Thank you to our sponsor of this week's newsletter, Grayscale. For fiscal advisors adjacent Chicago, Grayscale is hosting an exclusive event, Crypto Connect, connected Thursday, May 22. Learn more.

In today’s Crypto for Advisors, Tedd Strazimiri from Evolve ETFs writes astir the improvement of tokenization and the worth it brings to investors.

Then, Peter Gaffney from Inveniam answers questions astir what tokenization tin bash for wealthiness managers and their clients successful Ask an Expert.

The Tokenization Boom: Why Ethereum Remains the Rails for Real-World Asset Tokenization

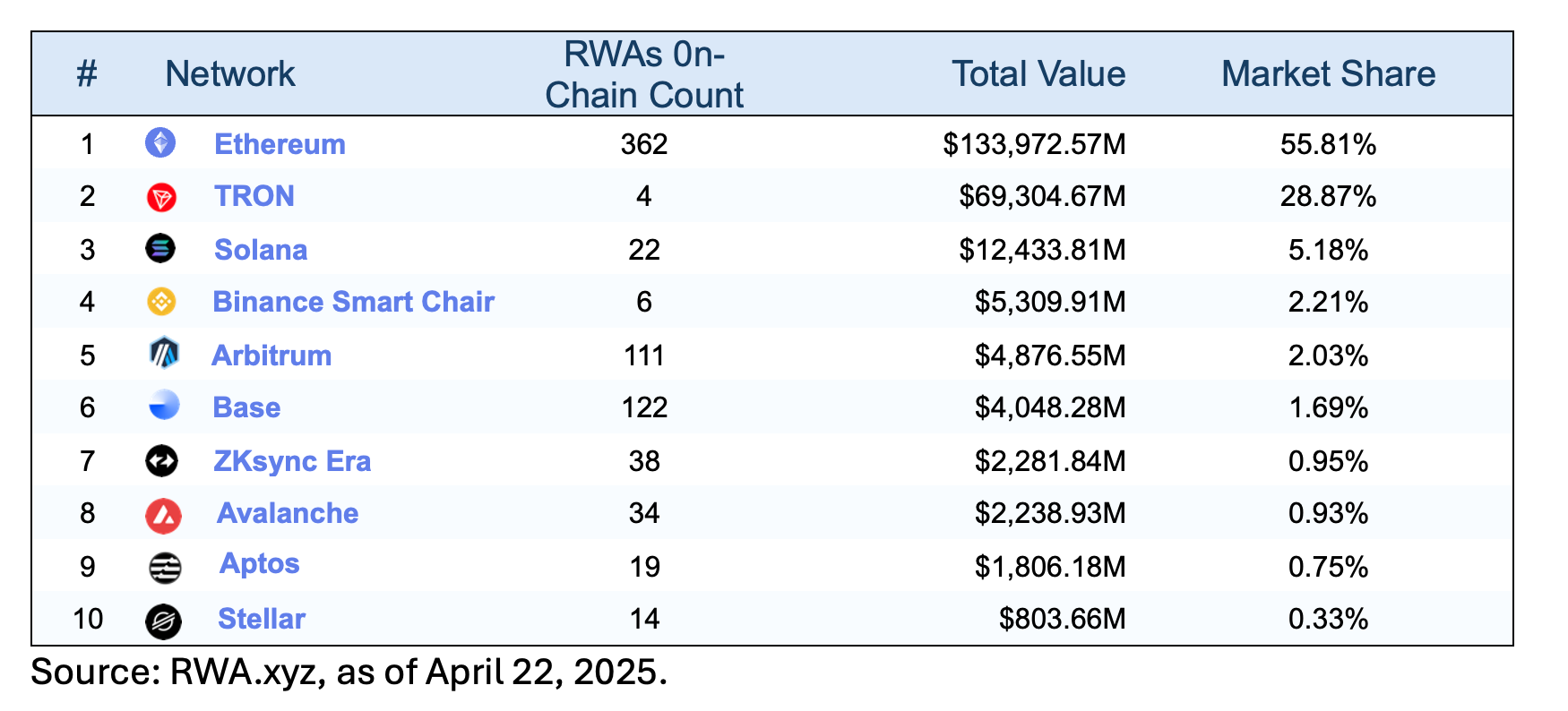

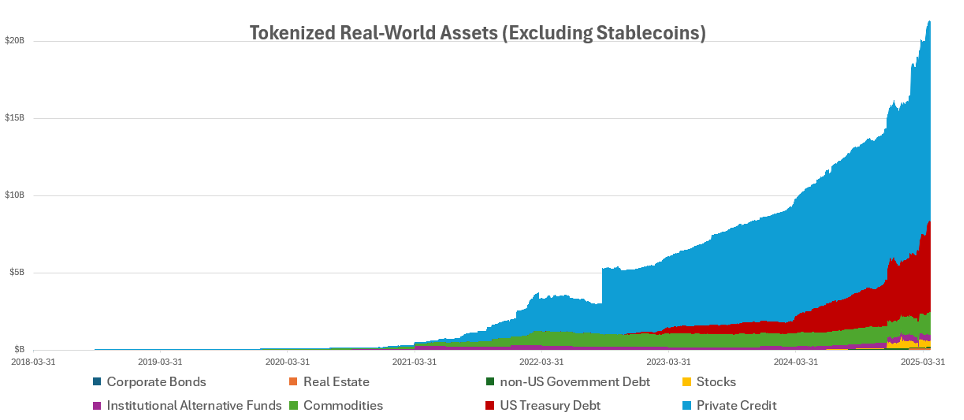

The tokenization of real-world assets (RWAs) has moved beyond buzzword presumption to go a multi-billion-dollar reality, led by Ethereum. Of the much than $250 cardinal successful tokenized assets, Ethereum commands astir 55% of the market. From stablecoins and U.S. Treasuries to existent estate, backstage credit, commodities and equities, Ethereum has emerged arsenic the preferred blockchain infrastructure for institutions aiming to span accepted concern with the integer plus world.

Why tokenization matters

At its core, tokenization is the process of converting ownership rights successful RWAs into integer tokens that unrecorded connected a blockchain. This translation introduces unprecedented efficiencies successful colony speed, liquidity and accessibility. Tokenized assets tin beryllium traded 24/7, settled instantly and fractionalized to scope a broader scope of investors. For institutions, tokenization reduces costs tied to custody, middlemen and manual processes, portion offering transparency and programmability.

