By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace is simply a oversea of greenish arsenic traders look past the stagflation specter raised by the Fed connected Wednesday and cheer President Donald Trump's hint of a large trade-deal announcement with a large trading partner.

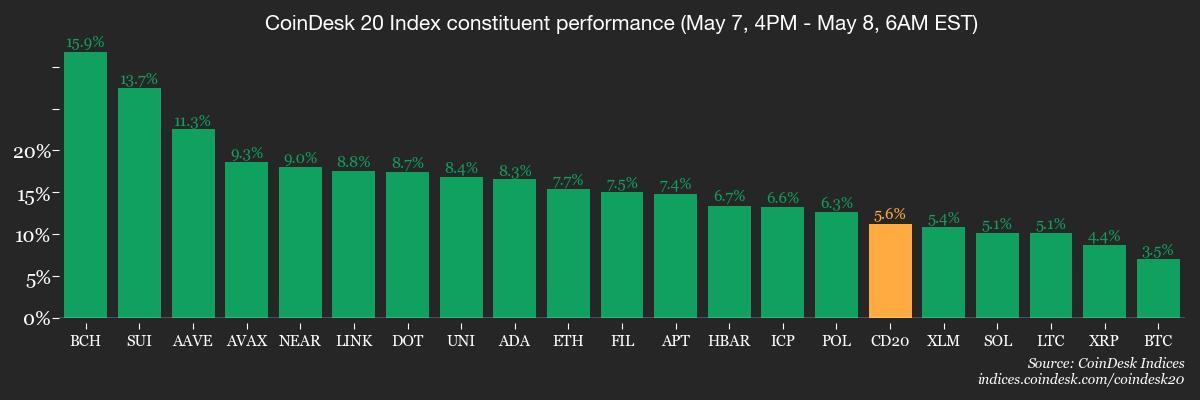

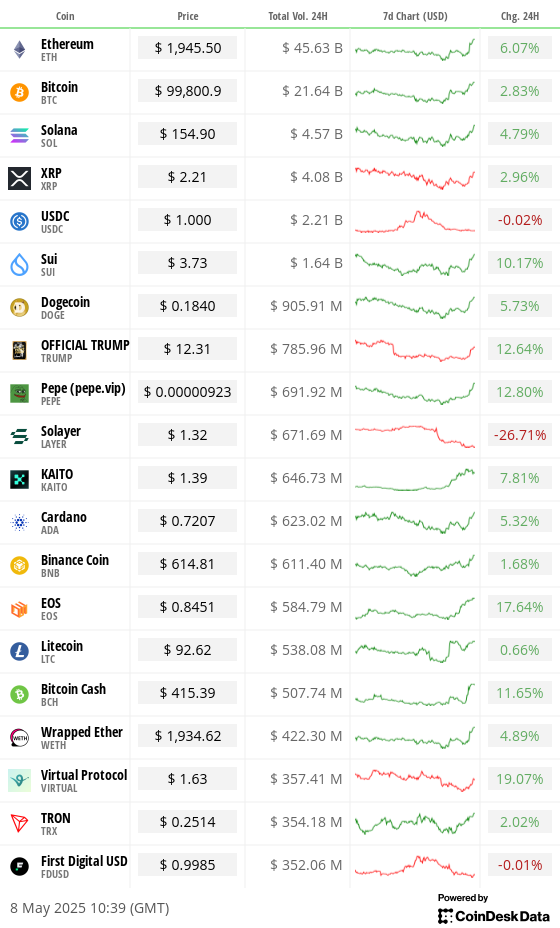

Bitcoin jumped 2.6%, nearing $100,000, adjacent with the WSJ reporting that the announcement could beryllium much of a model for talks than existent confirmation of an agreement. The wider marketplace enactment successful bigger gains, with XRP, ETH, ADA, DOGE and respective different coins rising 4% to 6%. Tokens associated with memecoin projects, furniture 1s and DeFi are starring the marketplace higher.

