Crypto trading volumes dropped sharply successful February arsenic concerns that President Donald Trump's tariffs connected Mexico, Canada and different countries would stifle planetary commercialized reduced capitalist request for adding to risky investments.

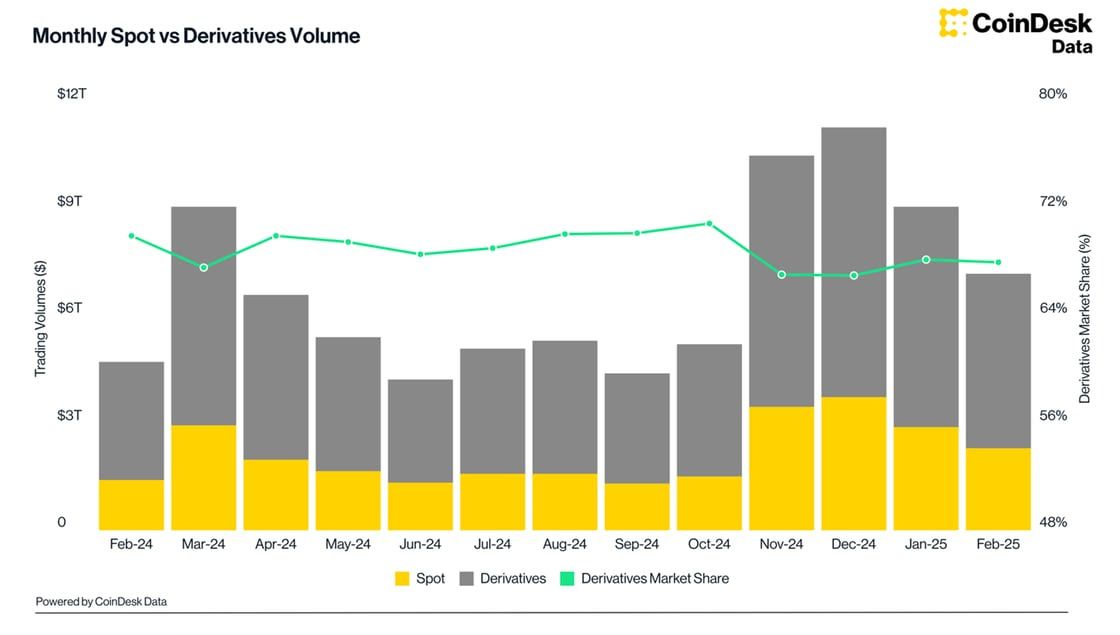

Combined spot and derivatives trading measurement connected centralized exchanges fell 21% to $7.2 trillion, the lowest level since October, according to CoinDesk Data’s latest Exchange Review.

Since November, the Trump medication has threatened to enforce tariffs connected trading partners including China and the European Union successful effect to what it considers unfair commercialized practices against the U.S. successful assorted industries.

Among centralized exchanges, Binance maintained its presumption arsenic the largest spot trading level with a 27% marketplace share. It was followed by Crypto.com (8.1%) and Bybit (7.4%) with Coinbase (COIN) and MEXC Global rounding retired the apical five.

Derivatives trading besides saw a important decline, with CME — the largest organization crypto trading venue — signaling its archetypal measurement driblet successful 5 months. CME’s trading measurement fell 20% to $229 billion, with bitcoin futures enactment sliding 20% to $175 cardinal and ether futures falling 13% to $35.9 billion.

The diminution successful trading coincided with a driblet successful the BTC CME annualized basis, which fell to 4.08%, its lowest level since March 2023. Nevertheless, the CME’s marketplace stock among derivatives exchanges grew to a grounds 4.67%.

The summation suggests that portion retail trading enactment has been waning, with Robinhood (HOOD) precocious reporting its crypto trading measurement fell 29% successful February, organization involvement successful the manufacture is holding.

Total unfastened involvement crossed each trading pairs connected centralized exchanges fell 30% to $78.8 billion, the lowest since Nov. 5, the study noted, reflecting the dense liquidations endured during the caller drawdown.

7 months ago

7 months ago

English (US)

English (US)