Meanwhile, the altcoin terms clang triggered inflows for XRP, Cardano and Polygon.

On June 19, European cryptocurrency concern steadfast CoinShares published its “Digital Asset Fund Flows Report,” revealing that cryptocurrency concern products experienced outflows totaling $5.1 cardinal past week. The outflows contributed to the continuation of a nine-week streak of outflows, resulting successful a cumulative full of $423 million.

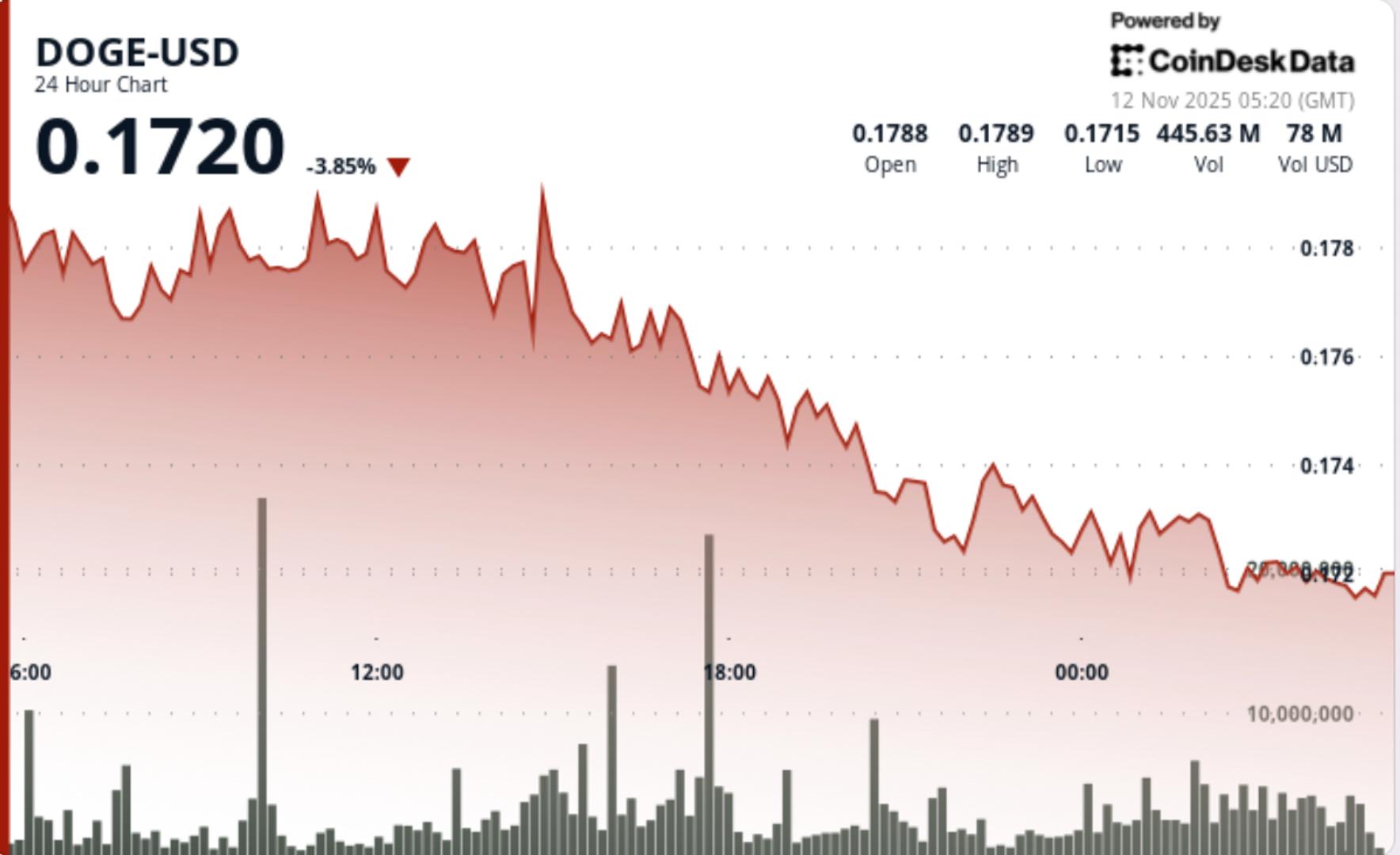

Weekly crypto plus flows. Source: CoinShares

Weekly crypto plus flows. Source: CoinSharesThe study noted that contempt this downward trend, determination was a glimmer of anticipation toward the extremity of the week, arsenic news emerged that BlackRock, 1 of the world’s largest plus managers, had submitted an exertion for a Bitcoin (BTC) exchange-traded merchandise (ETP) successful the United States. This improvement resulted successful insignificant inflows; however, they were not important capable to offset the earlier outflows observed during the week. As a consequence, the streak of outflows persisted.

Examining the determination breakdown, the U.S. and Germany experienced insignificant inflows of $3.7 cardinal and $2.4 million, respectively. The U.S. maintained its pb successful presumption of full inflows year-to-date, accumulating $147 million, portion Canada struggled with outflows amounting to $277 million. CoinShares’ study author, James Butterfill, added, “Despite improving regulatory conditions successful Hong Kong, we person not seen immoderate measurable inflows into ETPs year-to-date portion full assets nether absorption (AuM) stay debased astatine US$39m.”

According to CoinShares, the erstwhile week’s clang successful altcoin prices served arsenic a catalyst for investors to summation their positions. Consequently, inflows totaling $2.4 cardinal were observed. Noteworthy cryptocurrencies specified arsenic XRP (XRP), Cardano (ADA) and Polygon (MATIC) were the absorption of these inflows, receiving amounts of $1 million, $0.6 cardinal and $0.2 million, respectively.

On the different hand, Ether (ETH) experienced the largest outflows for the week, totaling $5 million. Additionally, some Tron (TRX) and Avalanche (AVAX) saw outflows of $0.4 cardinal each. In a akin vein, CoinShares noted, “Blockchain equities saw the largest outflows since FTX, totalling $12.3m.”

On June 15, BlackRock applied for the archetypal Bitcoin spot exchange-traded money (ETF) successful the United States. If approved, the ETF would supply investors with a regulated and accessible mode to summation vulnerability to Bitcoin. Coinbase Custody Trust Company would beryllium the custodian for the fund’s Bitcoin holdings, portion the Bank of New York Mellon would grip fiat assets. The ETF’s Bitcoin terms would beryllium updated each 15 seconds based connected the CF Benchmarks index. The support of BlackRock’s exertion could person important implications for the wider acceptance and adoption of cryptocurrency concern products successful the United States.

2 years ago

2 years ago

English (US)

English (US)