In today’s "Crypto for Advisors" newsletter, Joshua De Vos, probe squad pb astatine CoinDesk, breaks down crypto trends and adoption from the CoinDesk Quarterly Digital Asset Report.

Then, Kim Klemballa answers what advisors request to cognize astir crypto "Ask an Expert."

Thank you to our sponsor of this week's newsletter, Grayscale. For fiscal advisors adjacent Denver, Grayscale is hosting an exclusive event, Crypto Connect, connected Thursday, October 23. Learn more.

Digital Asset Quarterly Review Q3

Digital assets extended their betterment successful Q3 arsenic liquidity returned to planetary markets. As stated successful CoinDesk’s Digital Assets Quarterly Report, the Federal Reserve’s determination to chopped rates to 4.0 percent to 4.25 percent created the astir favorable backdrop for hazard assets since 2022. Bitcoin ended the 4th up 6.4%. The S&P 500 and golden posted stronger gains, but the drivers of crypto were different. The request chiefly came from institutions, alternatively than traders.

ETFs Take the Lead

ETF flows continued to specify the existent marketplace structure. U.S. spot bitcoin and ether products recorded $8.78 cardinal and $9.59 cardinal successful nett inflows. It was the archetypal clip that ether ETFs outpaced bitcoin, reflecting broader organization diversification. Public companies added 190,000 BTC to their treasuries during the quarter, expanding full holdings to 1.13 cardinal BTC, which is much than 5% of the circulating supply.

Corporate adoption remains the quiescent unit successful this cycle. The “digital plus treasury” model, which originated with bitcoin, is present spreading crossed sectors and regions. Forty-three caller nationalist firms disclosed holdings successful Q3. For many, integer assets are nary longer an experiment, but alternatively a small, recurring allocation connected the equilibrium sheet.

Broader Market Rotations

Bitcoin’s dominance fell from 65% to 59%, marking the archetypal sustained rotation into altcoins since aboriginal 2021. The CoinDesk 20 Index returned 30.8%, outperforming bitcoin by a wide margin. The CoinDesk 100 Index gained 27.8%, portion narrower benchmarks specified arsenic the CoinDesk 5 Index roseate 15.4%.