But portion tokenization is simply a inclination that tin instrumentality basal crossed aggregate blockchains, Ethereum’s dominance is nary accident. Its established infrastructure, wide developer ecosystem and proven information person made it the go-to level for large players entering the space.

Ranked: Blockchain Networks Supporting RWA Tokenization

BlackRock’s BUIDL and the emergence of organization tokenization

One of the champion examples of organization adoption of tokenization is BlackRock’s BUIDL, a tokenized U.S. Treasury money built connected Ethereum. Launched successful aboriginal 2024, BUIDL allows investors to entree U.S. Treasuries via blockchain, offering real-time colony and transparency into holdings. The money has rapidly scaled to implicit $2.5 cardinal successful assets nether management, securing a 41% marketplace stock successful the tokenized U.S. Treasury space. Ethereum remains the ascendant concatenation for tokenized Treasuries, accounting for 74% of the $6.2 cardinal tokenized US treasuries market. BUIDL isn’t conscionable a product; it’s a awesome that TradFi sees Ethereum arsenic the backbone of the adjacent fiscal era.

Stablecoins: the instauration layer

No treatment of tokenization is implicit without stablecoins. U.S. dollar-pegged assets similar USDC and USDT correspond the immense bulk (95%) of each tokenized assets. Stablecoins unsocial relationship for much than $128 cardinal of Ethereum’s tokenized economy1 and service arsenic the superior mean of speech crossed DeFi, cross-border settlements and remittance platforms.

In galore processing economies, similar Nigeria oregon Venezuela, stablecoins supply entree to the U.S. dollar without needing a bank. Whether shielding savings from ostentation oregon enabling seamless planetary trade, stablecoins amusement the real-world worth of tokenized dollars, backstopped by the Ethereum network.

