Spot and derivatives trading activities connected centralized cryptocurrency exchanges declined for the 2nd consecutive period by 11.5% to $2.09 trillion, mounting a caller debased for the existent year, according to CCData.

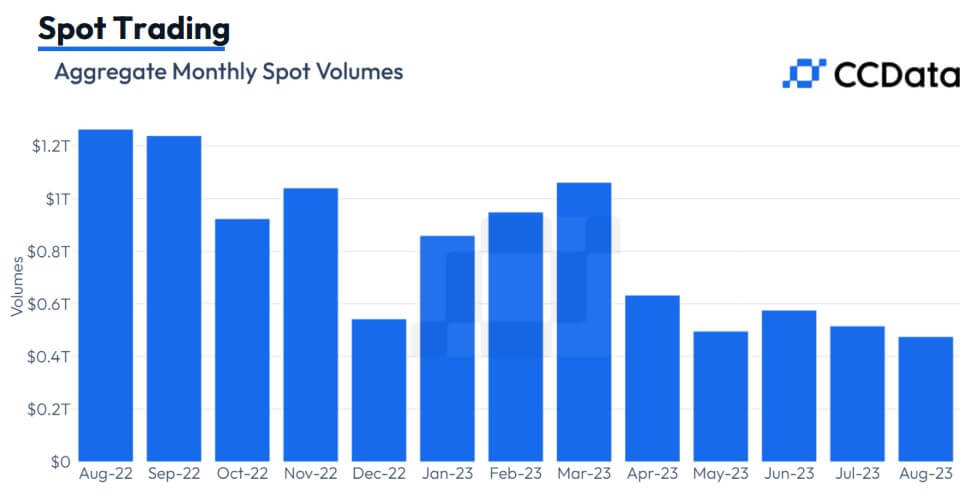

The crypto information aggregator reported that spot trading activities fell 7.78% to $475 cardinal successful August, the lowest measurement recorded since March 2019. CCData stated that regular volumes connected centralized exchanges besides deed a debased of $5.90 cardinal connected August 26, the weakest since Feb. 7, 2019.

Source: CCData

Source: CCDataPer CCData, the decreased crypto trading enactment was contempt Grayscale’s caller occurrence against the U.S. Securities and Exchange Commission (SEC). According to the firm, the ineligible triumph failed to spur a meaningful accumulation of crypto assets. The steadfast wrote:

“The trading volumes connected centralised exchanges person remained debased since April this twelvemonth and are present comparable to the stagnant trading enactment successful the carnivore marketplace of 2019.”

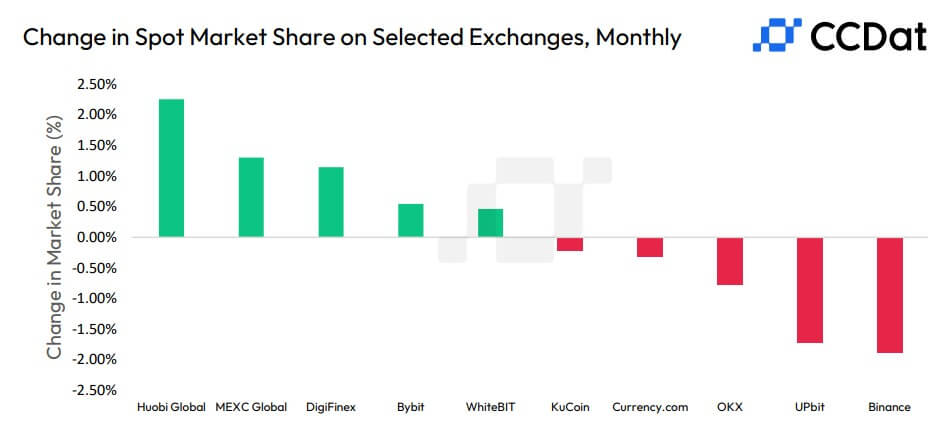

Binance marketplace stock falls

While Binance continues to pb successful spot trading measurement with $183 billion, it’s noteworthy that the exchange’s marketplace stock has declined consistently for six consecutive months, present resting astatine 38.5%—its lowest constituent successful the past year.

Binance’s caller setbacks tin beryllium chiefly attributed to regulatory and ineligible issues, which person prompted important changes wrong the company’s top leadership. Several high-ranking executives person departed, ostensibly for idiosyncratic reasons; however, determination is wide speculation that their departures are linked to mounting regulatory pressures.

An illustration of however these issues person affected Binance is however its trading measurement wrong Russia plummeted by implicit 80%, according to Kaiko data. Although Binance has publically stated its committedness to adhering to imposed sanctions connected the country, caller media reports person raised questions astir the exchange’s continued use of sanctioned fiscal institutions to facilitate peer-to-peer transactions.

Huobi measurement climbs

In August, the Huobi Exchange experienced a important boost successful its spot trading volume. Notably, its spot trading measurement surged by an awesome 46.5%, reaching $28.9 billion. This surge catapulted Huobi into the presumption of the second-largest level successful the manufacture and saw its spot marketplace stock leap to 6.3%, its highest constituent since October 2021.

Source: CCData

Source: CCDataThis surge successful Huobi’s trading enactment has drawn important attention, peculiarly successful airy of its associations with Justin Sun, the laminitis of Tron’s network, and ongoing inquiries regarding its stablecoin reserves.

The station Crypto trading sinks to 2019 levels arsenic Binance sees marketplace dip and Huobi volumes surge appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)