Happy Uptoper! In today’s "Crypto for Advisors" newsletter, Gregory Mall, main concern serviceman astatine Lionsoul Global, explains the improvement of bitcoin-backed lending successful some decentralized and centralized fiscal systems.

Then, Lynn Nguyen, CEO of Saros, answers questions astir tokenized stocks successful "Ask an Expert."

Thank you to our sponsor of this week's newsletter, Grayscale. For fiscal advisors adjacent San Francisco, Grayscale is hosting an exclusive event, Crypto Connect, connected Thursday, October 9. Learn more.

Crypto arsenic Collateral: What Wealth Managers Should Know About the Resurgence of the Institutional Loan Market

Lending and borrowing person agelong been cardinal to fiscal markets — and crypto is nary exception. In fact, collateralized lending emerged successful the integer plus abstraction good earlier Decentralized Finance (DeFi) protocols gained prominence. The signifier itself has heavy humanities roots: Lombard lending — utilizing fiscal instruments arsenic collateral for loans — dates backmost to medieval Europe, erstwhile Lombard merchants became renowned crossed the continent for extending recognition secured by movable goods, precious metals, and yet securities. By comparison, it has taken lone a abbreviated clip for this centuries-old exemplary to conquer integer plus markets.

One crushed lending against crypto collateral is truthful compelling is the unsocial liquidity illustration of the plus class: apical coins tin beryllium sold 24/7/365 successful heavy markets. The speculative quality of crypto besides drives request for leverage, portion successful immoderate jurisdictions Lombard-style loans connection taxation advantages by enabling liquidity procreation without triggering taxable disposals. Another important usage lawsuit is the behaviour of bitcoin maximalists, who are often profoundly attached to their BTC holdings and reluctant to trim their wide stack. These semipermanent holders typically similar borrowing astatine debased loan-to-value ratios, with the anticipation that bitcoin’s terms volition admit implicit time.

The History of the Collateralized Lending Market

The archetypal informal bitcoin lenders appeared arsenic aboriginal arsenic 2013. But it was during the ICO roar of 2016-2017 that institutional-style players specified arsenic Genesis and BlockFi emerged. Despite the crypto wintertime of 2018, the centralized concern (CeFi) marketplace expanded, with retail-focused firms similar Celsius and Nexo joining the fray.

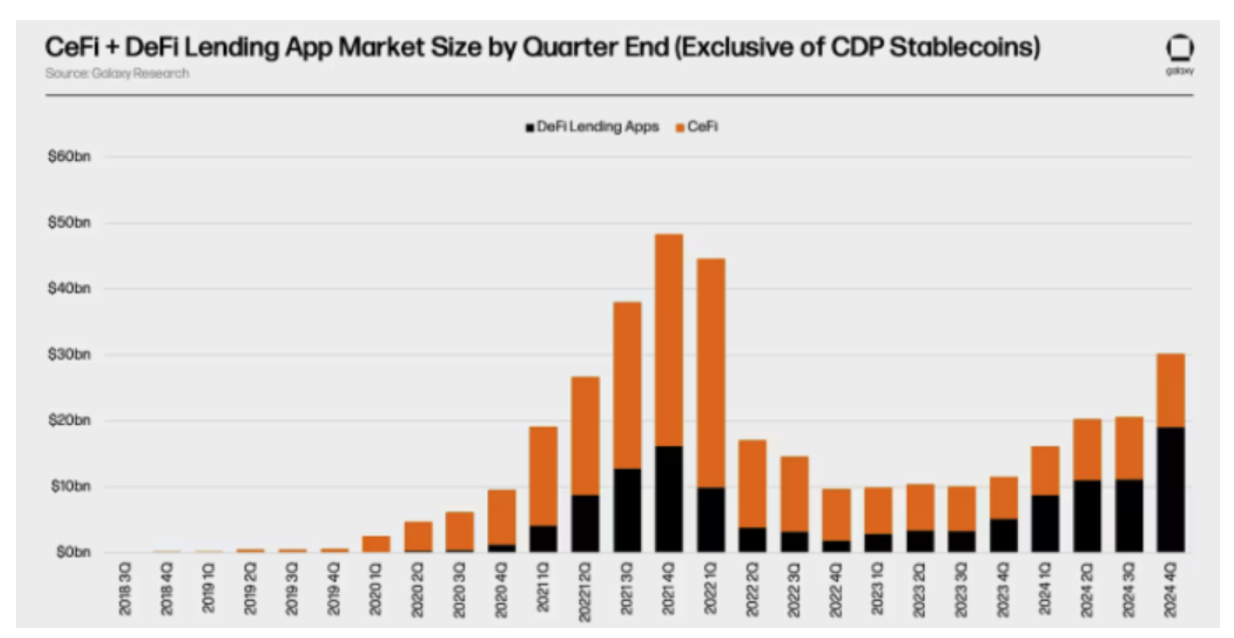

The emergence of DeFi successful 2020-2021 further supercharged lending. Both CeFi and DeFi platforms proliferated, competing aggressively for depositors. But arsenic contention intensified, equilibrium expanse prime deteriorated. Several large CeFi players operated with important asset–liability mismatches, leaned heavy connected their ain governance tokens to bolster equilibrium sheets, and relaxed underwriting standards, particularly with respect to haircuts and LTVs (loan-to-value ratios).

