In today's Crypto for Advisors newsletter, Alex Tapscott, explains the flywheel effect, and it’s interaction connected the crypto markets.

Then, Natalie Hirsch from Polymath answers questions astir questions astir investing successful nationalist crypto companies successful Ask an Expert.

Thank you to our sponsor of this week's newsletter, Grayscale. For fiscal advisors: register for the upcoming Minneapolis lawsuit connected September 18th.

The Crypto Flywheel Keeps Spinning!

These days it’s go fashionable to picture however crypto is driving a "flywheel effect" successful the market, and that is simply a crushed to beryllium bullish. But what is the flywheel effect, exactly?

The word was popularized by Jim Collins successful his 2001 publication "From Good to Great." Collins asked america to ideate idiosyncratic pushing a elephantine wheel. With the archetypal push, the instrumentality budges lone slightly, but aft hundreds of pushes, it begins to summation momentum — each caller propulsion becomes easier and accelerates the instrumentality further.

Nobody tin accidental for definite which propulsion helped it to execute that momentum, due to the fact that it is the merchandise of each the tiny pushes together. The acquisition for concern leaders is this: Do the tiny worldly close consistently and you’ll beryllium rewarded successful the agelong run.

Today, the word has evolved into thing else. Rather than describing lone the interaction of dependable operational decision-making, flywheel effects present picture however affirmative feedback loops interaction systems, similar marketplaces and full industries.

Here are immoderate of the ways that dynamic is astatine play successful crypto and nationalist markets:

Because of the request from investors for entree to crypto assets, integer plus treasury companies (aka DATs) similar MicroStrategy tin contented shares astatine a premium to their underlying nett plus value, bargain bitcoin and different assets, and turn NAV per share. This tin thrust the underlying plus higher and induce much radical to bargain shares of their company.

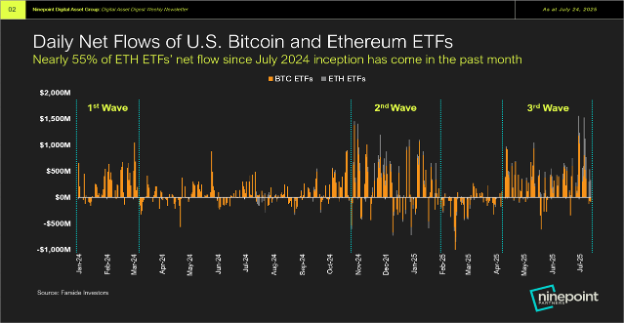

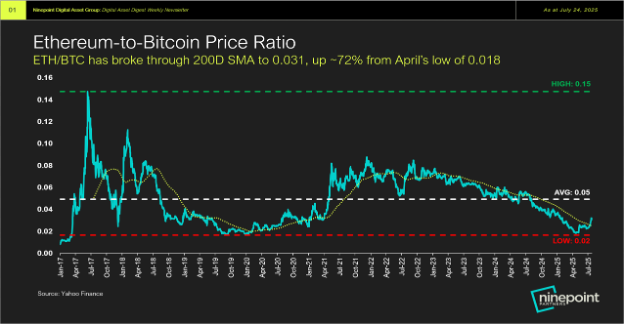

Flywheel effects are besides seen successful ETF markets. The motorboat of ether-focused integer plus treasury companies helped accelerate flows into ETFs too. Ether ETFs person seen inflows of much than $6 cardinal since launching. ETH gained arsenic overmuch arsenic 50 percent successful July and closed the period astatine astir $3,800, and the Ether-to-bitcoin terms ratio broke supra its 200-day moving average.

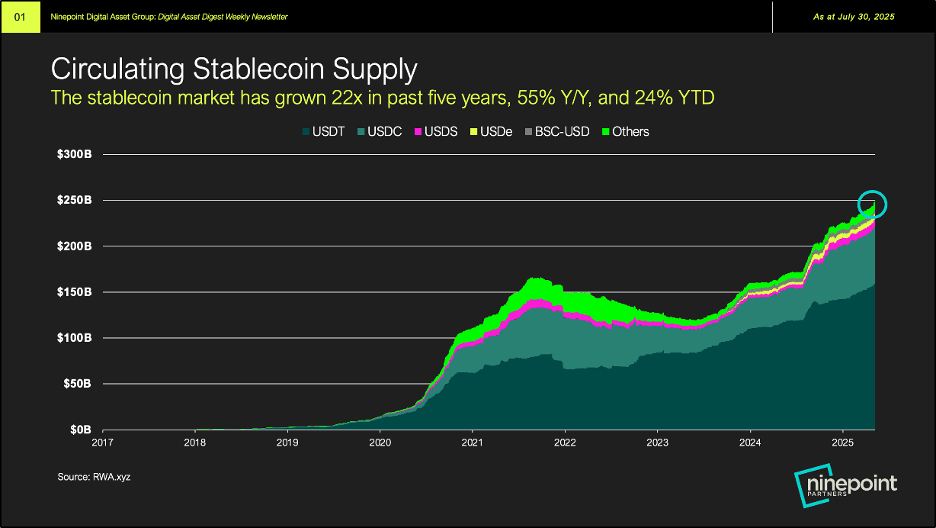

Stablecoin issuers nutrient flywheel effects too. For example, Tether, issuer of the USDT coin, reinvests its tremendous profits ($4.9 cardinal past quarter) successful bitcoin, pushing the terms higher, expanding aggregate involvement successful bitcoin and creating request for stablecoins similar USDT to bargain them.

