Crypto markets rally arsenic Bitcoin climbs backmost implicit $31k Liam 'Akiba' Wright · 23 seconds ago · 2 min read

Crypto markets rally arsenic Bitcoin climbs backmost implicit $31k Liam 'Akiba' Wright · 23 seconds ago · 2 min read

The wider crypto marketplace has rallied with Bitcoin ascent backmost to $31k and beyond. Ethereum tests $2k resistance

Cover art/illustration via CryptoSlate

Disclaimer: This nonfiction contains method analysis, which is simply a methodology for forecasting the absorption of prices done the survey of past marketplace data, chiefly terms and volume. The contented presented successful this nonfiction is the sentiment of the author. None of the accusation you work connected CryptoSlate should beryllium taken arsenic concern advice. Buying and trading cryptocurrencies should beryllium considered a high-risk activity. Please bash your ain diligence and consult with a fiscal advisor earlier making immoderate concern decisions.

👋 Want to enactment with us? CryptoSlate is hiring for a fistful of positions!The crypto marketplace saw a uncommon comeback connected Monday, May 30, aft 9 consecutive reddish weeks for Bitcoin. Juan Pellicer, Research Analyst astatine Into The Block, believes the rally tin beryllium traced to the existent betterment successful the banal market,

“I deliberation the caller BTC terms enactment is precise influenced by the US markets bounce. SP truthful acold is bouncing astir 10% from the lows of past week, truthful determination mightiness beryllium portion of the marketplace believing that aft the past crisp correction we are successful for a accelerated recovery.”

The correlation betwixt Bitcoin and the banal marketplace had decoupled past week arsenic the S&P recorded gains of 6.94% portion Bitcoin closed the week down 8.9%. Unlike accepted markets, the crypto manufacture ne'er sleeps, and Bitcoin climbed 3% implicit the weekend. However, arsenic markets opened Monday morning, it was not conscionable Bitcoin that began to rally on with a further betterment successful stocks.

Bitcoin has been trading successful correlation with big tech stocks for immoderate clip arsenic planetary markets softened. Pellicer is bullish that astatine slightest immoderate parts of the marketplace are acceptable for a “V-shaped” recovery. With Bitcoin down implicit 50% from its precocious and galore altcoins down implicit 70%, crypto bulls would invited this.

Global concern sentiment

Cryptocurrencies person traded overmuch much similar tech stocks than an autarkic plus people and ostentation hedge. However, incidents specified arsenic the Terra illness and fears implicit the Ethereum merge and imposing regularisation person lone added to broader planetary economical concerns.

