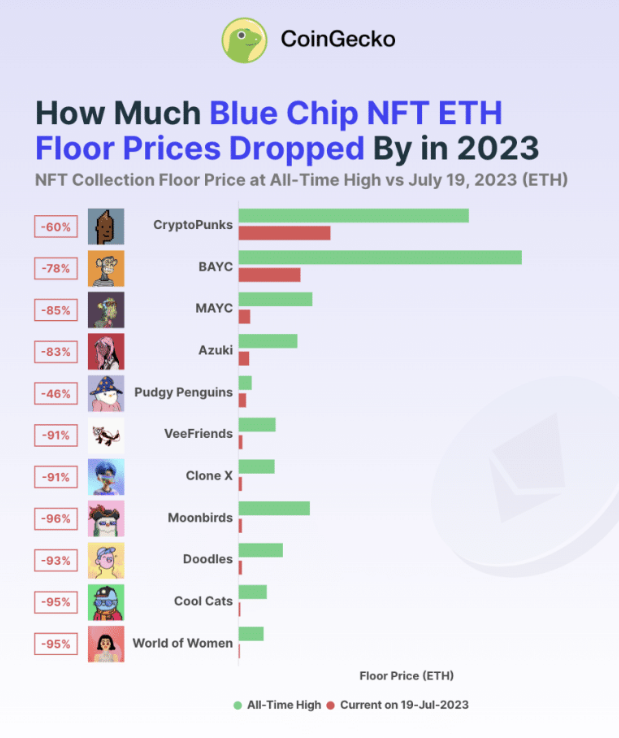

Consider the concern with CryptoPunks. CoinGecko discovered that of the apical 11 “blue chip” NFT projects studied, CryptoPunks suffered the worst losses.

Non-fungible tokens known arsenic “blue spot NFTs” are regarded arsenic highly precious and prestigious successful integer assets. These NFTs are often linked to well-known and recognized producers oregon organizations, specified arsenic renowned artists, enduring businesses, oregon indispensable humanities items.

Collectors and investors wide question aft them owed to scarcity, humanities relevance, and the artist’s estimation that find their value.

Alarming statistic presently facing CryptoPunks are raising questions among NFT enthusiasts. These formerly well-liked integer assets person precocious encountered a worrying situation, sparking disputes and disagreements among investors and fans.

At the clip of writing, the level terms for these NFT collections was acceptable astatine 47.69 ETH. Data from NFT Floor Price shows that the collection’s worth declined aft reaching a precocious of 11,000ETH during the 2021 NFT bull market.

The measurement and income of CryptoPunks person importantly decreased during the past 7 days, claims OpenSea. Sales were down 60%, portion measurement dropped sharply by 64%.

Due to their distinctiveness and adaptable rarity, CryptoPunks, developed by Larva Labs successful 2017 and helped summation generative PFP collections, are inactive incredibly sought-after NFTs.

CryptoPunks, regarded arsenic creation and collectibles, person generated respectable profits for their owners. CryptoPunk #5822, which sold for $23 cardinal successful February past year, was the astir costly ever.

Now, successful presumption of the fig of unsocial progressive wallets, CryptoPunks has seen a depressing simplification of astir 20%, and transactions person besides suffered, losing much than 32% of their values.

Meanwhile, CryptoPunks’ monthly income measurement is besides feeling the heat, declining precipitously since March. The NFT inaugural reported income of $30.43 cardinal for the month, but by the extremity of June, those figures had substantially dropped to little than $10 million.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Reuters

2 years ago

2 years ago

English (US)

English (US)