Tokenized Stocks and beyond

Tokenized stocks connected Ethereum correspond a increasing but inactive nascent conception of the tokenized plus space. These integer assets reflector the terms of real-world equities and ETFs, offering 24/7 trading, fractional ownership, planetary accessibility and instant settlement. Key benefits see accrued liquidity, little transaction costs and democratized entree to markets traditionally constricted by geography oregon relationship type. Popular tokenized stocks see Nvidia, Coinbase and MicroStrategy, arsenic good arsenic ETFs similar SPY. As regulatory clarity improves, tokenized equities connected Ethereum could reshape however investors entree and commercialized stocks, particularly successful underserved oregon emerging markets.

Additionally, existent estate, backstage credit, commodities and adjacent creation are uncovering their mode onto Ethereum successful tokenized formats, proving the chain’s adaptability for divers plus classes.

Tokenized RWAs (excluding Stablecoins)

Source: RWA.xyz, arsenic of April 22, 2025.

Conclusion

Ethereum’s dominance successful tokenized assets isn’t conscionable astir being archetypal — it’s astir being built for permanence. As the infrastructure underpinning real-world plus tokenization matures, Ethereum’s relation arsenic the fiscal furniture of the net becomes much pronounced. While newer chains similar Solana volition carve retired niches successful the space, Ethereum continues to beryllium the level wherever regularisation meets innovation, and wherever concern finds its adjacent form.

- Tedd Strazimiri, merchandise probe associate, Evolve ETFs

Ask an Expert

Q. What are the worth drivers of tokenization for a wealthiness manager?

A. The tokenization of assets should travel with newfound utility. Financial advisors, wealthiness managers and different fiduciaries already person entree to a wide beingness of concern products. Where tokenization adds worth is done the infrastructure emerging astir tokenized real-world assets, peculiarly applications enabling the collateralization and margining of asset-backed tokens.

Blockchain-based information absorption systems, similar Inveniam, are designed to alteration real-time, asset-level reporting to facilitate backstage asset-backed stablecoin loans, with the aforesaid integrity and traceability that exists elsewhere successful the crypto space. This allows bequest backstage plus classes — similar existent property and recognition — to relation likewise to however $30 cardinal successful crypto loans are presently collateralized connected platforms similar Aave. This caller inferior is simply a important value-add and a differentiating work origin that advisors tin connection clients beyond accepted crypto allocations.

Q. How does tokenization assistance advisors execute their portfolio absorption goals?

A. Alongside benefits similar collateralization, advisors besides summation greater power implicit lawsuit portfolio allocations done second-order tokenization benefits. Many concern funds crossed backstage equity, hedge funds, backstage recognition and commercialized existent property person precocious minimum concern requirements and illiquid secondary trading activity. This “set it and hide it” mentality leads to inefficient portfolio management, successful which advisors either overallocate oregon underallocate owed to the “lumpiness” of the underlying asset.

By contrast, tokenized funds tin beryllium fractionalized acold much efficiently than existing offerings, meaning advisors tin bargain successful astatine overmuch little minimums, specified arsenic $10,000 increments, versus millions of dollars astatine a time. Then arsenic lawsuit preferences, positions and portfolios shift, advisors tin reallocate accordingly, making usage of secondary liquidity venues and ongoing low-minimum subscriptions. This improves an advisor’s quality to conscionable lawsuit demands and execute instrumentality targets without being inhibited by outdated practices.

- Peter Gaffney, manager of DeFi & integer trading, Inveniam

Keep Reading

- SEC Commissioner Hester Peirce stated that “tokenization is simply a exertion that could importantly interaction fiscal markets.

- New Hampshire makes past and becomes the archetypal U.S. authorities to bring into instrumentality authorities concern successful bitcoin and integer assets.

- Morgan Stanley is processing plans to connection direct crypto trading connected its E*Trade level by 2026.

6 months ago

6 months ago

English (US)

English (US)