A multi-million dollar exploit of stablecoin-focused decentralized speech (DEX) Curve Finance has traders pivoting toward the rival Uniswap's UNI token.

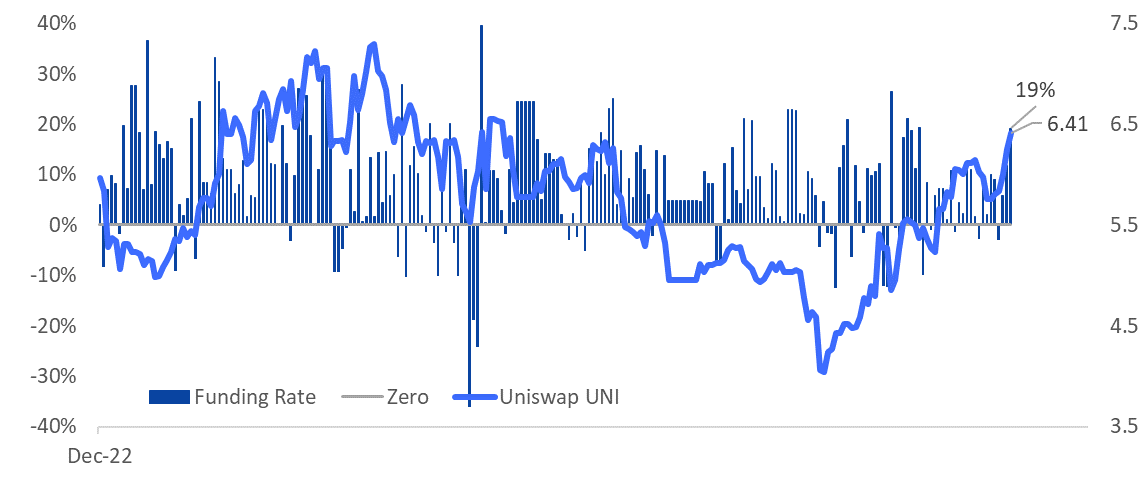

Funding rates successful perpetual futures tied to UNI person surged to an annualized 19% successful the aftermath of the exploit, according to information tracked by crypto services supplier Matrixport.

A affirmative backing complaint means the perpetual contract's terms is trading astatine a premium to the people terms oregon the estimated existent worth of a contract, besides known arsenic "marking-to-market." Positive rates besides bespeak longs oregon traders holding leveraged bargain positions are dominating and consenting to wage backing to shorts to support their positions open.

"The UNI token [perpetuals] trades astatine a astir 20% premium arsenic traders expect Uniswap to summation adjacent much marketplace stock aft the CRV exploit," Markus Thielen, caput of probe and strategy astatine Matrixport, said successful an email.

Funding rates person jumped to an annualized 19%. (Matrixport) (Matrixport)

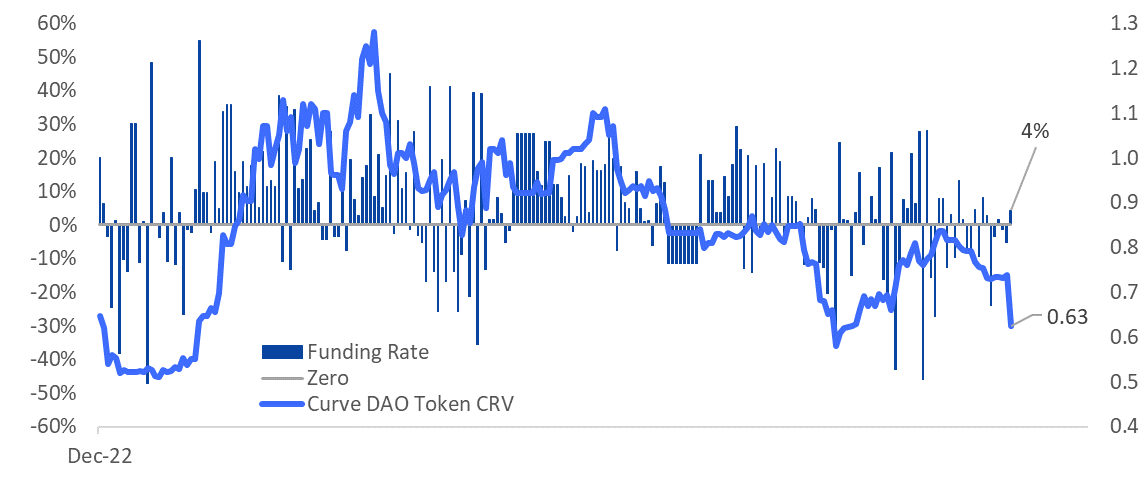

Funding rates person jumped to an annualized 19%. (Matrixport) (Matrixport)Late Sunday, Curve, the third-largest DEX, fell unfortunate to a flash indebtedness exploit that enactment $100 cardinal worthy of cryptocurrency astatine risk. Curve DAO's autochthonal CRV token fell implicit 15% to $0.63 pursuing the attack. The speedy diminution introduced further risk, perchance threatening to liquidate $70 cardinal worthy of borrowed presumption of Curve founder.

Still, the perpetual futures marketplace indicates nary signs of panic, with backing rates successful CRV and AAVE markets holding supra zero.

Funding rates successful CRV perpetual futures stay affirmative aft the exploit. (Matrixport) (Matrixport)

Funding rates successful CRV perpetual futures stay affirmative aft the exploit. (Matrixport) (Matrixport)"CRV DAO perp futures are inactive trading astatine a tiny premium, indicating that traders are much focused connected moving positions distant from the DEX (regarding TVL) alternatively than shorting the token," Thielen said.

The full worth locked (TVL) locked successful Curve Finance fell from $3.2 cardinal to $1.8 cardinal pursuing the hack, according to information root DeFiLlama. Meanwhile, the TVL locked successful Uniswap has held dependable astatine astir $3.8 cardinal portion AAVE's has declined from $5.85 cardinal to $5.37 billion.

Edited by Parikshit Mishra.

2 years ago

2 years ago

English (US)

English (US)