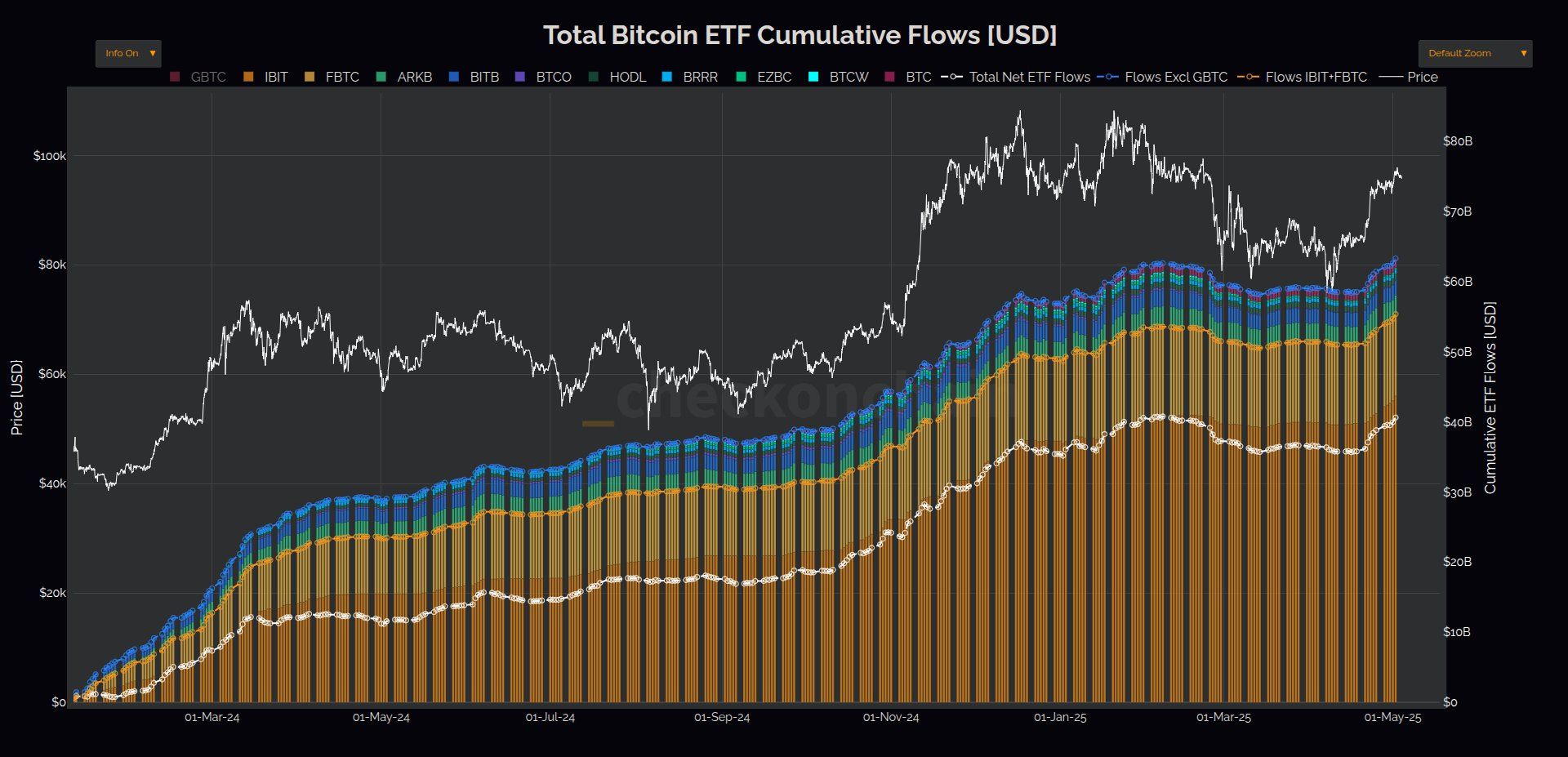

In cardinal news, cumulative inflows into the U.S.-listed spot bitcoin exchange-traded funds (ETFs) person hit an all-time high of $40.62 billion, signaling continued organization adoption. (Check Chart of the Day.)