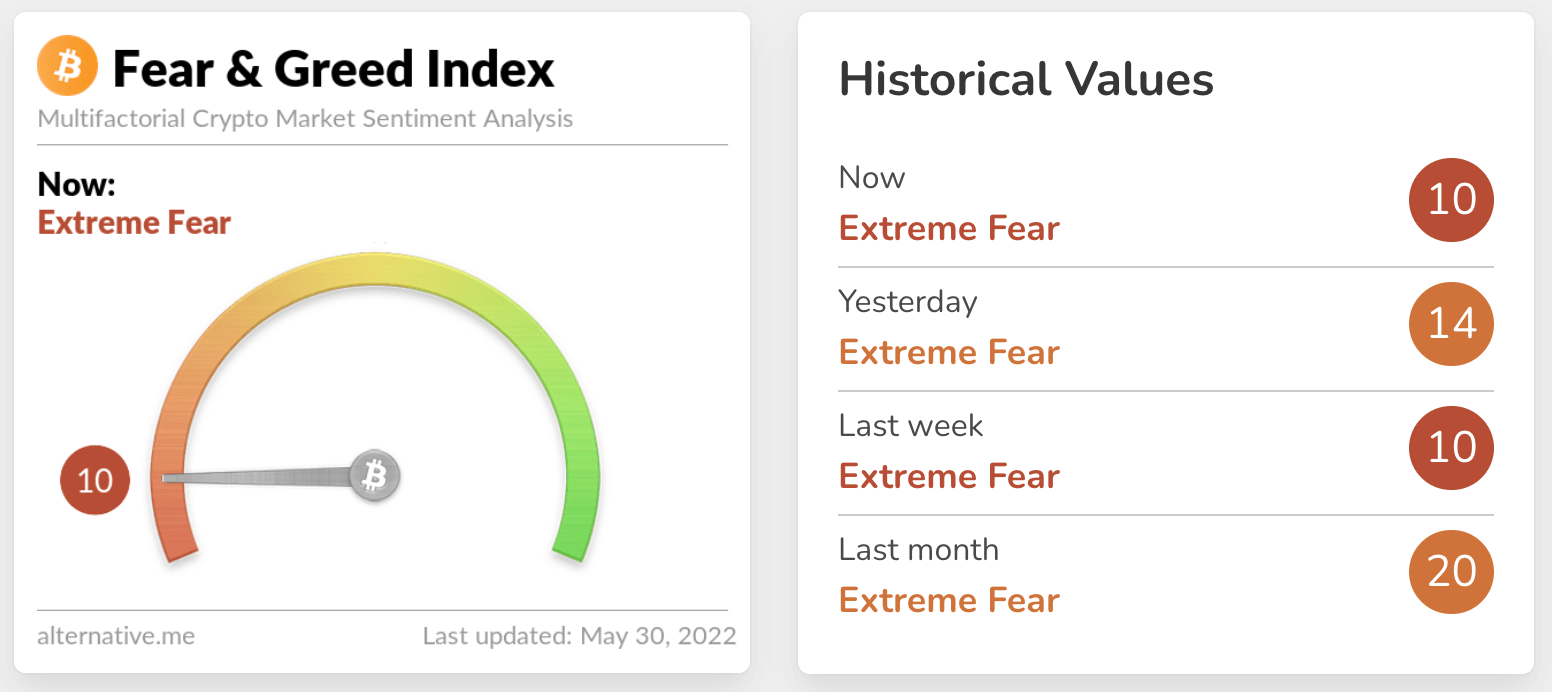

The warfare successful Ukraine, rising inflation, looming nutrient shortages, and expanding involvement rates person besides added a antagonistic sentiment to crypto investing. The fear and greed scale presently indicates we are adjacent to highest fearfulness with a people of antagonistic 10.

Source: Alternative.me

Source: Alternative.meWeakening dollar value

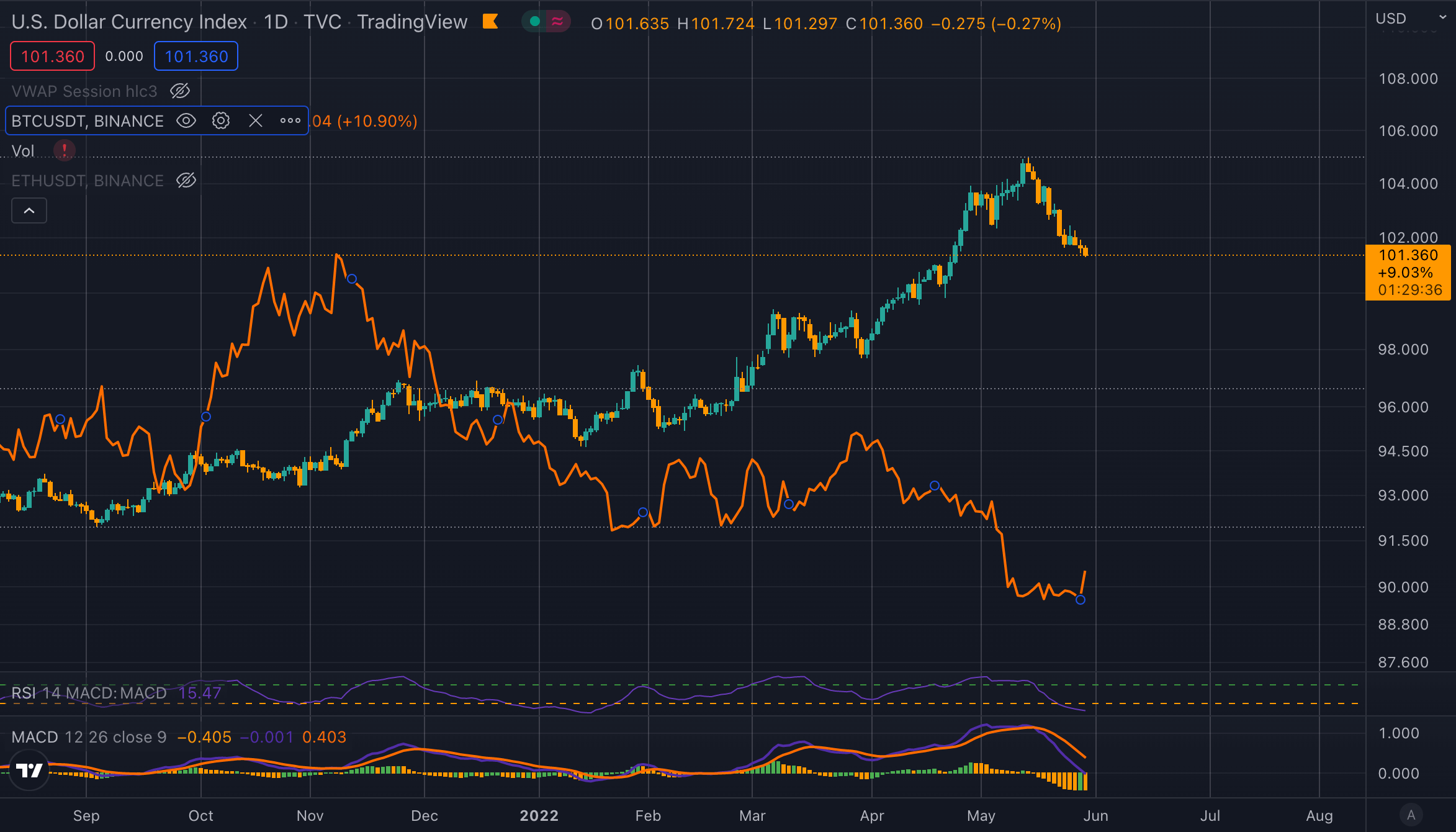

It is worthy noting that the dollar’s spot is besides a origin successful assessing the terms of cryptocurrencies. Most cryptocurrencies are valued against the dollar utilizing stablecoins specified arsenic USDT, BUSD, and USDC. As the dollar weakens, the worth of cryptocurrencies volition organically rise.

The illustration beneath shows the divergence of the $DXY and Bitcoin. Since 2021, arsenic the DXY has risen, the terms of Bitcoin has demonstrated a antagonistic correlation. Positively for the crypto industry, Bitcoin is besides rising against different large currencies, confirming the breakout.

Source: TradingView

Source: TradingView

3 years ago

3 years ago

English (US)

English (US)