Bitcoin’s (BTC) dip beneath $35,000 resulted successful liquidations totaling more than $300 million crossed the cryptocurrency marketplace during the past 24 hours.

Coinglass data revealed $120 cardinal successful liquidation for investors holding positions successful the flagship asset, chiefly affecting agelong traders who incurred astir of the losses.

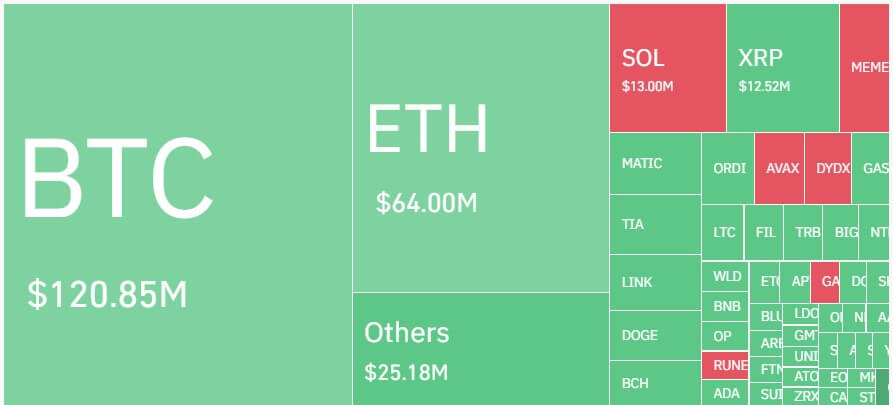

$307 cardinal liquidated

In the past 24 hours, the cryptocurrency marketplace witnessed a important liquidation of $307.14 million, with 77,548 traders liquidated.

Crypto Market Liquidation (Source: Coinglass)

Crypto Market Liquidation (Source: Coinglass)According to Coinglass data, astir losses were borne by agelong traders, who mislaid astir $264 million. Bitcoin and Ethereum (ETH) contributed importantly to this figure, accounting for a combined nonaccomplishment of $170 million. On the different hand, abbreviated traders recorded losses of little than $15 million.

Across exchanges, implicit 75% of the full liquidations were connected OKX and Binance. During the reporting hours, traders connected these exchanges mislaid much than $200 million. Other exchanges similar Huobi, Deribit, and Bitmex besides recorded a sizeable magnitude of the full liquidations.

The astir important liquidation occurred connected OKX, with a BTC-USDT-SWAP presumption valued astatine $9.45 million.

BTC nether $36k

Earlier today, Bitcoin declined 6% to a play debased of $34,743 aft trading supra $36,000 for an extended period.

Over the past respective weeks, the flagship plus had gone connected a tally that saw its worth propulsion to a yearly precocious of nearly $38,000 connected the backmost of the marketplace optimism surrounding the anticipation of an support for spot BTC ETF.

CryptoSlate Insights cautioned that this tally could witnesser pockets of “market corrections,” arsenic they “are a mean portion of immoderate fiscal cycle, contributing to the wide wellness of the market.”

Meanwhile, Coinbase has predicted that approving a spot BTC ETF would make “compliance-friendly” fiscal products attracting involvement from divers capitalist classes similar registered concern advisers (RIAs), status funds, and institutions.

The station Crypto liquidation breakdown – 77,548 traders deed by $307M liquidation, Bitcoin and Ethereum pb losses appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)