Another flywheel effect tin beryllium seen successful the IPO market. Circle’s (CRCL) palmy IPO was followed with respective companies filing to spell public, specified arsenic Grayscale, BitGo, Bullish and Gemini. A question of palmy IPOs grows the full investable beingness of companies, broadening its entreaty and accelerating its inclusion successful accepted portfolios and indexes.

A flywheel is, by its nature, thing that creates a affirmative feedback loop. What happens erstwhile things reverse?

Let’s commencement with those integer plus treasury companies. Some person taken connected leverage. If their shares autumn oregon the underlying plus declines, they volition request to merchantability assets to conscionable these liabilities. That volition enactment downward unit connected their banal and the underlying asset, similar bitcoin.

Right now, IPOs are acting arsenic a tailwind, but if the rhythm lasts agelong enough, each sorts of businesses volition effort to pat the markets. If they neglect to conscionable expectations, investors whitethorn constitute disconnected the full assemblage for a time, arsenic they did during the dot-com crash. That volition person a chilling effect connected everything.

Currently, ETH treasury companies are buying ETH, driving the terms higher. However, arsenic the terms rises, ETH holders are queuing up to merchantability their staked ETH. The higher the terms goes, the much that whitethorn travel free-trading. That’s putting the brake connected the flywheel.

In the end, the bully times can’t past forever. Markets are cyclical, and this 1 volition travel to an end. But close now, the (fly)wheels are successful motion, and everyone from regulators to nationalist companies to crypto founders and organization investors are nudging that wheel. It volition instrumentality a batch to halt their momentum.

- Alex Tapscott, managing director, Ninepoint Capital Digital Asset Group

Ask an Expert

Q. Is it a bully clip to put successful crypto IPOs?

A. The abbreviated reply is yes. While the occurrence of Circle, which exceeded expectations with precedent-setting gains, stood out, wide marketplace sentiment remains highly favourable.

The motorboat of spot BTC and ETH ETFs successful the US has brought a important superior influx. Regulatory clarity successful large markets similar the U.S. and Europe has boosted capitalist assurance successful plus issuers who present travel established listing procedures and run with legitimised governance frameworks.

Add to this the ongoing bull run, and investors are seeing a robust accidental for semipermanent worth creation.

Q. What benignant of crypto IPOs should investors absorption on?

A. More than token prices, investors should absorption connected the project’s fundamentals and halfway propositions. Projects with robust, foolproof, intelligibly drafted concern models, realistic plans, and defined gross streams volition execute better. These whitethorn see stablecoins, custody services, and staking platforms astatine the superior level.

On a secondary level, fintech, infrastructure, and analytics-related projects are besides expected to output well. The laminitis and enactment squad play a important role, which implies amended money absorption and ongoing innovation.

With adoption surging, advisory services tin assistance investors place the best-positioned projects successful a increasing field.

Q. What are the prospects of crypto IPOs?

A. The crypto marketplace has matured, and organization adoption is rising. In the adjacent future, crypto-asset issuers are expected to go much structured and businesslike successful accessing accepted superior markets. If the affirmative inclination continues, capitalist assurance successful high-risk-high-return opportunities volition besides grow.

Issuers are present much assured successful going public. However, investors should attack with prudence. Crypto IPOs are champion treated arsenic high-risk components wrong a well-diversified portfolio.

Retail investors indispensable enactment alert to macro events that whitethorn impact marketplace sentiment. Asset and money managers should comparison the show of crypto stocks with accepted tech stocks portion monitoring liquidity and volatility.

- Natalie Hirsch, CFO, Polymath

Keep Reading

- A July recap of the crypto markets by CoinDesk, successful concern with NYSE and TrackInsight.

- CoinDesk breaks down July crypto ETF and ETP flows.

- The SEC permits in-kind instauration and redemptions for crypto ETFs.

- President Trump prepares to motion an bid that blocks banks from denying banking services to companies progressive successful bitcoin and crypto.

- JP Morgan has partnered with Coinbase to fto users money wallets and acquisition crypto straight this fall.

3 months ago

3 months ago

English (US)

English (US)