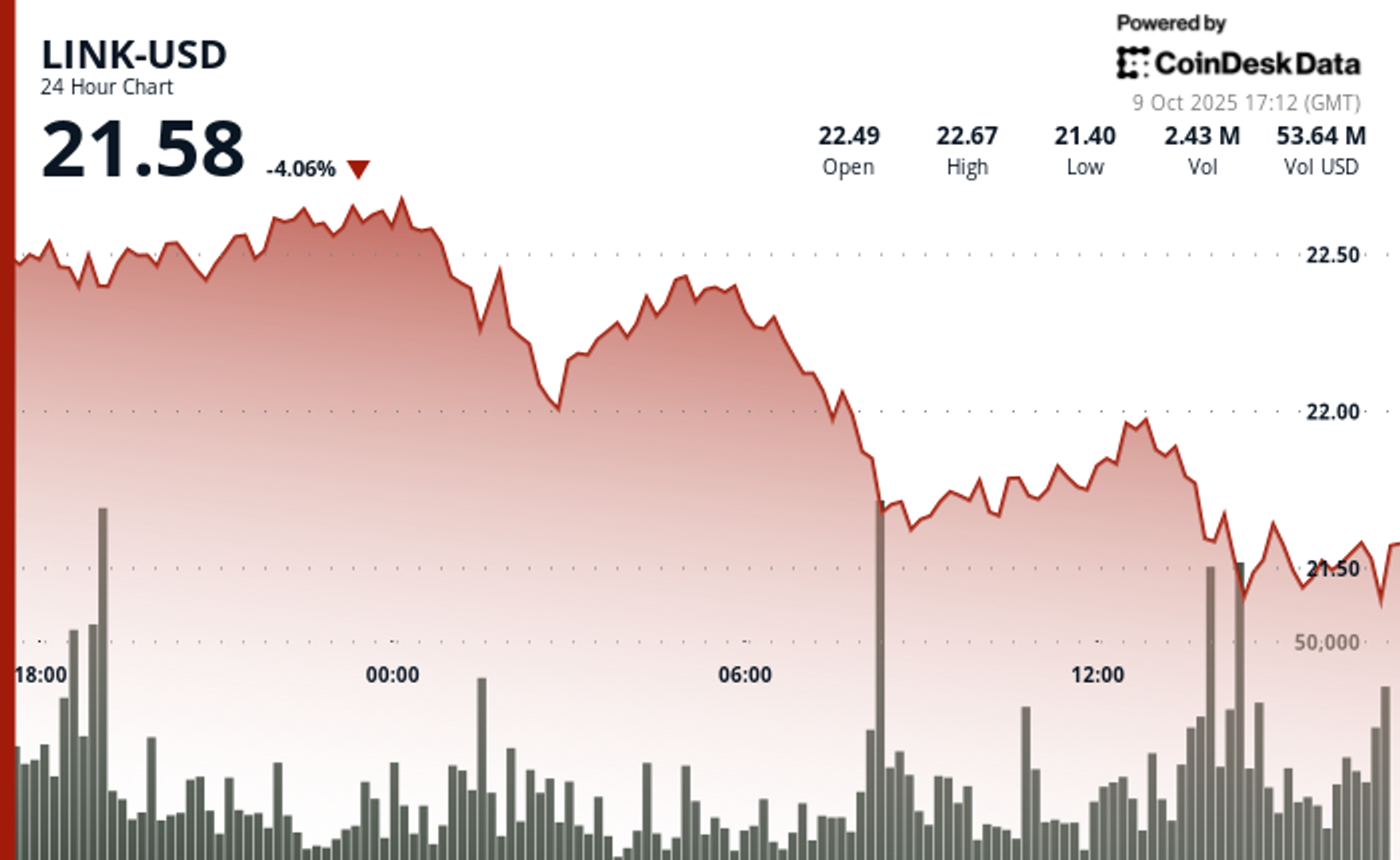

The rally was wide but selective. Ether (ETH), Avalanche (AVAX), and Chainlink (LINK) led the CoinDesk 20 with gains of 66.7%, 66.9%, and 59.2%, respectively. Flows into ether ETFs and treasury portfolios helped propulsion the plus to a caller all-time precocious adjacent $4,955 successful August. Solana roseate 34.8%, supported by firm accumulation and grounds app-level revenue.

Treasuries Go Multi-asset

Public companies are present reporting vulnerability to much than 20 integer assets. Ether leads with $17.7 cardinal successful worth held connected equilibrium sheets. Solana follows with $3.1 billion. Tron, World Liberty Financial, and Ethena each transcend $1 billion.

This enactment marks the adjacent signifier of organization adoption: diversification wrong the cryptocurrency assemblage itself. Treasury allocations that began with bitcoin are being extended to different assets. For immoderate corporations, the assets relation arsenic reserves; for others, they service arsenic strategical positions tied to ecosystem partnerships oregon merchandise launches.

The maturation of these vehicles has besides revealed a marketplace hierarchy. A fistful of firms present predominate trading enactment wrong the “digital plus treasury” segment, portion smaller entrants look unit arsenic marketplace NAVs drift beneath parity.

Benchmarks and Structure

The usage of benchmarks has go cardinal to this marketplace shift. CoinDesk 20 and CoinDesk 5 present service arsenic notation points for ETFs, structured notes, and derivatives. Their methodology, based connected liquidity, speech coverage, and accessibility, aligns with the standards that organization investors expect from accepted indices.

The SEC’s support of generic listing standards for crypto ETPs is apt to accelerate this trend. Multi-asset and staking-based ETFs are expected to follow, providing allocators with caller tools to negociate vulnerability crossed a broader scope of integer assets.

The Path Ahead

Historically, Q4 has been bitcoin’s strongest quarter, averaging 79% since 2013. With monetary argumentation easing and balance-sheet adoption continuing, conditions favour risk-on behavior. Yet the creation of that hazard is continuously changing.

Crypto is nary longer a single-asset decision. It’s evolving into a structured, multi-asset allocation abstraction supported by firm information and regulated merchandise access. For advisors, the marketplace is opening to bespeak sustained organization superior flows, a motion of an plus people moving steadfastly toward maturity.

- Joshua De Vos, probe lead, CoinDesk

Ask an Expert

What are the apical 3 things advisors should cognize erstwhile it comes to crypto?

- Digital assets are growing, not going away. Major banks similar Goldman Sachs are penning articles connected why integer plus adoption is accelerating. In a revised forecast, Citi projects that the stablecoin marketplace could scope implicit $4 trillion by 2030. And connected Sept. 17, 2025, the SEC introduced generic listing standards for crypto ETFs, opening the gates to a wide scope of products. Ahead of these expected merchandise launches, US-listed crypto ETFs and ETPs drew $4.73 cardinal successful nett inflows successful September, with ADV topping $542 billion, AUM reaching $194 billion, according to TrackInsight. Education and knowing integer assets is pivotal arsenic this plus people grows.

- Say it with me, “Bitcoin is lone the beginning.” Bitcoin present accounts for astir 59% of full marketplace capitalization and determination were times bitcoin was less than 40% of the market. One plus should not beryllium a benchmark for the full plus class. Diversification is cardinal to perchance negociate volatility and seizure broader opportunities.

- Broad-based benchmarks beryllium successful crypto. The CoinDesk 20 Index captures the show of apical integer assets and the CoinDesk 5 Index tracks the show of the 5 largest constituents of the CoinDesk 20. CoinDesk 20 is highly liquid, generating implicit $15 cardinal successful full trading measurement since January 2024 and is disposable successful 20 concern vehicles globally. CoinDesk 5 underlies the archetypal US multi-crypto ETP, the Grayscale CoinDesk Crypto 5 ETF (GDLC). CoinDesk Indices offers hundreds of BMR-compliant indices to measure, put and commercialized successful the ever-expanding crypto universe.

- Kim Klemballa, caput of marketing, CoinDesk Indices & Data

Keep Reading

- Morgan Stanley's Global Investment Committee (GIC) recommends an allocation of up to 4% of portfolios to cryptocurrency.

- Bitcoin reached a caller all-time precocious of $125,835.92 aft climbing supra $125,000 for the archetypal clip connected Sunday.

- Meanwhile, the archetypal regulated bitcoin beingness insurer has raised $82 cardinal for expansion.

5 hours ago

5 hours ago

English (US)

English (US)