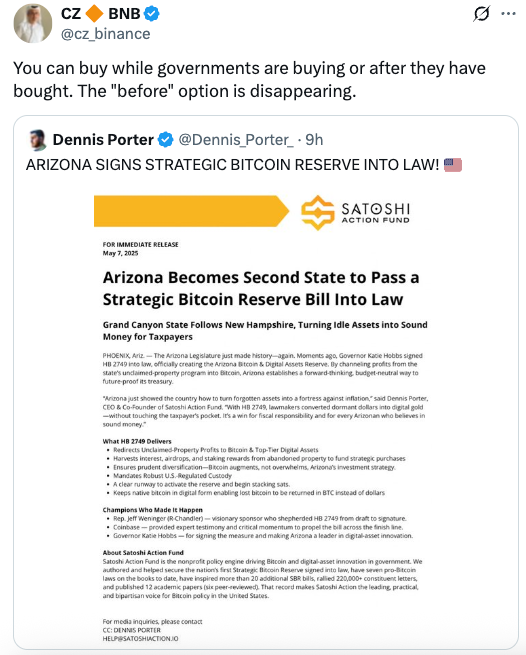

On Thursday, Arizona became the 2nd U.S. authorities to walk a bitcoin reserve bill. The regularisation allows the authorities to instrumentality ownership of abandoned coins successful the lawsuit that the proprietor ignores messages sent wrong 3 years. It besides lets the authorities marque BTC investments.

An ether whale ICO subordinate sold 5,200 ETH astatine $9.54 million, extending a bid of caller liquidations. The whale inactive holds 8,300 ETH ($15.28 million).

Decentralized layer-1 blockchain Avalanche's C-Chain registered the highest magnitude of transactions successful 2 years, with the median state outgo of conscionable $0.00078. The AVAX token traded 7% higher astatine $21 astatine property time.

Stripe unveiled a caller diagnostic called Stablecoin Financial Accounts, powered by Bridge, unlocking entree to dollar-denominated services successful implicit 100 countries.

On the macro front, the archetypal 4th U.S. portion labour outgo information volition beryllium watched by traders for signs of sticky wage terms ostentation that could perchance hold the Fed complaint cuts. Stay alert!

What to Watch

- Crypto:

- May 8: Judge John G. Koeltl volition condemnation Alex Mashinsky, the laminitis and erstwhile CEO of the now-defunct crypto lending steadfast Celsius Network, astatine the U.S. District Court for the Southern District of New York.

- May 12, 1 p.m. to 5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable connected "Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet" volition beryllium held astatine the SEC's office successful Washington.

- Macro

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Bank Rate Est. 4.25% vs. Prev. 4.5%

- May 8, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended May 3.

- Initial Jobless Claims Est. 230K vs. Prev. 241K

- May 8, 10 a.m.: President Donald Trump volition reportedly unveil the model of a commercialized woody with the U.K. astatine a White House property conference.

- May 9-12: Chinese Vice Premier He Lifeng will clasp commercialized talks with U.S. Treasury Secretary Scott Bessent during his sojourn to Switzerland.

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected whether to enactment the last $10.7 million from its 35 million ARB diversification plan into 3 low‑risk, dollar‑based funds from WisdomTree, Spiko and Franklin Templeton. Voting ends connected May 8.

- Compound DAO is voting connected which caller collateral benignant to prioritize connected Compound V3. Voting ends May 8.

- May 8, 10 a.m.: Balancer and Euler to big an Ask Me Anything (AMA) session.