The fragility became wide successful the 2nd 4th of 2022, erstwhile the collapses of the stablecoin TerraUSD (UST) and the hedge money Three Arrows Capital (3AC) triggered wide losses. Prominent CeFi lenders — including Celsius, Voyager, Hodlnaut, Babel, and BlockFi — were incapable to conscionable withdrawal demands and entered bankruptcy. Billions of dollars successful lawsuit assets were erased successful the process. Regulatory and court-led post-mortems pointed to acquainted failings: bladed collateral, mediocre hazard management, and opacity astir inter-firm exposures. A 2023 examiner’s study connected Celsius described a concern that marketed itself arsenic harmless and transparent portion successful world issuing ample unsecured and under-collateralized loans, masking losses, and operating successful what the examiner likened to a "Ponzi-like" fashion.

Since then, the marketplace has undergone a reset. The surviving CeFi lenders person mostly focused connected strengthening hazard management, enforcing stricter collateral requirements, and tightening policies astir rehypothecation and inter-firm exposures. Even so, the assemblage remains a fraction of its erstwhile size, with indebtedness volumes astatine astir 40% of their 2021 peak. DeFi recognition markets, by contrast, person staged a stronger comeback: on-chain transparency astir rehypothecation, loan-to-value ratios, and recognition presumption has helped reconstruct assurance much swiftly, pushing full worth locked (TVL) backmost toward its 2021 grounds levels.(DefiLlama).

Source: Galaxy Research

Does CeFi person a relation adjacent to DeFi?

Crypto has ever been driven by an ethos of on-chain transparency and decentralization. Yet CeFi is improbable to disappear. Following the crisis, the abstraction is much concentrated, with a fistful of firms, specified arsenic Galaxy, FalconX, and Ledn, accounting for the bulk of outstanding loans. Importantly, galore organization borrowers proceed to similar dealing with licensed, established fiscal counterparties. For these players, concerns astir anti-money laundering (AML), Know Your Customer (KYC), and Office of Foreign Assets Control (OFAC) vulnerability arsenic good arsenic regulatory risks, marque nonstop borrowing from definite DeFi pools impractical oregon impermissible.

For these reasons, CeFi lending is expected to turn successful the coming years — albeit astatine a slower gait than DeFi. The 2 markets are apt to germinate successful parallel: DeFi providing transparency and composability, CeFi offering regulatory clarity and organization comfort.

- Gregory Mall, main concern officer, Lionsoul Global

Ask an Expert

Q. How volition Nasdaq's integration of tokenized securities into the existing nationalist marketplace strategy and related capitalist protections payment investors?

This measurement instantly brings 3 thoughts to caput — distribution, efficiency, and transparency. It's a game-changer for mundane investors who aren't engaging overmuch successful accepted finance. Blockchains are becoming much scalable each year, and I emotion the thought of efficient, composable Decentralized Finance (DeFi) usage cases for tokenized securities. Plugging these assets into our manufacture means we'll besides spot acold much transparency compared to bequest systems.

Stats backmost this up — the planetary tokenized plus marketplace is hitting astir $30 cardinal this year, up from conscionable $6 cardinal successful 2022. This means broader organisation — ideate a tiny capitalist successful agrarian America earning 5 to 7% yields connected tokenized stocks without needing a broker's blessing. Moving from accepted concern to DeFi, I've seen myself however blockchains tin optimize portion besides being much transparent and inclusive. This isn't conscionable hype — it's astir helping much radical physique wealthiness done smarter, digitized tools that level the playing field.

Q. What are the challenges investors mightiness look if the Securities and Exchange Commission (SEC) approves Nasdaq's connection to commercialized tokenized securities?

It's not going to each beryllium plain sailing. Firstly, determination volition beryllium method hurdles that request to beryllium overcome, and these volition impact timeframes arsenic good arsenic idiosyncratic acquisition for investors. Mixing blockchain infrastructure with bequest systems is not straightforward, and this volition apt impact aboriginal adopters, arsenic good arsenic the archetypal prevalence of liquidity.

Early investors volition besides request clearer guidance connected regulation. There's a request for crystal-clear guidance connected token rights, arsenic investors whitethorn look issues related to events specified arsenic dividends oregon voting. When introducing caller technologies, it is besides indispensable to instrumentality information precise seriously. Cyberattacks person spiked 25% year-over-year, and we've each seen the high-profile cases related to blockchains. Though you would presume this would beryllium a precedence for Nasdaq.

All of these issues are solvable arsenic acold arsenic I'm concerned. So I'm not excessively worried.

Q. Nasdaq has mentioned Europe's trading of tokenized stocks is "raising concerns" due to the fact that investors tin entree tokenized U.S. equities without existent shares successful companies. How volition Nasdaq's connection to connection "the aforesaid worldly rights and privileges arsenic bash accepted securities of an equivalent class" payment investors?

Here, we're talking astir benefits that see entree to the aforesaid rights arsenic accepted securities — voting, dividends, and equity stakes. In Europe, investors person been capable to get securities without afloat rights, which I presumption arsenic akin to holding an exclusive non-fungible token (NFT) without gaining the rank benefits it grants. Imagine owning a Cryptopunk but not having entree to the PunkDAO and the task opportunities disposable to holders.

Nasdaq is fundamentally trying to forestall investors from getting shortchanged. This is simply a large payment due to the fact that you are not conscionable getting entree to a much dynamic but constricted mentation of the plus — you're inactive getting each of the perks. When I deliberation of the imaginable here, it's breathtaking — ideate afloat fledged stocks with 24/7 trading, little fees, and importantly shorter colony times.

Keep Reading

- BlackRock’s spot ETF IBIT present allows for successful in-kind instauration and redemptions of bitcoin.

- Canadian Royal Mounted Police person dismantled a crypto trading platform on with a seizure of implicit $56 cardinal for operating illegally.

- The Bank of England Governer has stated the stablecoins could signifier a major displacement in the banking system.

1 month ago

1 month ago

English (US)

English (US)