- May 15, 10 a.m.: Moca Network to big a Discord townhall league discussing web updates.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating proviso worthy $8.08 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating proviso worthy $35.66 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating proviso worthy $57.45 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating proviso worthy $1.14 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $17.7 million.

- Token Launches

- May 8: AIXBT to beryllium listed connected Binance.US.

- May 8: Space and Time (SXT) to beryllium listed connected Binance, MEXC, BingX, KuCoin, Bitget and others.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to beryllium delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 3 of 3: Stripe Sessions (San Francisco)

- Day 2 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 9-10: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest successful DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- $3, conscionable $3.

- That's each Movement web earned successful fees implicit the past 24 hours, DeFiLlama information shows, the lowest successful a week for the embattled concatenation erstwhile valued astatine $1 billion.

- Daily DEX volumes person cratered beneath $500K, a melodramatic autumn from earlier exuberance that saw the web process much than $2 cardinal a day.

- The descent comes days aft CoinDesk reported irregularities with however the MOVE token was distributed and supplied to trading firms.

- Ironically, the MOVE token launched earlier the concatenation existed, raising millions via backstage income portion the existent blockchain infrastructure lagged acold behind.

- The task handed retired 66 cardinal MOVE tokens (5% of supply) to a market-making steadfast called Rentech, which dumped astir each of it for $38 million.

- Founder Rushi Manche was terminated connected May 7, conscionable days aft being suspended. He admitted to “zero oversight” and blamed bad-faith advisers for the project’s illness successful X posts pursuing the CoinDesk report.

- MOVE has fallen implicit 85% from its highest of $1.45 successful December 2024 to conscionable 15 cents.

- With nary trust, nary traction and, now, astir nary fees, Movement has turned into the cautionary communicative of 2025 — a billion-dollar insubstantial committedness with a $3 reality.

Derivatives Positioning

- BTC and ETH perpetual backing rates roseate adjacent to an annualized 10%, signaling a strengthening bullish temper successful the market.

- BTC, ETH futures premium connected the CME inactive stay nether 10%.

- On Deribit, bitcoin and ether options hazard reversals amusement a bullish bias for calls crossed aggregate clip frames.

- Notable artifact trades see a abbreviated presumption successful the $85K BTC enactment expiring successful June and a calendar dispersed involving calls astatine strikes $140K and $170K, expiring connected Sept. 26 and Dec. 26, respectively.

Market Movements:

- BTC is up 3.49% from 4 p.m. ET Wednesday astatine $99,620.26 (24hrs: +2.77%)

- ETH is up 7.76% astatine $1,939.15 (24hrs: +5.11%)

- CoinDesk 20 is up 5.75% astatine 2,854.54 (24hrs: +3.81%)

- Ether CESR Composite Staking Rate is down 6 bps astatine 2.894%

- BTC backing complaint is astatine 0.0048% (5.2242% annualized) connected Binance

- DXY is up 0.48% astatine 100.09

- Gold is down 1.25% astatine $3,343.61/oz

- Silver is down 0.25% astatine $32.40/oz

- Nikkei 225 closed +0.41% astatine 36,928.63

- Hang Seng closed +0.37% astatine 22,775.92

- FTSE is up 0.39% astatine 8,592.98

- Euro Stoxx 50 is up 1.21% astatine 5,293.07

- DJIA closed connected Wednesday +0.7% astatine 41,113.97

- S&P 500 closed +0.43% astatine 5,631.28

- Nasdaq closed +0.27% astatine 17,738.16

- S&P/TSX Composite Index closed +0.75% astatine 25,161.18

- S&P 40 Latin America closed -0.2% astatine 2,512.07

- U.S. 10-year Treasury complaint is up 5 bps astatine 4.315%

- E-mini S&P 500 futures are up 1.03% astatine 5,170.00

- E-mini Nasdaq-100 futures are up 1.4% astatine 20,240.00

- E-mini Dow Jones Industrial Average Index futures are up 0.82% astatine 41,552.00

Bitcoin Stats:

- BTC Dominance: 65.08 (-0.44%)

- Ethereum to bitcoin ratio: 0.01942 (4.02%)

- Hashrate (seven-day moving average): 909 EH/s

- Hashprice (spot): $53.34

- Total Fees: 6.64 BTC / $661,908.40

- CME Futures Open Interest: 142,255 BTC

- BTC priced successful gold: 29.5 oz

- BTC vs golden marketplace cap: 8.37%

Technical Analysis

- The XRP-ETH ratio has dived retired of the year-to-date ascending trendline.

- The breakdown suggests ether outperformance comparative to XRP successful the days ahead.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $392.48 (+1.78%), up 5.35% astatine $413.49 successful pre-market

- Coinbase Global (COIN): closed astatine $196.56 (-0.17%), up 4.77% astatine $205.94

- Galaxy Digital Holdings (GLXY): closed astatine C$26.49 (+2.28%)

- MARA Holdings (MARA): closed astatine $13.33 (+1.37%), up 5.55% astatine $14.07

- Riot Platforms (RIOT): closed astatine $7.84 (-0.25%), up 5.1% astatine $8.24

- Core Scientific (CORZ): closed astatine $8.90 (-1%), up 5.28% astatine $9.37

- CleanSpark (CLSK): closed astatine $8.03 (-0.74%), up 5.23% astatine $8.45

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.59 (+0.34%), up 5.89% astatine $15.45

- Semler Scientific (SMLR): closed astatine $33.05 (-0.12%), up 4.99% astatine $34.70

- Exodus Movement (EXOD): closed astatine $40.01 (+1.34%), up 0.25% astatine $40.11

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $142.3 million

- Cumulative nett flows: $40.68 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily nett flow: -$21.8 million

- Cumulative nett flows: $2.48 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The illustration shared by pseudonymous expert Checkmate shows the cumulative inflows into the U.S.-listed spot bitcoin ETFs person deed a grounds precocious supra $40 billion.

- Early this week, BlackRock's IBIT surpassed the SPDR golden ETF successful year-to-date inflows.

While You Were Sleeping

- Trump to Announce Trade-Deal Framework With Britain (The Wall Street Journal): The U.K. is seeking alleviation from steep U.S. tariffs connected alloy and autos successful speech for curbing a taxation connected integer services, according to radical acquainted with the talks.

- India and Pakistan May Have an Off-Ramp After Their Clash. Will They Take It? (New York Times): India and Pakistan signaled country for de-escalation aft Indian strikes killed implicit 20 successful Pakistan, with some sides portraying their responses arsenic constricted and back-channel talks reportedly underway.

- Binance Founder CZ Confirms He Has Applied for Trump Pardon After Prison Term (CoinDesk): CZ said his lawyers had applied for a statesmanlike pardon aft media reports successful March wrongly claimed helium had already done so.

- Arthur Hayes Says Bitcoin Will Hit $1M by 2028 arsenic U.S.-China Craft Hollow Trade Deal (CoinDesk): The erstwhile BitMEX CEO predicted bitcoin volition deed $1 cardinal by 2028, citing Treasury-driven liquidity and geopolitical shifts portion dismissing U.S.-China commercialized deals arsenic mostly symbolic.

- The EU Wants to End All Russian Gas Imports. Moscow’s Friends successful the Bloc Say It’s a ‘Serious Mistake’ (CNBC): The European Commission’s program to extremity each vigor imports from Russia by 2027 was condemned by Hungary and Slovakia.

- Bankers Are Bouncing Back to Life arsenic Hunger for Junk Debt Soars (Bloomberg): Some U.S. investors are moving into European junk bonds to diversify amid tariff-related uncertainty, drawn by expectations of faster complaint cuts and request for companies insulated from commercialized risks.

In the Ether

6 months ago

6 months ago

English (US)

English (US)